Archive

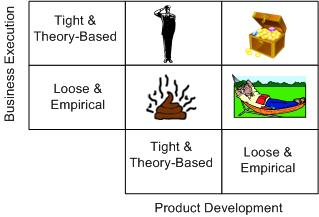

Tight, Theory-Based, Loose, Empirical

Processes designed to execute the business of an enterprise should be tight and theory-based. Processes designed to develop the products of an enterprise should be loose and empirical.

In the best performing companies, this ridiculously simplistic BD00 generalization is true? In the worst companies, the opposite is true?

Mulligan!

In golf, when you shank a shot off the tee, sometimes you’re allowed a “Mulligan“. A Mulligan is a “do over” where everyone cheatingly agrees that your first shot never took place and you get to tee off again with no stroke penalty. As you might surmise, I love freakin’ Mulligans; especially when the agreement allows TWO Mulligans per 18 hole round. Whoo Hoo!

Like the bailed-out principals that ignited the world’s financial meltdown, it looks like the army and its contractor cohorts are getting a Mulligan with the cancelled, 15-year, multi-billion dollar JTRS (Joint Tactical Radio System) program. Everyone involved in the original shank shot gets to wipe the slate clean; the program gets a shiny new name (JTN = Joint Tactical Networks program) to shake off the prior stank; and the players can start gorging on taxpayer money again.

But of course, this next go around will be different – the approach will be “entrepreneurial” despite the fact that all the participants are huge command & control hiermalarkies.

Related articles

- No Lessons Learned (bulldozer00.com)

- No Lessons Learned II (bulldozer00.com)

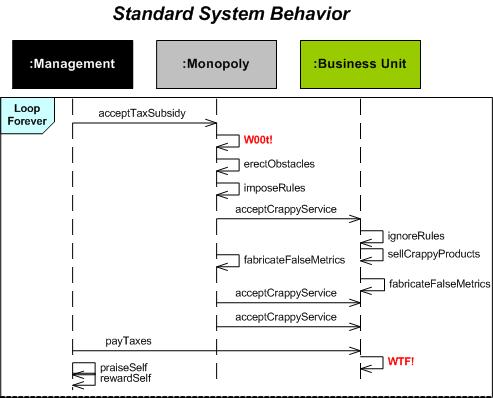

Still Only One

In early September, I noted in a post that Oracle Inc. CEO Larry Ellison had broadcast his first and only tweet on June 6th. Out of curiosity, I moseyed on over to his twitter home page to check up on his “status“:

Bummer! Still no more tweets since then, but at least Legendary Larry picked up almost 3000 new followers in the interim.

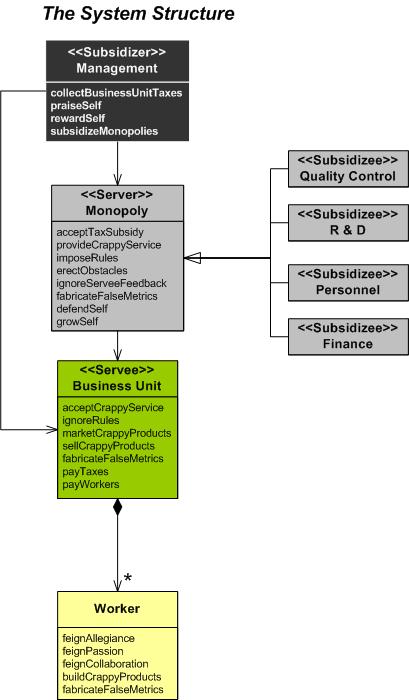

Monopolistic Providers

In search of economies of scale, centrally planned and controlled economies in nations and corporations tend to create monopolistic providers of goods and services. For example, in corporations, accounting, personnel, and R&D departments are usually deliberately organized as subsidized monopolies. They are subsidized in the sense that the users of their products or services do not pay for them directly; the supplying units are supported financially by funds that are allocated to them from above. The pool from which these funds are drawn is filled by a “tax” allocated from above to the units served. Monopolistic units that are subsidized are generally insensitive and unresponsive to the users of their services, but they are sensitive and responsive to the desires of the higher-level units that subsidize them. These higher level units are even more removed from the units served than the serving units. As a result, they are often unaware of, or unresponsive to, the needs and desires of the internal users of monopolistically provided goods and services. – Russell Ackoff (Ackoff’s Best: His Classic Writings on Management)

