Archive

The Mysterious ACH Delay

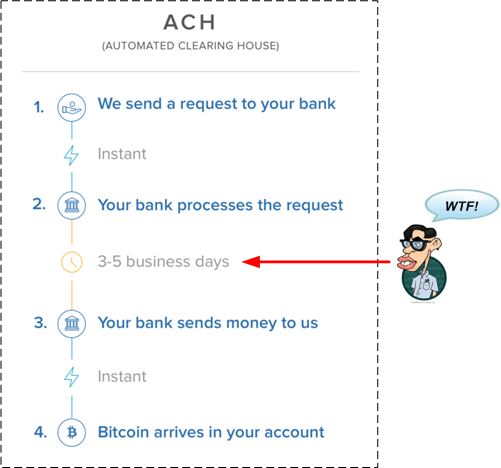

One of the FAQs on Coinbase.com and other Bitcoin exchanges is: “Why does it take so long to get my bitcoins?“. As the graphic below illustrates, the delay is due to the ancient “Automated Clearing House” (ACH) system that banks employ to process money transfers.

Prior to grokking the topic and personally experimenting with the technology, most people will probably say (as with anything radically new and different) that Bitcoin is too complicated for them. But hey, those same people (like me) most likely have no idea what goes on behind the scenes during the mysterious ACH delay when they use the current, antiquated banking system. And yet, they initiate this complicated process every time they move money between financial institutions. International money movement via wire transfer is an even more perplexing, costly, and delay-inducing process.

As the bitcoin user experience improves as a result of the innovation taking place in the industry, the complexity of bitcoin technology will fade into the background; just like the opaque, byzantinian complexity of the current financial system technology has been pushed behind the scenes.

Instantaneous Entrepreneurship

The best way to acquire Bitcoins is to earn them. If you have a skill, service, or goods to sell, you can instantaneously start your own business. If you accept Bitcoins, no bank or credit card company approvals/fees are required. You can be your own bank. Simply setup a web site, advertise your stuff, and hoist your bitcoin address and/or its QR code on the site.

Of course, if the price of Bitcoin goes to zero, and there is a non-trivial chance it will, all your effort will have been wasted. But hey, entrepreneurship is all about putting skin in the game and taking risks. As for me, I’ll continue exchanging dollars for Bitcoins on Coinbase.com.

The Bitcoin Ambassador

Many people in the bitcoin community call Roger Ver the “Bitcoin Jesus“. I call Andreas Antonopoulos the “Bitcoin Ambassador“. I do this because I’ve seen him eloquently mesmerize the Canadian and Australian governments on what bitcoin is and why its benefits far outweigh its costs.

After watching the following fascinating videos, you can judge for yourself whether I’m right or wrong.

If you’re a bitcoin fan and you appreciate his passionate efforts to disarm the most hostile forces against widespread bitcoin adoption – national governments, hustle on over to Andreas’s site and show your appreciation by sending him a bitcoin tip.

Time To Crack Some Heads!

Whenever tragedy strikes, politicians tend to make a rush to judgment and propose or execute dumbass moves that make it appear like they’re doing something useful. Ebola scare? Ban travel to all! Immigration problem? Build a 1000 mile wall! Terrorist attack? Damn it, close the borders to all!

As long as politicians maintain their cozy relationship with the bankstas who finance their irresponsible deficit spending in return for bailouts waiting in the background, they’ll be on a constant vigil for excuses to inhibit the growth of Bitcoin. On the heels of the Paris attacks, the latest call for action is to “crackdown” on Bitcoin as a means for terrorist financing.

First of all, no one, no matter how powerful and well funded, can “crackdown” on Bitcoin – because there is no head to chop off. All that those who have much to lose when Bitcoin eats their lunch can do is pass laws that attempt to make it annoyingly difficult for fiat currency to get into and out of the bitcoin economy.

Second, and most important of all, is that Bitcoin is not even a major source of terrorist financing. As the following report, published just last month by the UK treasury for its politicians shows, the terrorist’s predominant financier is, as you might have guessed, your friendly banksta. You know, the one that charges a fee every time you sneeze and “invests” your hard earned cash in risky schemes at no risk to themselves.

