Bitcoin Before Bitcoin

When I first discovered the divine invention that is Bitcoin from an obscure posting on the nerd site slashdot.org, I performed the proverbial deep, speedo-less, dive into this strange, new, multi-discipline (economics + computer science + cryptography) idea that grabbed my attention by the cajones. My first question was “how the feck can this digital monetary network be technically sound?” My second was “how the feck can Bitcoin be ‘decentralized’ (with no single point of failure or no benevolent dictator like Linus Torvalds in charge)?” My third was “what the feck do ‘trustless’ and ‘permissionless’ mean?” The questions came fast and furious out of nowhere. They were piling up inside my head and pushing every other thought overboard. Based on my gut feeling that there was something special brewing, I was primed and juiced to learn and understand the Bitcoin protocol.

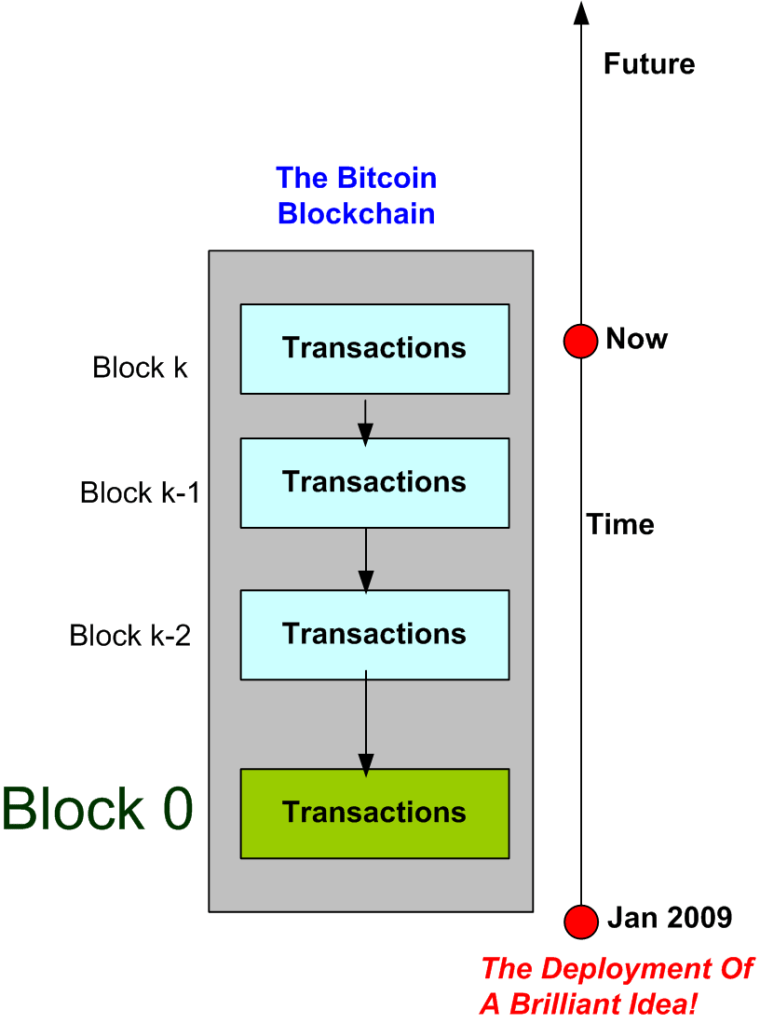

Being an overpaid software engineer and not knowing anything about “real” money, I chose to go down the technical path first by downloading the C++ core source code from GitHub, compiling it, running the test suite, and then running the node software. I watched in wonder as the node software proceeded to synchronize with the worldwide Bitcoin network and download the entire blockchain. Every transaction that ever occurred over the network from t == 0, which was Jan 3, 2009, to t == now was written to my hard disk! I also interacted with some of the fiercely dedicated core developers on the web and I even submitted a simple aesthetic code change to the core development team (that was rejected, lol).

