My 10 Year Love Affair With Opdivo

I finally got the tattoo I really wanted. I’ve been walking around saying “I’m sooo (fucking) lucky” for years now, especially when I see someone I know get sick and die AFTER my macabre cancer diagnosis. There have been many of them: a dear nephew, a cousin, his wife, my dad, and my aunt. The number of famous people who got sick and died after my diagnosis are in the dozens.

On February 16, 2016, I was told by a Thoracic Surgeon I had stage 3 non-small cell lung cancer. He walked me through a series of chilling CT scan slices showing 4 tumors in my right lung. One big white honker that looked like a wasp’s nest weighing in at 5.3 cm long was staring and laughing at me from the scrolling display. The Emperor Of All Maladies (EOAM) unmasked himself to me. The horned fuck-face himself whispered “you’re mine now, moo hah hah hah!”

After:

1) a series of 6 hardcore “mustard gas” chemo treatments, fondly referred to as systemic carpet bombing,

2) a series of 30 radiation treatments,

3) a targeted pill (Gilotrif) that didn’t work,

4) metastasis of 4 new tumors in my warped noggin’ (which were radiated back into hell),

I tried the new immunotherapy drug from Bristol-Meyers Squibb called Opdivo (Nivolimab). I’ve been pretty much cruising with a monthly half-hour infusion of my chemical savior since then. Oh, except for brain surgery last May to excise 2 non-tumor radiation growths in my brain where 2 original tumors were entrenched.

I finally had to stop my beloved Opdivo in July because it jacked my immune system so high I literally started attacking myself 😂. It’s a well known side effect that immunotherapy drugs can attack any part of the body at any time during or after treatment. Thus, “I” attacked my lungs via inflammation that made breathing so difficult I had to go to the ER. It got so bad that all I could think about moment to moment was getting enough air into my lungs to nourish my tissues with life giving oxygen.

At first the doctors thought it was the flu, then pneumonia, and finally, the dreaded pneumonitis. After being put on oxygen and a high dose of prednisone steroids for a month, I recovered. After weaning for 2 weeks off of the roids, it came raging back and it felt like I was suffocating myself again. Thus, I’m on roids yet again and I have 3 pulmonologists working for me. I’m tapering off the roids again and we’ll see what’s next. The scary thing is I’m not under any cancer treatments anymore. The Emperor has an opening to come after me now. Bring it on Jerkface.

I’m deeply grateful to my Opdivo guardian for helping me become fucking lucky, soooo fucking lucky.

The Fart Detector

Since I’m retired and my 10th lung cancer anniversary is next month (I can’t believe how fucking lucky I am!), I don’t have to worry about “reputation”. I feel FREE.

So, with that advance warning, let me tell you about my funny “fart detector” story. If you don’t think it’s funny then I ban you from reading this blog forever more. If you think it’s weird and gross, then I love you, especially if you’re older than 5.

While browsing through apps for Christmas looking for schitt to buy, I came across a CO2 detector. It was cheap and I already had a CO detector, so hey, I bought one as a complimentary device for my gadget collection.

I plugged it in near my bed on the window sill and thought that was it, finito, just another gadget. But it wasn’t. Some time later, out of nowhere: the meter tripled in value from 500 to 1700 ppm, the status light slider mysteriously moved from green to red, and the dang thing started beeping. I thought it was a false alarm or defective device… but it wasn’t. It went off again a short time later, and then again. WTF?

In a flash of insight magically manifested in my surgically repaired brain, I correctly deduced that it went off a few seconds after a poopy puff of air wafted its way into the sensor. It perfectly correlated with my, you know, my gas generator down there. It’s been detecting the gas expulsions faithfully for weeks now and I laugh every time it does (I bet you would too, no?). As a TMI side note, since being on steroids for weeks now to quell a lung inflammation side effect from my immunotherapy treatments, I’m farting more.

The cool thing about this post is that I’m writing it from my dentist’s chair on my phone waiting for him to chop some of my tongue out like a midevial torturer. But all is still well in my world since I’m still alive and healthy. How about yours?

Portability Is Gold’s Achilles Heel

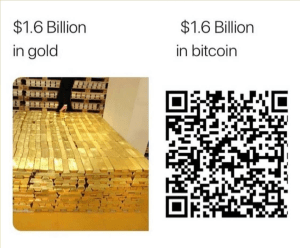

Here is some irrefutable truth about how a 6,000 year old expensive, Rube Goldberg (planes, trains, automobiles, (and (boats!)), gold-token transportation network gets crushed by Bitcoin’s cheap, fast, secure, decentralized, electrical, Bitcoin-token transportation network.

