From Egalitarian To Segregated

The way the Bitcoin protocol is evolving, it looks like more and more “regular” people are being priced out of the the L1 “trustless” blockchain and kicked upstairs onto L2 “trust-me” IOU payment service providers.

Trust Us!

Are we Bitcoiners in the painful process of witnessing the birth of a new central banking junta that we’ll have to TRUST to not rip us off in the future?

The Transformation Of Wealth Into Influence

AXA is a French multinational insurance firm headquartered in the 8th arrondissement of Paris that engages in global insurance, investment management, and other financial services.

I’m excited to announce that we raised $55 million in Series A funding….. We’re thrilled to welcome Horizons Ventures, AXA Strategic Ventures, and Digital Garage to our great group of investors and advisors. – Austin Hill, Co-founder, Blockstream Inc.

The Clanthink Theme

The Think Types

Groupthink = Everyone believes in the idea/concept, but tantalizingly, it could be either wrong or right. If the group is wrong and all of the the individuals outside of the groupthink circle of membership remain steadfastly silent out of fear of persecution, then the group, and those that that they lead, all suffer.

Spreadthink = Everyone in the group places a different level of importance and meaning on the idea/concept.

Clanthink = Everyone in the group believes in the idea/concept, but it’s outright wrong. Those outside of the group that don’t believe the idea/concept are ostracized, tortured, killed……. or all of the above.

The Clanthink Theme

Blockstream Inc. + Key Bitcoin Core Software Development Team Contributors: High transaction fees, long confirmation times, and network congestion due to chronically full blocks are good for Bitcoin.

The Statements

The References

Quote reference: What Is Bitcoin?

Blockstream Affiliation reference table: Meet The Team

The Morphing….

The next blockbuster horror film coming soon to a theater near you: “The Morphing“. It documents the disastrous transition of a fluid, decentralized, unified, team into a hardened, centralized, divided, team.

The World Wide Acceptance Threshold

Assume you’re building a radical new financial system from the ground up intended to be useful to every human being on the planet – not just to the rich, powerful, manipulative, greedsters who lord over the current antiquated and rigged system.

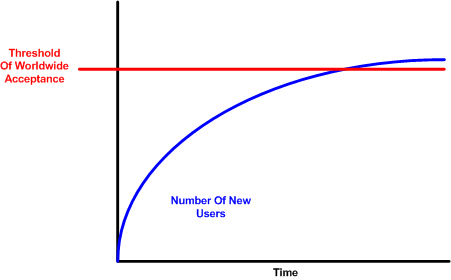

In order to survive the continuous offensive onslaughts from those entrenched oligarchs, your goal is to onboard as many everyday users as needed as fast as possible to unambiguously prove that the ground breaking system is not just being used by “criminals, terrorists, pedophiles, drug dealers, and tax avoiders“. You need to surpass the World Wide Acceptance Threshold (WWAT) of, say, 1 billion users.

Satoshi Nakamoto’s Bitcoin “peer-to-peer electronic cash system” is currently the most popular system trying to reach and exceed the magical WWAT. It currently has millions of users, but the usability of the system (high transaction fees, long confirmation times) is deteriorating at an alarming rate due to network saturation triggered by the rate of growth of new users.

There are two solutions out there competing to relieve the pressure on the bitcoin network so that the rate of new user growth doesn’t go to zero (or negative!): SegWit and Bitcoin Unlimited (BU):

The SegWit solution provides a short term, hard limited, pressure relief valve to allow some network breathing room for orderly new user additions. The BU solution provides a dynamically variable pressure relief valve to achieve the same effect. It tries to adapt to the changing new user growth rate over time.

The above graphs indicate that the SegWit solution is agnostic toward the rate of new user growth and halts system progress toward the WWAT goal at some point after its introduction. The BU solution allows the system to gracefully expand in proportion to the rate of new user growth, providing friction toward progress to the goal, but not a hard stop like SegWit.