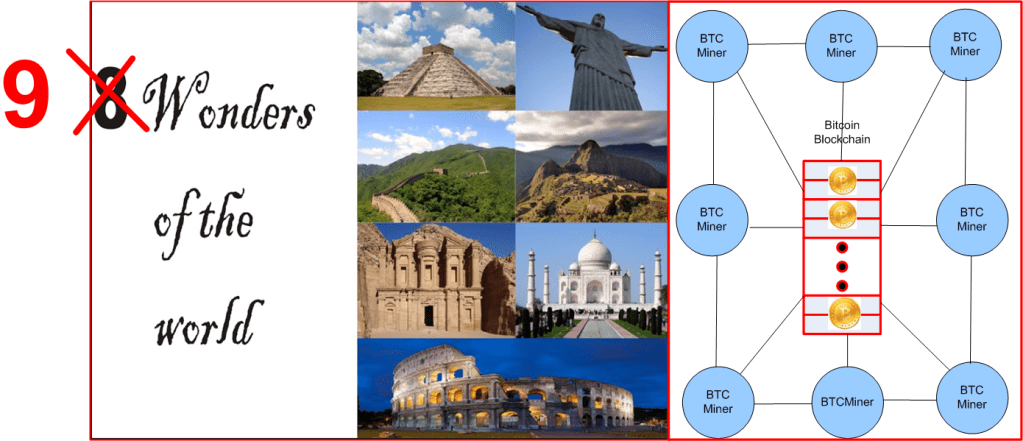

When I finally surfaced from the technical dive, I was convinced that Bitcoin was a brilliant work of original, intellectual art; the ninth wonder of the world. I developed a deep respect for, and a warm feeling of gratitude toward, whoever Satoshi Nakamoto was/is. I knew(know) that Bitcoin was(is) going to provide equal economic opportunity to billions of “unbanked” and inflation-ravaged people around the world. I just didn’t know how it would play out or how long it would take. Sadly, people who don’t understand Bitcoin from this worldly viewpoint either think of it as a scam or a speculative, profitless, stock.

One of the pleasant fringe benefits of diving deep into the Bitcoin protocol was discovering the obscure field of “Austrian Economics“. Despite taking the cookie cutter macro-economics course as an undergrad many moons ago, I never heard of this weird, heretical, way of thinking about money. Instead of classical economic growth through inflation, Austrian economists advocate for growth through deflation. Blasphemy!