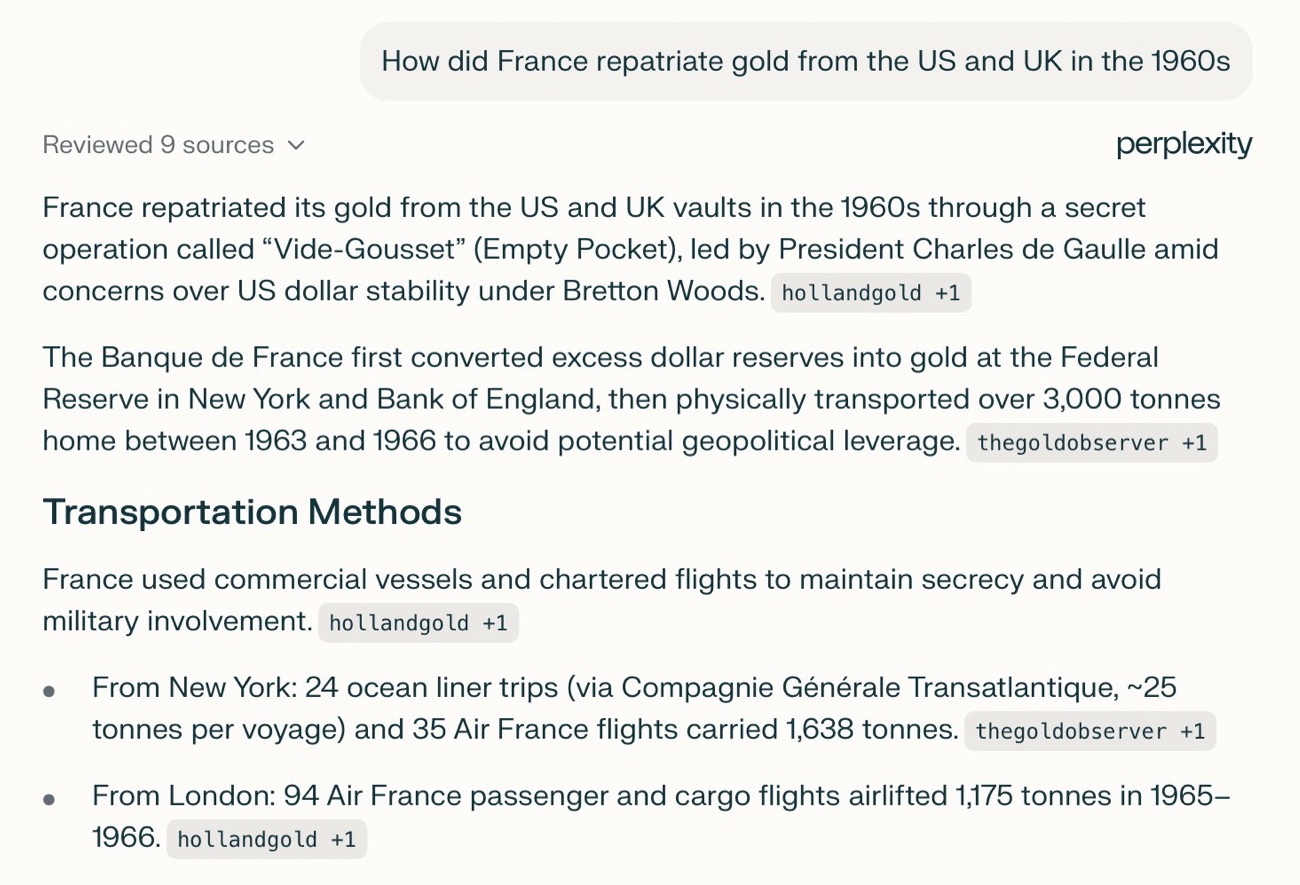

France Did Not Trust The US Government To Custody Its Gold. Would you?

It’s The Attributes, Stupid

Things are scary and weird once again in the Bitcoin universe. Every Bitcoin advocate I know missed this pullback and sentiment in general is low. The price of BTC has wobbled slowly between $87k-$92k for months like a boat without a motor, and the knives are out. But once again Bitcoin don’t care.