SegWit is less technically risky because it is a much more conservative approach and it has undergone more peer review and offline network testing than BU. The biggest risk that BU introduces into the system is the concept of an “Emerging Consensus“. The EC rules allow the market to dynamically decide the network saturation level over time.

Neither SegWit nor BU will push the Bitcoin protocol over the WWAT threshold alone. BOTH need another layer of help on top of the base Bitcoin protocol layer to achieve the goal. However, even though it is riskier than SegWit, I think BU allows more time for Bitcoin to grow before users start leaving in droves for alternative cryptocurrencies due to skyrocketing user fees and transaction times. But hey, that’s just my opinion.

Dubious At Best, Disingenuous At Worst

Adam Back recently claimed on Twitter that the Bitcoin Core development team is “decentralized“.

However, that’s a dubious assertion at best, and a disingenuous one at worst. Mr. Back is the President of Blockstream Inc. His startup company is financed by $70M from traditional bankstas who could give a shit about billions of unbanked/poor people being given the ultimate tool to: bootstrap themselves out of poverty, participate in commerce with merely a cell phone, and dramatically increase the world’s GDP.

Here is a snapshot of some of the most influential and vocal members of the core development team directly employed by Blockstream. The big guns are Adam Back and Greg Maxwell. Interestingly, Mr. Back, who is now an” executive“, but somehow still strangely thought of as a major technical contributor, doesn’t seem to be actively involved in the design/coding effort. That’s because his presidential title makes him responsible for Blockstream’s financial performance over all else.

Admittedly, not all Bitcoin Core developers are paid by Blockstream, but some are contracted out by the private, for-profit, company. But, as the presented evidence shows, the Bitcoin Core development team cannot be claimed to be DECENTRALIZED.

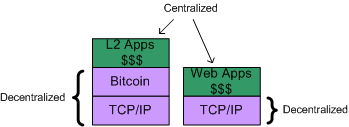

Startup investors, especially bankstas, expect a high ROI on their risky investments ASAP. Regarding Bitcoin, their investment returns can only come from centralized technologies, known as L2 tech, layered on top of Bitcoin. L2 technologies are to Bitcoin like web sites are to the TCP/IP protocol. That’s where real big money is made. By design, Blockstream is an L2 technology product company that must use the Bitcoin protocol to build on top of.

Hence, by implementing and promoting the SegWit improvement to the Bitcoin protocol before a deterministic, time-dependent, dynamically increasing maximum block size policy, raises suspicion in the Bitcoin community that Blockstream is out to freeze Bitcoin L1 on chain scaling growth after SegWit is activated in order to get money-making L2 technologies deployed as fast as possible. Again, suspiciously, there is no unified, visible, commitment from the Core development team as a whole to pursue an on chain scaling improvement next as priority one to relieve network pressure and allow a marginally increased onboarding of a cluster of new, less well off, users. No room to breathe.

Meanwhile, the Bitcoin network is becoming more exponentially saturated as new users (Venezuela, Mexico, Greece, Cypress, China, Japan, Africa, India) try flocking to Bitcoin to use as cash but are turned back by wildly rising transaction fees and confirmation times – a massive decrease in usability to large swaths of people. The flight from Bitcoin to alternative cryptocurrencies resulting from the poor stewardship of the Bitcoin protocol by the Core development team is vividly visible in this market share chart:

Satoshi Nakamoto, the genius creator of Bitcoin, said something to the effect of:

In the future, there will either be massive BTC transaction volume, or zero volume.

Ironically, the anti-fragile Bitcoin system proven to be indestructible by powerful external forces over 8 years of 24 X 7 operation, may end up instantaneously imploding due to internal forces caught in the throes of a bloody death match.

Sloppy Coding

This sloppy code runs a $20 billion, bleeding edge, financial system. I’ve written, and still do write, sloppy production code like this. However, some of the key stewards of this particular code base think they walk on water.