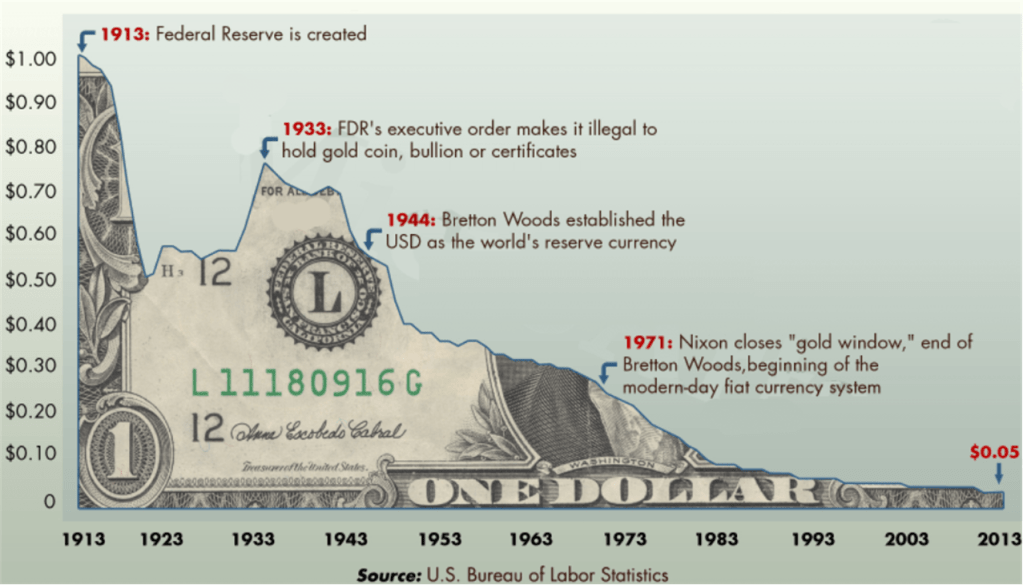

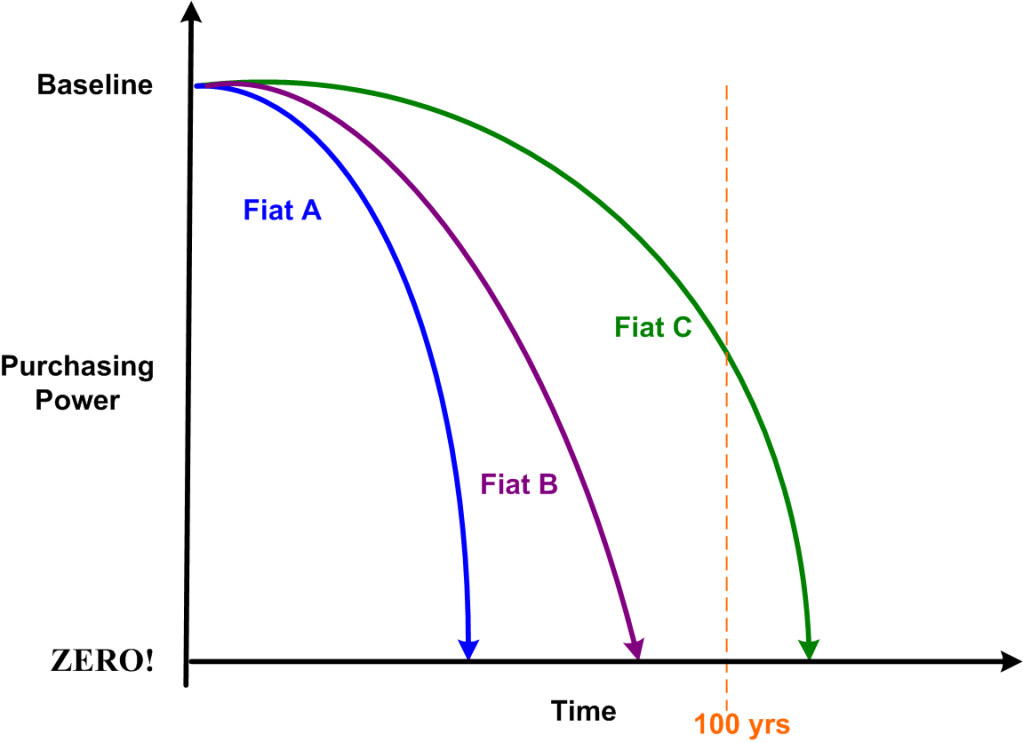

The best thinkers in this reviled school of economic thought argue how something that the vast majority of us take for granted, the control of a nation’s money supply, should not be left in the hands of the rulers (politicians + central bankers). They will, as history has shown without exception, irresponsibly debase the nation’s fiat money (fiat means: you must use the paper money we control to pay taxes or else you will get rekt) over time by printing more of it whenever it’s politically expedient to fund their pet projects and wars instead of having the guts to impose taxes to pay for them. The pic below shows what inflation, via central bank and government collusion, has done to the purchasing power of the US dollar over 100 years.

Inflating away the purchasing power of fiat money happens in every country with a central bank. That’s a lot of feckin’ countries! It’s just a matter of how fast the debasement takes to destroy a nation. It’s faster for the citizens of developing countries (Zimbabwe, Venezuela, Argentina, Lebanon, Turkey) and slower for the citizens of developed countries.

Before my obsession with Bitcoin took hold, I took it for granted that government should control a nation’s fiat money supply. Hey, we should “trust” those we elect to be doing the right thing with our taxes and savings, no? That is the way it’s supposed to be, damnit! After diving deeper, I found that history has repeatedly shown that because of human nature (you know, that pesky Dawkins selfish gene), a nation’s rulers always manipulate the money supply and disrupt free markets not to “promote the general welfare” of its citizens like you, but to enrich themselves and their cronies at our expense.

The Austrian economists saw through the political charade. They learned that the only way for a nation’s citizens to truly flourish was to “take” control of money out of the hands of centralized governments and distribute it amongst the citizenry that honestly earns it through work. But what does “take” mean in the context of “take control of money out of the hands of the government?” How can anyone/group have any chance of pulling that off against a giant, multi-tiered, energy-guzzling, law enforcement apparatus? Unlike Bitcoin, which is backed by diligent Proof-of-Work, Government-controlled fiat money is backed by coercive Proof-of-Force.

One of the leading Austrian economists, Friedrich Hayek, brilliantly envisioned the blurry outline of Bitcoin, before Bitcoin, as the solution to the intractable “take” problem in 1984, 24 years before Satoshi Nakamoto conceived of Bitcoin in 2008.

It’s sad Mr. Hayek isn’t alive today to see that Bitcoin is his sly and roundabout way to “take the thing out of the hands of government“. And they can’t stop it.

The Stank Of Scanxiety

With the usual stank of scanxiety in the air, I underwent my tri-monthly brain MRI scan yesterday.

