Archive

A Double Success Story

I really enjoy reading accounts of how companies overcome a minefield of obstacles to achieve both financial and social success. It’s much easier to achieve financial success at the top in exchange for social freedom at the bottom than it is to achieve success in both areas at the same time (hint: HR groups are the greatest impediment to dual success). For confirmation of this assertion, simply look at the coupling between profit margins and social misery at any third world sweatshop.

One such double financial + social success story is told in the Fast Company article:” How Target’s CEO Inspires Teamwork At A Massive Scale”. However, BD00, the saucy and skeptical bloke that he is, always consumes such anecdotes with a grain of salt when the narrator is a single soul from the C-level suite. In the Target story, the telltaler is the CEO himself, Mr. Gregg Steinhafel.

The good news is that Gregg wasn’t appointed from without. He rose through the ranks:

“A veteran of Target’s rank and file, Steinhafel joined the company back in 1979, worked his way up over the next two decades to become president, and eventually took the corner office in 2008.“

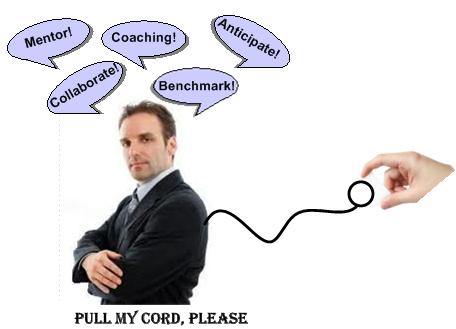

The bad news is that when you traverse the article and pluck out his quotes, they are the same old, same old:

“We are the coaching staff that help design the playbook, but implement it at the same time.”

“At Target, nothing happens without a large, collaborative effort.”

“Everyone is a mentor and mentee. It is one of the fun and exciting parts of [any] job.”

“It’s our responsibility to act and continue to support the teams.”

“All the senior leaders like to sit down and forward think, and anticipate where the puck is going.”

“We benchmark against the world’s best to develop ideas for future growth.”

“We are constantly checking in.”

Direct quotes and disrespectfully snarky graphic aside, the double success story at Target seems genuine and I’m thrilled that the company has leveraged social media tools to improve its performance through networked collaboration. I just wish that some lower level employees were asked to contribute to its telling – anonymously, of course.

For sure, you’ll easily find a ton of one-sided, C-suite-sourced stories like this Target tale in the mainstream press and best-selling business book section at Amazon.com. However, you won’t find any in the works of Ackoff, Argyris, Deming, Block, Culbert, Cohen, Livingston, and other dirty rotten scoundrels. The stories they tell are the stories I find fascinating and mind-changing.

Note: I’ve had a vague and notional image of the pull-cord executive doll in my contaminated mind for several months now. I finally conjured up a BS post to host it. Whoo Hoo!

Shifting The Burden

In a capitalist society, borgs that ship crap to their customers go out of business sooner or later:

In a corpo-socialist society, big, arrogant, and self-important borgs that ship crap to their customers get bailed out by both customers and non-customers in the form of taxpayer-financed government bailouts:

Note the feedback loop in action: crap -> customer -> money -> US Gov -> money -> to borg -> crap -> customer. It reminds me of the “shifting the burden” system archetype presented by Peter Senge in his classic book “The Fifth Discipline“. In corpo-socialist societies, the burden of staying in business is shifted from the borg itself to the American people. So much for the ideal of being responsible and accountable for your own success. It applies to individuals and small companies, but not to corpo behemoths.

Approval Barriers

All business advice is founded on the core principle of “delighting the customer“. However, not all customers are created equal. Most mainstream business advice seems to “assume” that the “customer” is an individual point source payer and user of the product/service.

However, the really big bux business deals occur between social systems of orgs where it’s hard to discern the payer(s) from the actual product end user(s). The seller has to navigate through the customer’s org to influence the right payers and users.

When the end user is some struggling group deeply nested within a behemoth command and control structure (like the US government or a Fortune 500 company), the system is setup for all kinds of mischief to occur. The gauntlet of approval barriers erected by bureaucrats and disinterested little Hitlers in the customer org often makes it impossible to get the right problem solving product into the hands of the problem holders. Tis what it is.

Unstated, But Deeply Rooted

Maturity is a state that most companies eventually reach. To break out of – or avoid – maturity, innovation is required: new products or services, new marketing or markets, more of what is different, not more of the same. – Russell Ackoff

Not only is “maturity” reached by most orgs, it is actively pursued in order to fulfill an unstated, but deeply rooted amygdalayian desire to transition from org to borg. The hilarity of the situation is that while a “maturing” org’s behaviors and processes unceasingly and silently nudge it toward rigid borgdom, the esteemed leadership continuously cries out for innovation. Do as I say, not as I do. D’oh!

Hameltonian Gems

Hameltonian == Hamiltonian, get it? I know, I know – that’s the worst free-association joke you’ve ever heard.

When it comes to eloquently cracking good jokes while talking about serious matters, Gary Hamel is right up there with fellow heretical management genius Russell Ackoff. Check out these gems from Mr. Hamel’s latest book, “What Matters Now“:

- Unfortunately, the groundwater of business is now heavily contaminated with the runoff from morally blinkered egomania.

- It was a perfect storm of human delinquency. Deceit, hubris, myopia, greed, and denial were all luridly displayed.

- “ninja” loans (no income, no job, no assets).

- Among the powerful, blame deflection is a core competence.

- As ethical truants, big business seems to rank alongside Charlie Sheen and Lindsay Lohan.

- If life had adhered to Six Sigma rules, we’d still be slime.