In times like these I always try fall back to my training as an engineer: find the bedrock truth.

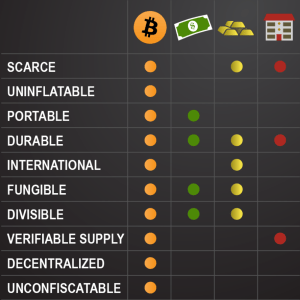

For 1000s of years humans have been looking for the perfect universally accepted money to transact with strangers in lieu of violence and pillaging like savages. As we evolved, we became “educated” and now we know what the hell they were searching for. They were sniffing for some physical matter that satisfied the following attributes:

They tried to use salt, shells, beads, feathers, cheese, rocks, yada, yada. Finally, the world magically converged on gold as the best money to employ for transacting with others. But of course, everyone was thinking local, point-to-point, handoffs and no one thought of an invincible, global, wall of energy that ferociously protects Bitcoin. Ultimately, it’s all about cosmic energy, all of it, and us.

Want some more emotionless metrics?

And the shapeless orgless org that nourishes our little badger:

And Bitcoin doesn’t have to worry about these types of noble but archaic concerns.

As more and more people learn about the current inflationary prison they’re in, they”ll continue to move out of USD, into gold, and into Bitcoin. It’s a slow trickle for now. Tick tock next block.

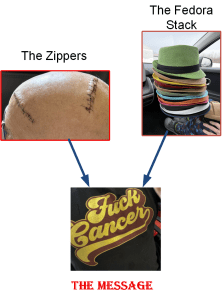

The Zippers, The Stack, The Message

Every day I pop the fedora off the top of the stack, wear it, and push it into the bottom of the stack. The next day it’s wash, rinse, repeat.

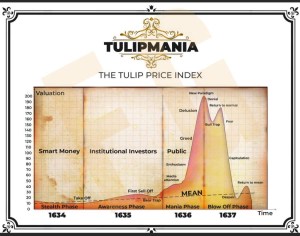

Ponzi, Ponzi, NOT

Ponzi scheme……

Ponzi scheme…

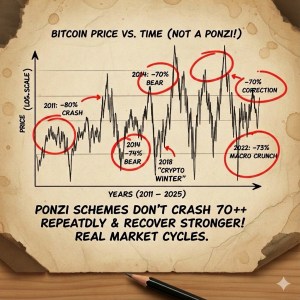

Ponzi schemes are like one and done ejaculations… 💦🍆. They ramp up quickly once, and then they undergo a blow off top, and then they crash, and then they are gone forever. Good riddance Ponzi perps.

Bitcoin is the anti-Ponzi. It has had 5, I repeat 5, price crashes of greater than 70% since birth. Even it’s off it’s all time high by only 30%, current sentiment toward the magical internet money is really negative, yet again. As the world’s “hardest” money (sorry you are in the process of being dethroned, my venerable but old and tired friend, gold), it always arises out of the ashes like the mythical Phoenix.

NOT a Ponzi scheme…

That’s because people around the world (not just here in the so-called almighty states) are valuing it more and more as it catches on and they become enlightened to the debt-orgy mess the whole world is stuck in due to wreckless, irresponsible, spending by the governments that rule over them. They are being what us maxis call, orange-pilled. Choose please: red, blue, or orange?

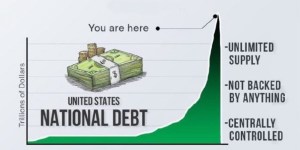

Fiat currency, purposefully unmoored to anything “hard” in the physical world other than paper, ink, and a cheap ass printer controlled by a centralized cabal of unelected bankers, is always debased and printed into oblivion to accommodate the political spending machine. I hate when that happens, don’t you?