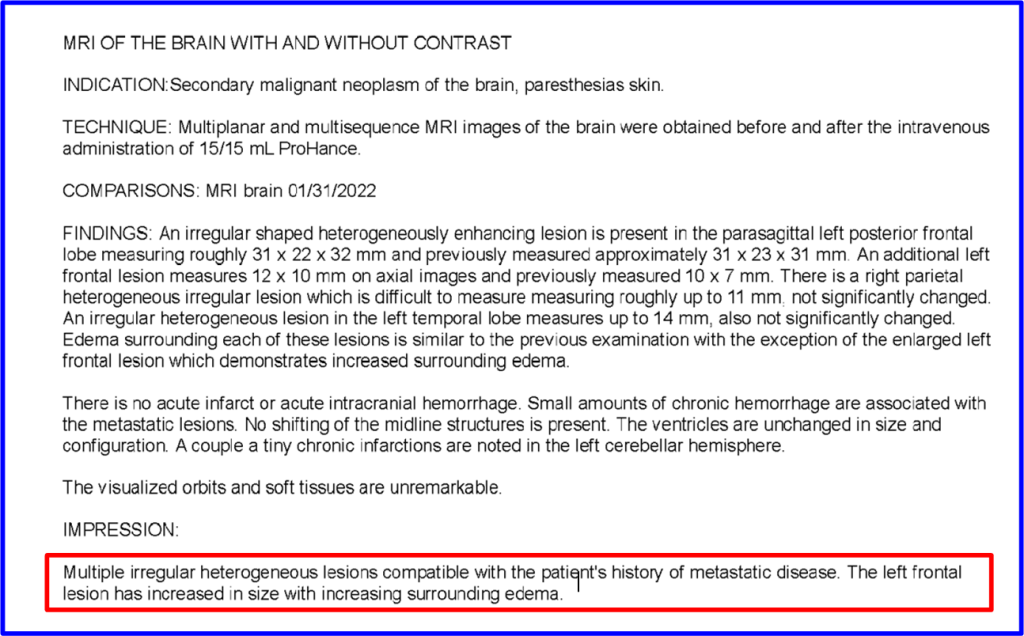

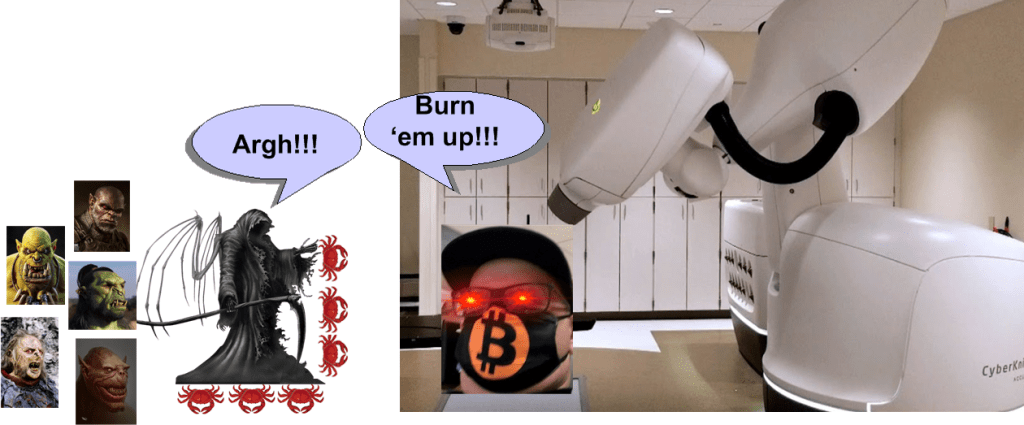

The resulting reconnaissance images of the bloodied battlefield showed that one of the EOAM‘s Orc armies seems to have grown after a long, four-year (!!!!) hiatus.

The good news is that there were no new tumors detected on the battlefield; and the other three Orc cancer fortresses have remained quasi-quiescent in their respective puddles of edema due to the monthly, $25k, immunotherapy whuppin’s they’ve been gettin’.

Because of this new, but not-so-surprising development, a CT/PET scan of my brain is currently being scheduled in order for my generalissimo neurosurgeon to get a high resolution look at what those fugly Orcs are doing. My trusted Cyberknife friend will probably have to be deployed yet again to burn those feckers back into their hellholes. If not, it’s either brain surgery or hospice….. just kidding. I have no idea what will happen next until it happens. lol, let’s rock!

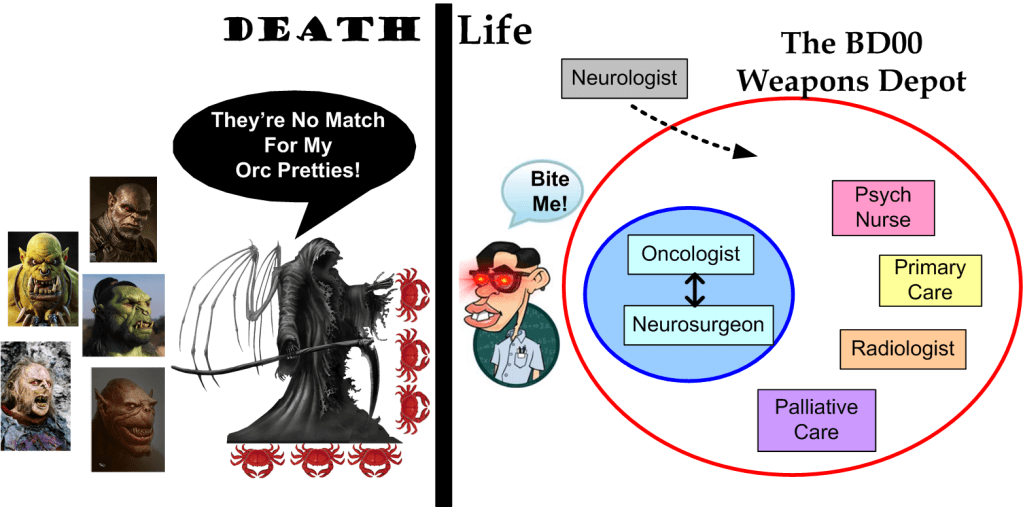

A New Weapon

I added a new doctor to my weapons cache in the ongoing death-match with the Emperor Of All Maladies. After getting a referral from my oncologist, I went to a neurologist for a consultation regarding the havoc my rebellious right leg is wreaking upon me due to the onslaught of the Emperor’s Orc army. I was curious to see if my newest Sun Tzu recruit could help blunt the progressive nerve deterioration I’ve been sensing along my entire leg (and feet).