- …they seem to have come from another solar system—one where CFOs are servants rather than gods.

- …you’d have an easier time getting a date with a supermodel or George Clooney than turning your company into an innovation hottie.

- Unlike Apple, most companies are long on accountants and short on artists. They are run by executives who know everything about cost and next to nothing about value.

Dynamic Loop Of Demise

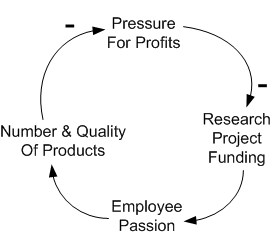

Uh Oh! Is Google going down the turd hole? First, in “Why I Left Google“, newly minted Microsoft employee James Whittaker says:

..my last three months working for Google was a whirlwind of desperation, trying in vain to get my passion back. The Google I was passionate about was a technology company that empowered its employees to innovate. In such an environment you don’t have to be part of some executive’s inner circle to succeed. The Google I left was an advertising company with a single corporate-mandated focus.

Then, in “Google’s Mounting Trash Pile“, Paul Whyte writes:

Google’s engineering culture has been an incredible asset. But the record shows that without some discipline, that asset can subtly but inevitably work against Google in its mission as a titan of Internet search and software.

On the one hand, Mr. Whittaker bailed because he felt the dense fog of bureaucracy and a narrowing focus descending upon the company. On the other hand, the (not unreasonable) pressure to jettison bogus research projects with no revenue stream in sight seems to be draining the passion and engagement out of the workforce. Can a vicious, self-reinforcing loop be in the making? Increase In Pressure For Profits -> Decrease In Reseach Funding -> Decrease In Employee Passion -> Decrease In Number And Quality Of Products -> Increase In Pressure For Profits.

I don’t think this dynamic loop of demise is one of Peter Senge‘s “Fifth Discipline” archetypes, but maybe it should be.

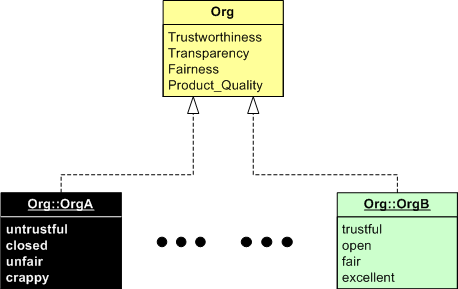

Four Attributes

Assume that every commercial enterprise can be “objectively” (LOL!) characterized by the following four discrete attributes:

- Trustworthiness [untrustful | trustful]

- Transparency [closed | open]

- Fairness [unfair | fair]

- Product_Quality [crappy | meh | excellent]

If I did the math right, there are 2*2*2*3 = 24 attribute combos. At one end of the spectrum, we have orgs that are untrustful, closed, unfair producers of crappy products and services. At the other end of the spectrum we have enterprises that are trustful, open, fair producers of excellent products and services.

So, what do you think the ratio of OrgAs to OrgBs is in the world, and why? Do you think the ratio is increasing or decreasing as civilization advances? Do you think the four attributes are uncorrelated or are they intimately coupled? Can an untrustful, closed, and unfair org produce excellent products and services? Given an OrgA, can it transform into an OrgB? Given an OrgB, can it transform into an OrgA? Which transformation is more likely?

Dramatic Difference

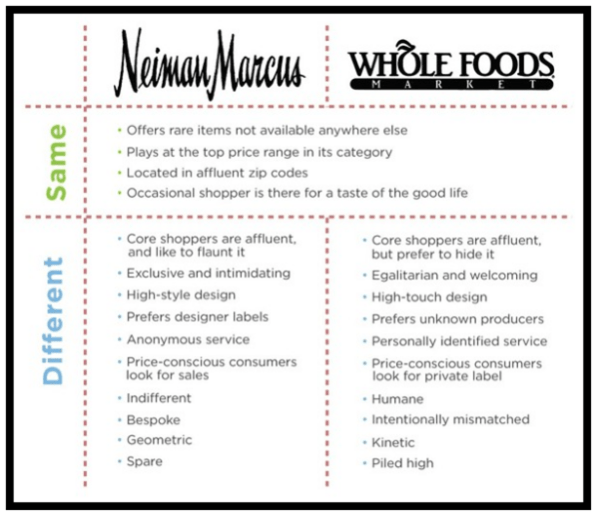

I’ve been an investor in Whole Foods Markets for about 10 years because I like CEO John Mackey‘s “Conscious Business” approach to capitalism. In this Fast Company post, “How Whole Foods Became The Luxury Brand Of Millennials”, Michael Pavone dramatically illustrates the difference between today’s winners and yesterday’s winners with this chart:

Maybe Eckhart Tolle is right when he says that a transformation to a “New Earth” is slowly but surely taking place. But then again, since Mackey-like approaches and businesses like Whole Foods Markets are still extreme outliers, maybe he’s wrong.

What do you think? Putting your company’s BS press clippings and self proclamations of greatness aside for a brief moment, how is your business really different from your moo-herd peers?

Cracked Up

One of the reasons why I love Russell Ackoff is that he cracks me up even while he writes about depressingly serious matters. Here’s just one example from his bottomless well of wisdom:

Business schools do not teach students how to manage. What they do teach are (1) vocabularies that enable students to speak with authority about subjects they do not understand, and (2) to use principles of management that have demonstrated their ability to withstand any amount of disconfirming evidence. – Russell Ackoff

Want another example? OK, OK, here it is:

“Walk the talk” is futile advice to executives because for them walking and talking are incompatible activities. They can do only one at a time. Therefore, they choose to talk. It takes less effort and thought. – – Russell Ackoff