Two Charts

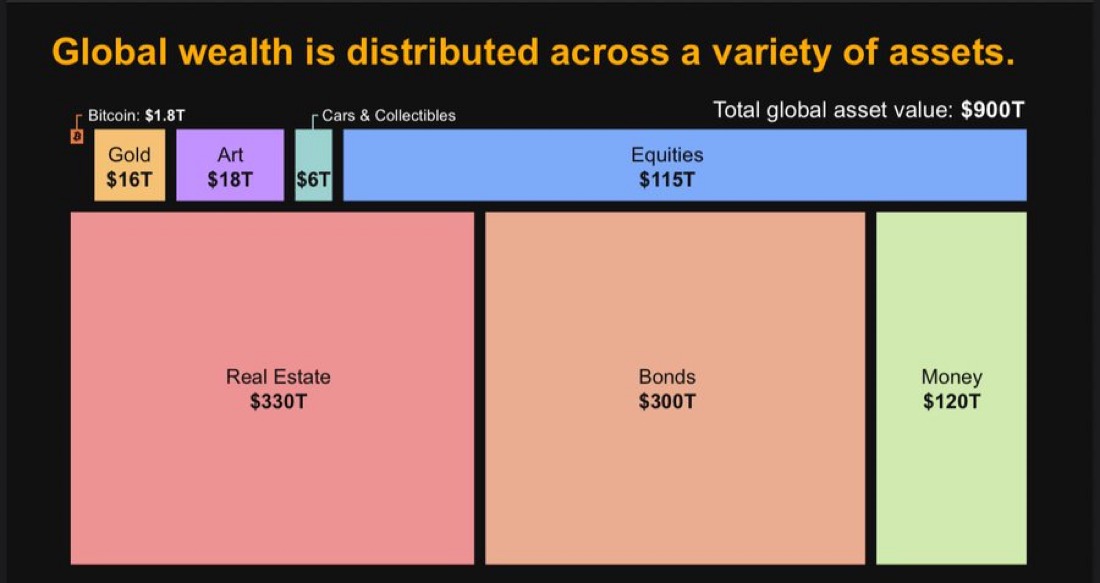

I can’t get the 2 charts below outta my surgically repaired head (see last pic below) today. On the top we see all the “value” stored in a melting ponzi paper-currency game which is debased 7%/year on average via money supply growth (forget about the rigged 3.0% CPI that the pols try to make you believe every year). Prices are up by 25% since 2021).

In the top left corner we see a tiny sliver of the monster $900T asset market value currently stored in Bitcoin’s tiny little sub $2T space. A 10x rise in price from here at $90k would only stuff $20T more into the space. Hence, that’s what people mean by Bitcoin being the greatest asymmetric trade of all time and why some predict $1M Bitcoin in the not too distant future.

It still blows me away how early it is in the evolution and adoption of BTC, but when the world is undergoing a major scientific revolution it gets turned upside down and the entrenched interests get exposed and expelled. In Thomas Kuhn’s eye opening “The Structure of Scientific Revolutions” he points out all the major historical paradigm shifts and they all resonate with his logic.