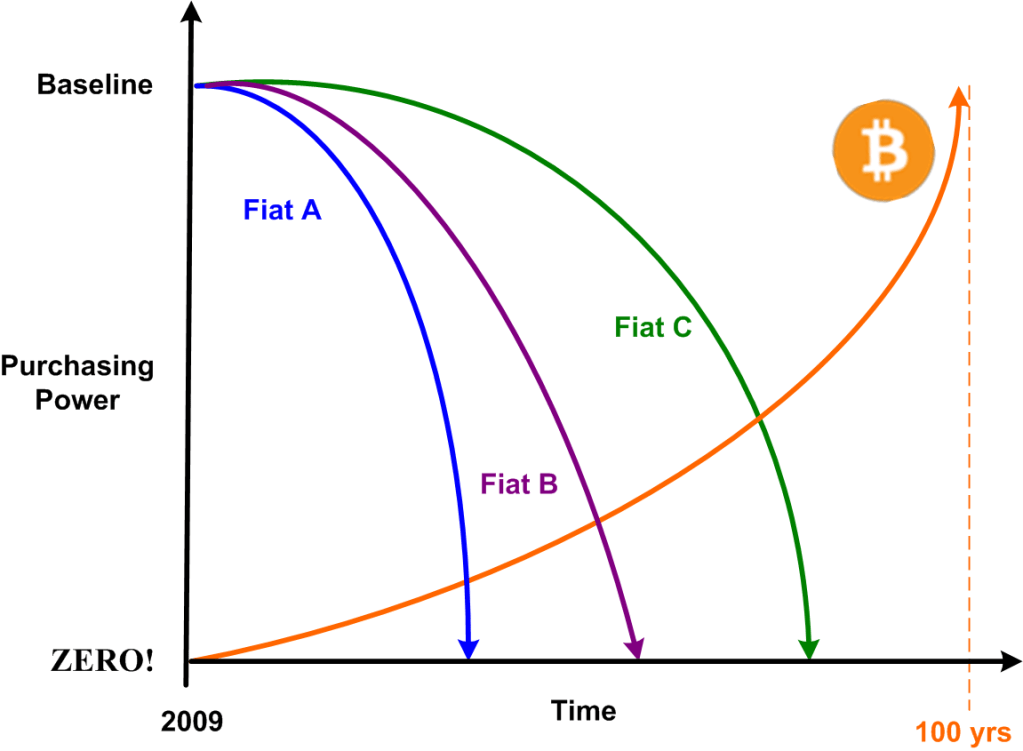

As I arrived for my appointment, I quickly discovered that the beloved Bitcoin Vandal had preceded me. I find it Interesting how the BV has the same neurologist as BD00.

I’m very fond of my brilliant oncologist and neurosurgeon dynamic duo because they have taken good care of me for the past six (!!!!!) years, scanning and monitoring the locations, movements, and strength of the Emperor’s orc armies. It’s understandable that the spastic/twitching/quivering nerves and tight/fatigued/crampy muscles that have been plaguing me extra hard for the past few months are outside their areas of expertise. While not suffering in outright pain, it’s a continuous feeling of discomfort stuck somewhere in purgatory outside of the realm of the famously debated 1 -10 pain scale. Mentally, the agitating cacophony of physical sensations is constantly hijacking my awareness away from the sacred “now” and projecting it into a fabricated thought-storm of frightening “wheelchair” scenarios.

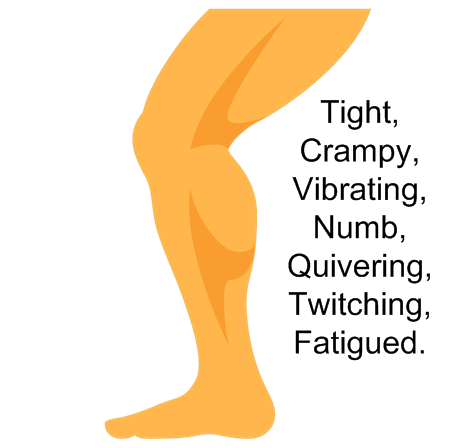

I actually didn’t meet with the neurologist during the visit. I was examined by his delightful LPA, Rose. We conversed for 45 minutes while she worked me over with all kinds of nerve-diagnostic gizmos that Q would be envious of. She was pushing, pulling, tapping, and poking all over the battlefield that is my right leg (and feet). Then, out of nowhere, in a Larry David moment, she stated that my calves were much bigger than my ankles. She paused and looked up at me as if I was supposed to know why. I frowned, shrugged, laughed, and asked her what the right proportion should be. She laughed, then I asked her if she was flirting with me, and then we both laughed at the absurdity of such a statement.