OK, time to practice my “bent” UML modeling skills and test your understanding with the class and sequence diagram pair below. The class diagram provides a structural view of a fictional Ackoffian system. The sequence diagram steps through an amalgam of behaviors in a world where monopolies rule. Any questions, comments, critiques, accolades, WTFs?

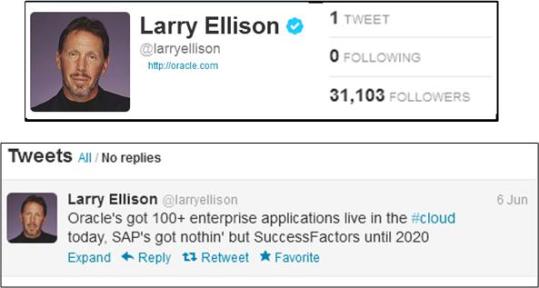

Just One Measly Tweet?

I just found out from this article, “The $1.3 Trillion Price Of Not Tweeting At Work“, that Oracle’s mercurial CEO, Larry Ellison, has tweeted one, and only one, message out onto the ether. And a nasty one it is:

The Fast Company article’s author, HootSuite CEO Ryan Holmes, also states an interesting fact:

Among CEOs of the world’s Fortune 500 companies, a mere 20 have Twitter accounts. As social media spreads around the globe, one enclave has proven stubbornly resistant: the boardroom. Within the C-suite, perceptions remain that social media is at best a soft PR tool and at worst a time sink for already distracted employees. Without a push from the top, many of the biggest companies have been slow to take the social media plunge.

Ryan goes on to speculate that the status quo may change because of the findings in a report from the McKinsey Global Institute:

According to an analysis of 4,200 companies by the business consulting giant, social technologies stand to unlock from $900 billion to $1.3 trillion in value. At the high end, that approaches Australia’s annual GDP. Two-thirds of the value unlocked by social media rests in “improved communications and collaboration within and across enterprises”.

BD00 hopes that Mr. Holmes is right, but there’s a lot of inertia and outdated tradition motivating the mute behavior in the head shed. There’s paranoia about giving away too much information to competitors and there’s a fear that the penthouse occupants might say something that destroys the illustrious image of infallibility unconsciously burned into the minds of themselves and their minions.

Just cutting email out of the picture in favor of social sharing translates to a productivity windfall as “more enterprise information becomes accessible and searchable, rather than locked up as ‘dark matter’ in inboxes.”

Oh man, despite the risk of being served with a cease-and-desist order and/or being slapped with a slander lawsuit, I couldn’t resist the urge to do this:

Besides our buddy Larry, can you name all the faymoose people in this dastardly mugshot collage without using Google? I’d offer up a BD00.com T-shirt to the winner, but I’m all sold out.

Related articles

- CEOs and Social Media (web2.sys-con.com)

- Do Non Tweeting CEOs and Brands Leave Money on the Table? (radian6.com)

- How is Social Media Affecting Your Business? (elocal.com)

- Fortune 500 Increased Use of Social Media in 2012 – Twitter #1 (customerthink.com)

- Social Media’s Productivity Payoff (blogs.hbr.org)

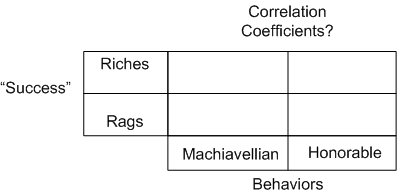

Correlation Coefficients

Please consider these well known, conflicting cliches:

- “Nice guys finish last”

- “What goes around comes around”

The first implies that in order to succeed, a ruthless, Machiavellian set of behaviors is required (Oracle? Bank Of America?). The second one-liner implies that those same behaviors will boomerang around and precipitate your downfall (Enron?, Lehmann Bros?). Do ya think there’s a strong correlation between org behaviors and financial success? Is there any correlation at all, or is it just a random crap shoot?