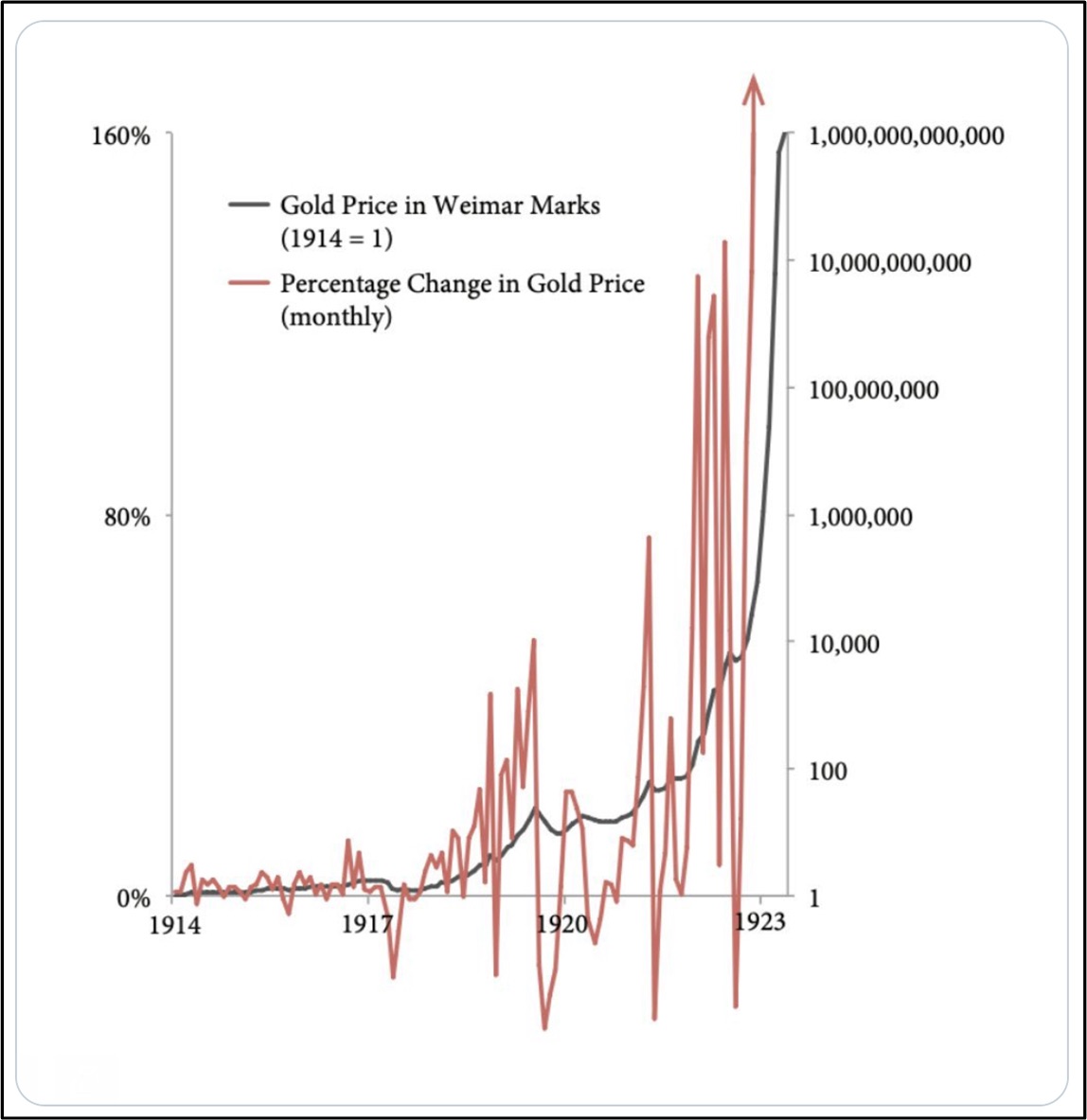

Next, we see how volatile the price of gold was in Weimar Germany against the German mark when the country exploded into hyperinflation. Who would’ve thought gold would be so volatile as a store of value. But in volatile times, everything becomes volatile. I don’t think the US will go hyper, but the macro economists I follow think 15-20% inflation is imminent, like next year. D’oh!

And third, we see why the rest of the fiat-paper brains don’t get it. Science progresses via a succession of funerals for the elite and smugly installed power base. Tick tock next block.

BTW, here’s my surgically repaired head, but that’s a story for another day.

The Pyramid

Are you ready for the “suddenly” part of “gradually, then suddenly” mantra? Start following Japan. We’re not too far behind.

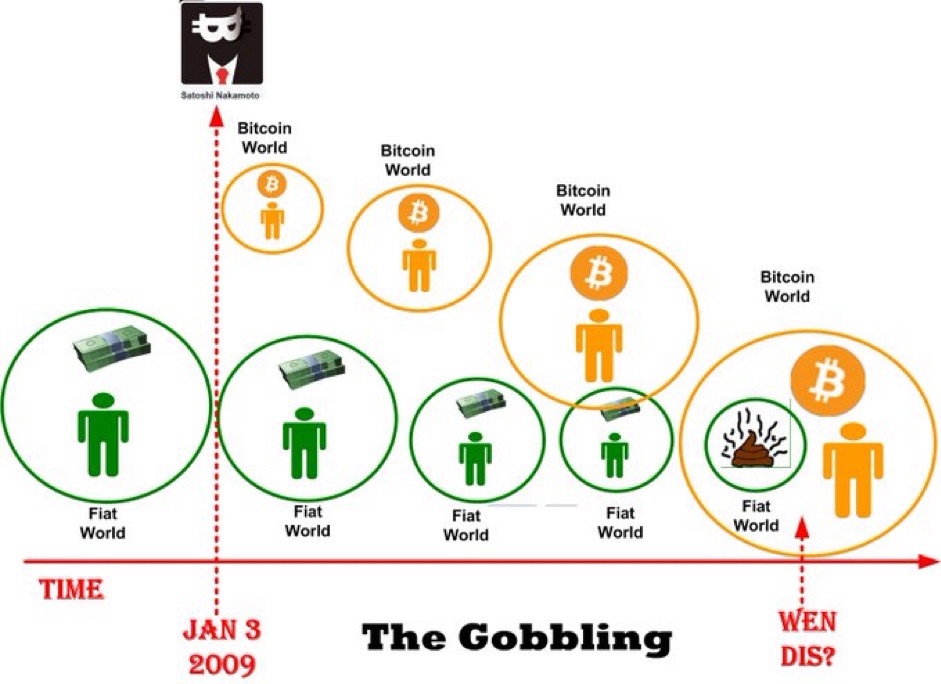

Wen Gobbling?