As Rose continued to examine my neurological state, she noticed the twitching frenzy going on just under my skin, and up and down my entire leg. I told her it feels tight, fatigued, crampy, and vibrating all at the same time (from Orc-hijacked nerves randomly misfiring and zapping the schitt out of my muscles?). She also noticed some twitches up and down my right arm. That was surprising to me because the arm feels fine and I’ve never had issues with it other than the occasional, chemo-induced, fingertip-numbness flareup. Oh, and also when I kept annoyingly dropping a notebook I was holding when I had a small stroke in 2019.

During our convo, we talked about the meds I’ve been taking to alleviate the symptoms from my nerve distress (gabapentin, alpha lipoic acid, B12, “ganja”). I also mentioned that I take klonopin occasionally for anxiety/sleep and I thought I noticed a positive correlation between the much-abused controlled substance and symptom alleviation. I wasn’t sure of the correlation because I don’t take it often and I couldn’t remember if I did so during bad flareups. Rose perked up and immediately said there absolutely was a positive correlation because klonopin serves as a muscle relaxant in addition to providing anti-seizure and anti-anxiety therapeutic effects. She then advised me to start taking a low dose daily.

I was both happy and sad when I heard Rose’s recommendation. I was happy because it’s just a dosage bump and not another new med to add to my drug cabinet. I was sad for two reasons:

1) I, the omniscient know-it-all, should’ve deduced that the klonopin-relief linkage made sense and thought of trying it daily months ago, Duh! Maybe I didn’t make the connection because of the threat of benzo-addiction loitering in the back of my mind, which is funny since I’m a stage 4 cancer patient and I shouldn’t give a schitt about addiction at this point. 😂🤣

2) I thought my neurosurgeon’s nurse (whom I also appreciate very much) should have suggested the bump in klonopin dosage to me years ago – since I’ve been whining about progressive neurologic problems at every MRI follow up since the beginning of time.

In addition to the suggested change in klonopin dosage, Rose ordered a 2 hour, full body MRI (in late May) to see if there’s a separate structural issue with my neck that may be causing or contributing to my chronic discomfort. I’ve never had the slightest neck problem before, but since she saw the same twitchy symptoms in my arm as the leg, she wants to cover that base.

So, that’s the latest update from the battlefront in my existential war with the fucker that is… the Emperor Of All Maladies.

Rules Without Rulers II

After I painted my “Rules Without Rulers” Picasso in the previous post, I stood back and reveled over the final product. Then, I experienced an unexpected communication from my creation. She whispered in my ear that something was amiss, but then she abruptly stopped speaking. She left it to the student, me, to figure out what was amiss. Hmm, I thought… interesting. Then, the words “add another layer” crossed the cavern from the formless into form and instantaneously appeared within my ringing+dizzy+stoned head (my pesky, hemorrhaging, brain lesions are leaking again!).