Please fill in the boxes below with a value ranging from -1.0 to 1.0 and place the sheet on the teacher’s desk on your way out of the classroom. The “right” answers, obtained from an impeccably executed and extensively peer-reviewed research study, will be disclosed at some random time in the future.

Building The Perfect Beast

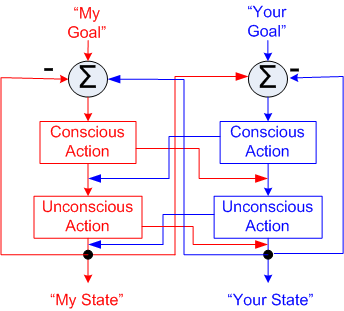

The figure below illustrates a simplified model of a Starkermann dualism. My behavior can contribute to (amity), or detract from (enmity) your well being and vice versa.

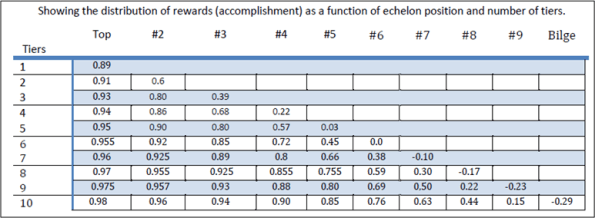

Mr. Starkermann spent decades developing and running simulations of his models to gain an understanding of the behavior of groups. The table below (plucked from Bill Livingston’s D4P4D) shows the results of one of those simulation runs.

The table shows the deleterious effects of institutional hierarchy building. In a single tier organization, the group at the top, which includes everyone since no one is above or below anybody else, attains high levels of achievement (89%). In a 10 layer monstrosity, those at the top benefit greatly (98% achievement) at the expense of those dwelling at the bottom – who actually gain nothing and suffer the negative consequences of being a member of the borg.

What do you think? Does this model correspond to reality? How many tiers are in your org and where are you located?

Your Fork, Sir

To that dumbass BD00 simpleton, it’s simple and clear cut. People don’t like to be told how to do their work by people who’ve never done the work themselves and, thus, don’t understand what it takes. Orgs that insist on maintaining groups whose sole purpose is to insert extra tasks/processes/meetings/forms/checklists of dubious “added-value” into the workpath foster mistrust, grudging compliance, blown schedules, and unnecessary cost incursion. It certainly doesn’t bring out the best in their people, dontcha think?

You would think that presenting “certified” obstacle-inserters with real industry-based data implicating the cost-inefficiency of their imposed requirements on value-creation teams might cause them to pause and rethink their position, right? Fuggedaboud it. All it does, no matter how gently you break the news, is cause them to dig in their heels; because it threatens the perceived importance of their livelihood.

Of course, this post, like all others on this bogus blawg, is a delusional distortion of so-called reality. No?

Shifting The Burden

In a capitalist society, borgs that ship crap to their customers go out of business sooner or later:

In a corpo-socialist society, big, arrogant, and self-important borgs that ship crap to their customers get bailed out by both customers and non-customers in the form of taxpayer-financed government bailouts:

Note the feedback loop in action: crap -> customer -> money -> US Gov -> money -> to borg -> crap -> customer. It reminds me of the “shifting the burden” system archetype presented by Peter Senge in his classic book “The Fifth Discipline“. In corpo-socialist societies, the burden of staying in business is shifted from the borg itself to the American people. So much for the ideal of being responsible and accountable for your own success. It applies to individuals and small companies, but not to corpo behemoths.