Fuggedaboud the next Bitcoin halving. As the figure below shows, I want to know when the gobbling is going to happen. We’re somewhere between the Bitcoin launch date and the gobbling, but I have no idea where. The end state is where all 160+ centralized fiat systems bend the knee to king Bitcoin.

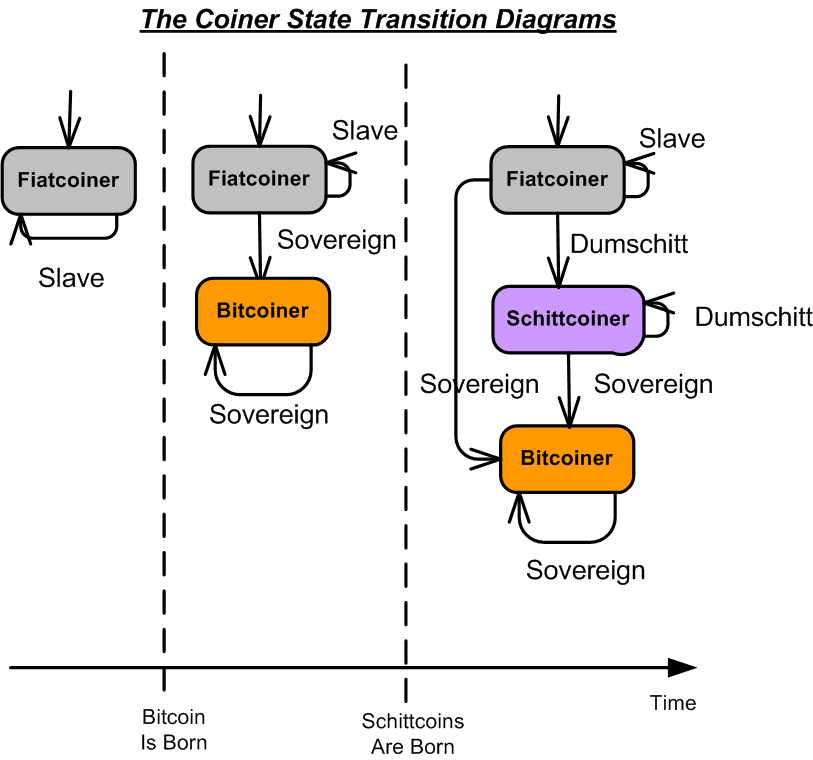

Fiatcoiner, Bitcoiner, And Schittcoiner

As the state transition diagram below shows, there are three types of coiners: Slave-Fiatcoiner, Sovereign-Bitcoiner, and Dumschitt-Schittcoiner. Before the immaculate conception that is Bitcoin, we were all Fiatcoiners, but not by choice. We were all born into one of the closed, 160+ jurisdictions in the world that required the use of Fiatcoins for daily living and tax payments. We were like fish in water as we took these Fiatcoin systems for granted that “they worked just fine”. But they don’t. Inflation, the insidious scourge designed into all fiat systems, erodes the purchasing power of all Fiatcoin holders.

Thankfully, my path to becoming a Sovereign-Bitcoiner was direct. I was lucky enough to fall down the Bitcoin rabbit hole and emerge enlightened before the plethora of Schittcoins (and yes, they include ethereum) popped up everywhere. They formed a treacherous moat between Fiatcoiners and Bitcoiners. This formidable barrier inhibited direct transitions into the enlightened Bitcoiner state.

Those Dumschitts who fell into the quagmire of centralized Schittcoin pump-and-dump schemes got rekt big time. Those horrible experiences nudged them down the bitcoin rabbbit hole, which converted them to Bitcoiners, who are all anti-Schittcoiners. Until the Schittcoin market fully implodes, direct transitions from Fiatcoiner to Bitcoiner while avoiding the Schittcoin swamp will be rare.

Notice that the Bitcoiner state has no exit transitions. Once a Bitcoiner, always a Bitcoiner In the long run, those who remain in the Schittcoiner and Fiatcoiner states will get rekt, and they’ll deserve it.