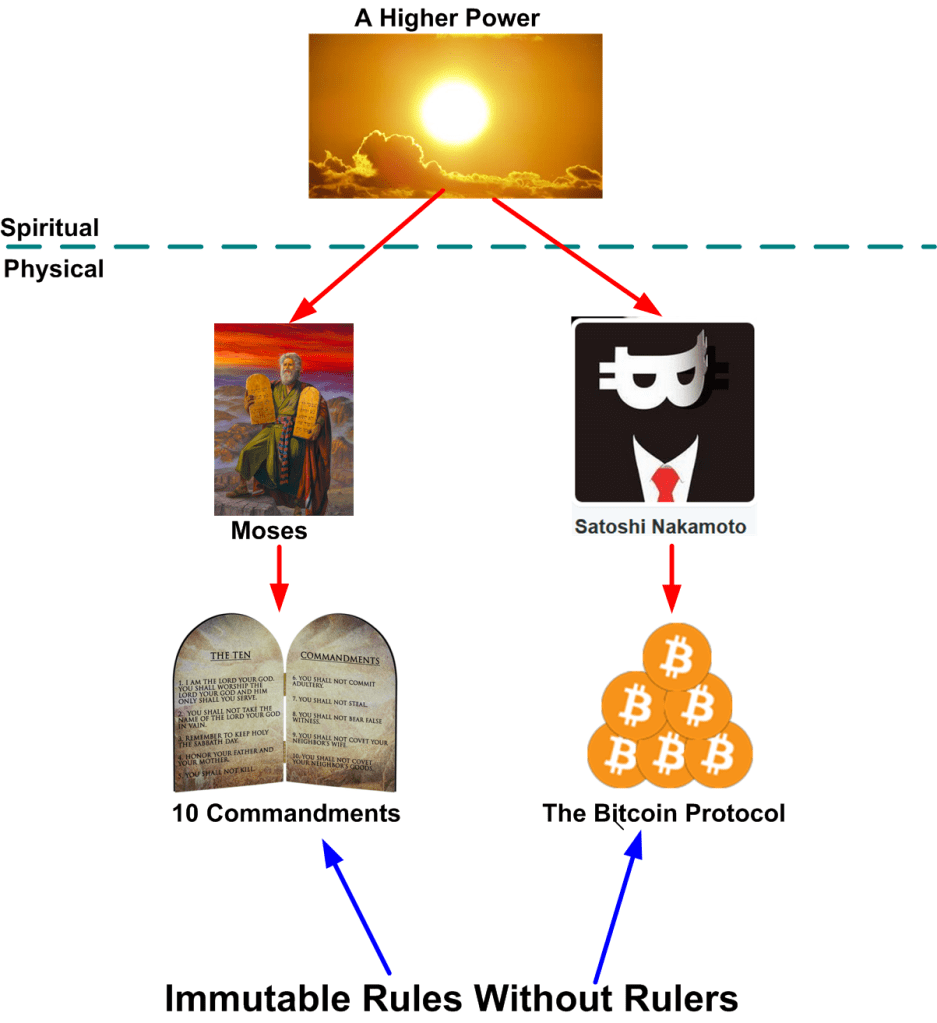

Being a hard-core admirer of the power of abstraction to pierce the armor of complexity, increase clarity, and catalyze understanding of something weird like “How Can There Be Rules without Rulers?”, I immediately determined that my lovely meant “another layer of abstraction“. So, here’s my encore painting showing how two examples of “rules without rulers” cross the chasm from the spiritual to the physical realm.

The intent is to postulate the path from energy -> thought -> words(code). The updated picture shows that Moses and Satoshi were animated by a universal life force from a mysterious layer “above them“, which represents a higher power of your choice (Yahweh, Allah, Gaiea, Tao, Zeus, etc.) Thus, they were lucky conduits to two world-changing ideas birthed for man, from no-man.

How’s that for another serving of BS from BD00?

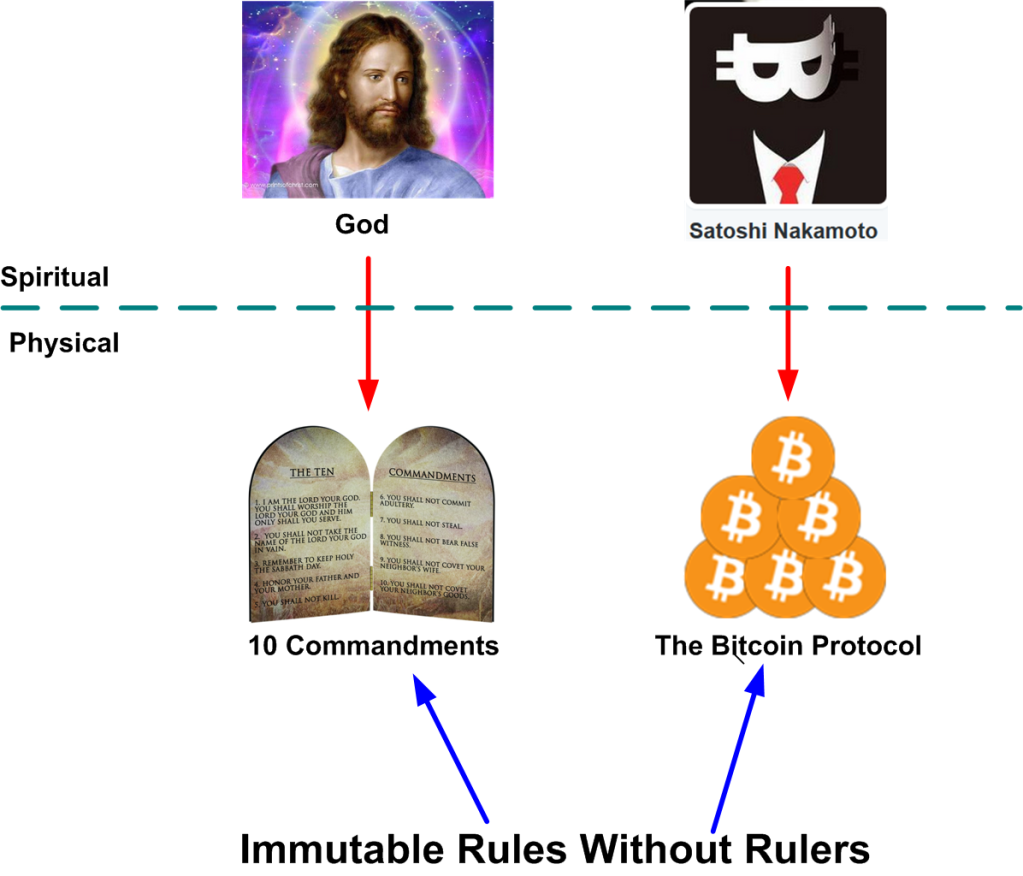

Rules Without Rulers

When you glance at the picture below, please don’t go overboard and think I’m comparing lord Satoshi to god. The purpose of this post is simply to compare the 10 commandments with the Bitcoin protocol for comedic effect, nothing more. Happy Easter!!!!!