Booms, Busts, Stability, Antifragility

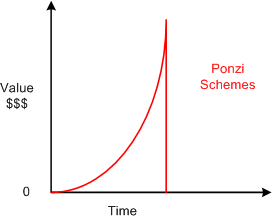

The figure below shows the one time boom-bust pattern of a Ponzi scheme (Bernie Madoff anyone?) We have a meteoric rise in value based on smoke and mirrors where a few get rich, and then an instantaneous dive during which many poor souls lose their shirts. Note that when the bubble pops, the party is over, finished, kaput.

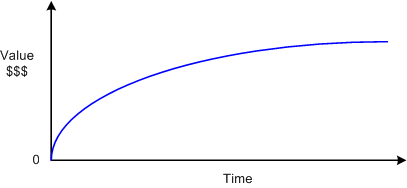

The next figure shows the slow and steady rise in value of a viable, value-creating, system. Since the value the system creates is real, the system achieves stability and remains operational for an enduringly long time. It becomes woven into the fabric of society. At some point, the populace starts taking the system for granted and assumes the system has been influencing their behavior forever.

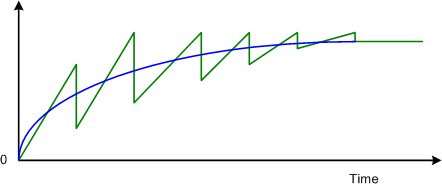

Here is my sketchy interpretation of what’s happening in the Bitcoin space:

Bitcoin has already experienced several heart-stopping boom-bust cycles throughout its steady march toward stability and widespread acceptance. But note that unlike a Ponzi scheme, which many dooms-mongers (like textbook economists and obsolete, fat-cat, bankstas) loudly claim Bitcoin is after every bust, Bitcoin has not gone kaput. It’s robust, resilient, and dare I say, anti-fragile. The system adapts and get stronger after withstanding every technical and political attack – improving itself via the community driven BIPs process.

Photo credit imgur.com gallery.

Photo credit imgur.com gallery.

Dinospeak

“I think there is a world market for maybe five computers.” – Thomas Watson, president of IBM, 1943

“Television won’t be able to hold on to any market it captures after the first six months. People will soon get tired of staring at a plywood box every night.” – Darryl Zanuck, executive at 20th Century Fox, 1946

“There is no reason anyone would want a computer in their home.” – Ken Olsen, founder of Digital Equipment Corporation, 1977

“Almost all of the many predictions now being made about 1996 hinge on the Internet’s continuing exponential growth. But I predict the Internet will soon go spectacularly supernova and in 1996 catastrophically collapse.” – Robert Metcalfe, founder of 3Com, 1995

Christine Lagarde, chief of the International Monetary Fund (IMF), recently said that banks have nothing to fear from Bitcoin. Jamie Dimon, CEO of JPMorgan bank and one of the recipients of the biggest taxpayer bailout of all time, said Bitcoin will not survive. Peter Ohser, the executive vice president of business development at global remittance giant MoneyGram, said: “We don’t see bitcoin in particular as a solution today to be able to disrupt us or provide a better or different service.”

The clueless heads of the institutional dinosaurs of today have spoken. Nuff said.

The Chasm Of Doom

In 1991, Geoffrey Moore wrote the following paragraph in his classic book, “Crossing The Chasm“.

Mr. Moore also introduced the Technology Adoption Lifecycle (TAL) curve in the book as follows:

The “chasm” in the curve is the critical do or die period in the life of a disruptive technology. If its advocates can’t manage to catapult the technology over this imposing chasm of doom, the technology either outright dies on the vine or it lives on in an impoverished, niche market.

My interpretation of Mr. Moore’s quote places me squarely into the “Early Adopter” segment of Bitcoin technology. Sure, it’s been 6 years since Satoshi Nakamoto bootstrapped the Bitcoin network into existence, but Bitcoin’s goal of obliterating the deeply entrenched, inequitable banking system and changing world behavior is anything but assured. The question is: “Has Bitcoin already crossed the chasm? I think so, but do you?

Volatility Is Good

Before I read this insightful bitcoin.com forum post by Wences Casares, I thought that Bitcoin’s extreme price volatility was an inhibitor to mainstream adoption.

Of all the ways in which Bitcoin could fail the one that worries me most, because I think it has the highest probability of all the bad things that could happen, is a price panic that drives the price to zero, or $15, from which it may be very hard for Bitcoin to recover the public’s trust.

Right now most of the money that is invested in Bitcoin is money people can afford to loose and that makes it safe money. So when Bitcoin goes from $1,200 to $200 there is not a vicious cycle of people who need to sell, because they cannot afford to loose more money, that drives the price to zero.

It is hard to estimate how many people own bitcoins, but it may be somewhere between 13 and 15 million people right now. If Bitcoin is successful we will see hundreds of millions of people own Bitcoin and, eventually, billions. The only way we can get to billions of people owning Bitcoin is by the price going up by several orders of magnitude, let’s say $ 1 million (but this is highly speculative and risky). So, if I am right, and Bitcoin has to go from $390 to $1,000,000 the best way for it to get there without crashing irreversibly is with as much volatility as possible. If bitcoin went up a couple percentage points every week and everybody began to think about it as a “sure” thing, investing money that was destined to pay for kids colleges or for retirement, that is a disaster waiting to happen price wise. Because when Bitcoin corrects those people have to sell because they cannot take more losses, potentially creating a vicious circle which is hard to reverse.

Ironically, we have to thank Bitcoin’s volatility for people not investing money they cannot afford to loose. As long as the Bitcoin price remains highly volatile and perceived as risky, we are OK. Begin to worry when it is perceived as a sure thing that everybody should own a lot of. – Wences Casares

Wences is a staunch Bitcoin advocate and the star character in the book “Digital Gold“. When he speaks, I listen closely.

If you want to help make the world a better place for literally billions of “unbanked” people and you have some money you can afford to lose, then screw blowing that money on casinos and/or lottery tickets. Follow these instructions:

- Download a desktop computer wallet program (I use the Electrum wallet) and create an encrypted wallet.

- Open an account on a bitcoin exchange (I use Coinbase.com)

- Exchange your “lose-able” fiat currency for bitcoins.

- When your bitcoins get deposited in your exchange’s online “custodial” wallet, transfer it off of the web and into your desktop wallet.

- If you’re really paranoid about having your Bitcoins stolen, grok how to move your keys out of your desktop wallet and into a hardware wallet or paper wallet – and then do so.

If you don’t physically possess your private bitcoin keys, you really don’t own any bitcoins. You have to trust whoever has possession of those keys to keep them safe – like you have to trust a bank to keep your fiat money safe. And as we all know too well from the 2008 debacle, third party keepers of “other people’s money” like banks are not to be trusted if there is a viable alternative. Bitcoin is one such alternative, but you have to spend the time to educate yourself and take personal responsibility for your financial well being.

BTC Dog

The Bitcoin system is designed such that only 21 million BTC will ever be minted – ever. The last BTC will be created in the year 2140. On first glance, one might say: “What? That’s not enough! If BTC is going to succeed, we’re going to need a boatload more BTC to be minted.”

But wait! Unlike the USD, which is divisible down to .01 USD, BTC can be sliced down to 1 “satoshi“, which is .00000001 BTC. Thus, when 2140 rolls around, 2,100,000,000,000,000 satoshis will have been minted world-wide. Man, that’s a lot o’ satoshis.

Fuggedaboud calling me BD00 anymore, just call me “BTC Dog” from now on. It’s got a nice gangsta rapper twang to it, no?

Bitcoin In UML

Abstraction Is Selective Ignorance – Andrew Koenig

All Models Are Wrong, Some Are Useful – George Box

The following figure attempts to show the relationships between major Bitcoin system entities as captured in a UML class diagram .

Starting from the bottom of the diagram, a Bitcoin user can own zero or more Hardware, Web, Mobile, PC, and/or Paper Wallets. Each type of Wallet is a Bitcoin node. A Miner is also a BTC network node. Each BTC node establishes a one-to-many relationship with other peer BTC nodes connected to the network.

An alternative UML structural “view” of the BTC system is given as:

Each BTC node retains a copy of the global, publicly shared Blockchain. As of this writing, the Blockchain has 380K+ Blocks. Each Block has one or more validated BTC Transactions embedded within it. Via the interface facilities provided by a BTC Node, a User composes a Transaction and submits it to the network for validation and execution. Each instance of a BTC Transaction contains a source address, destination address, the BTC amount to be transacted, and the source address owner’s signature.