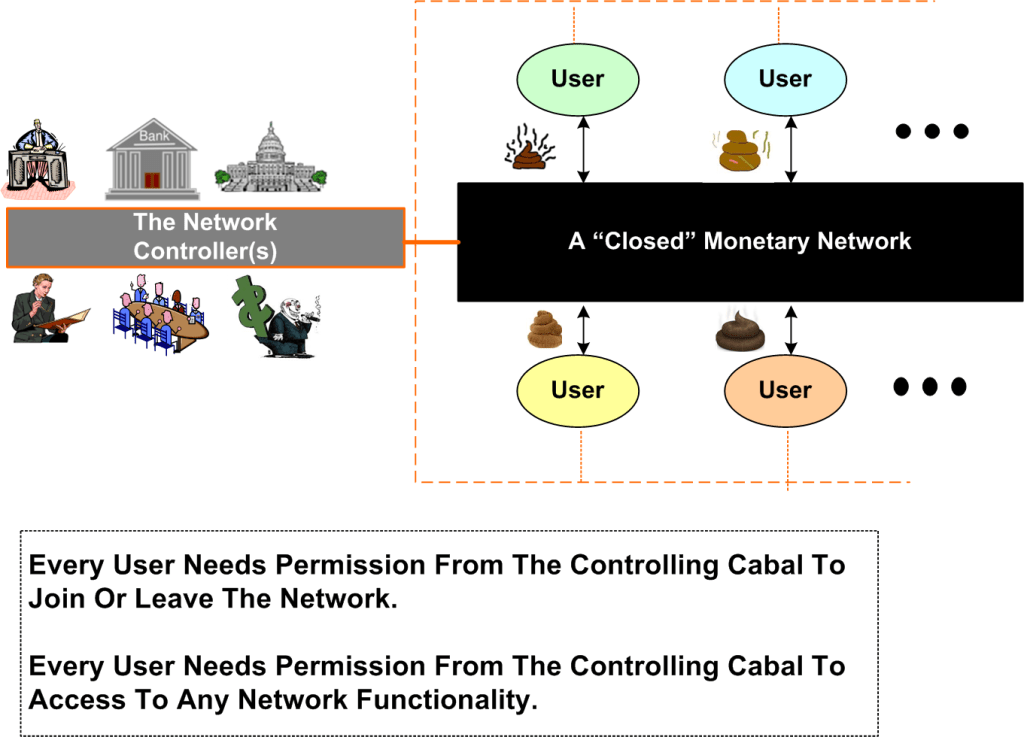

Bitcoin: Freedom From Moral Hazard

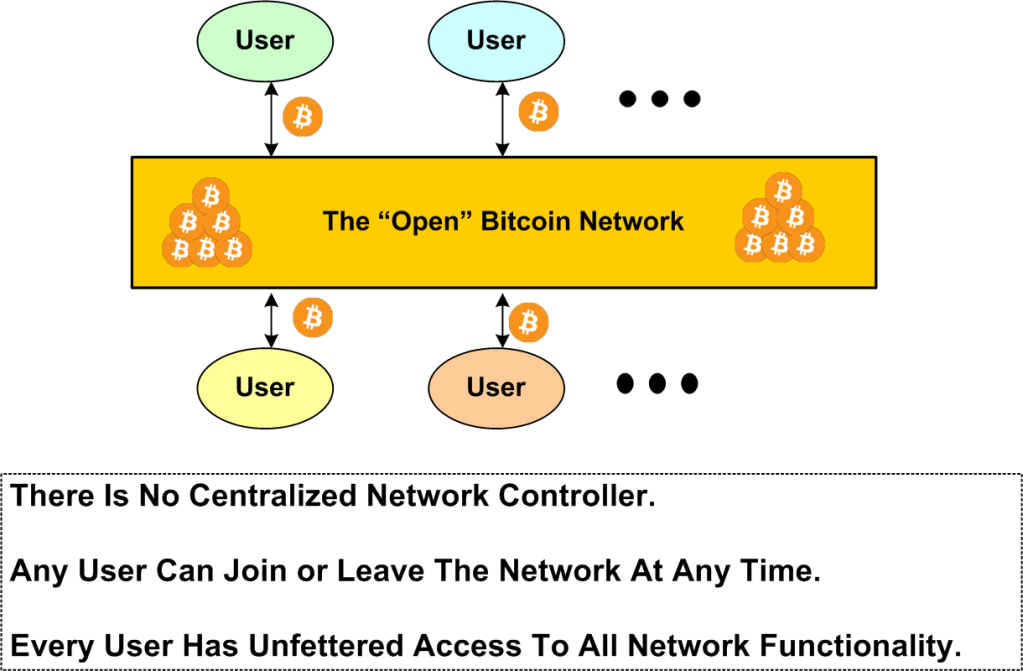

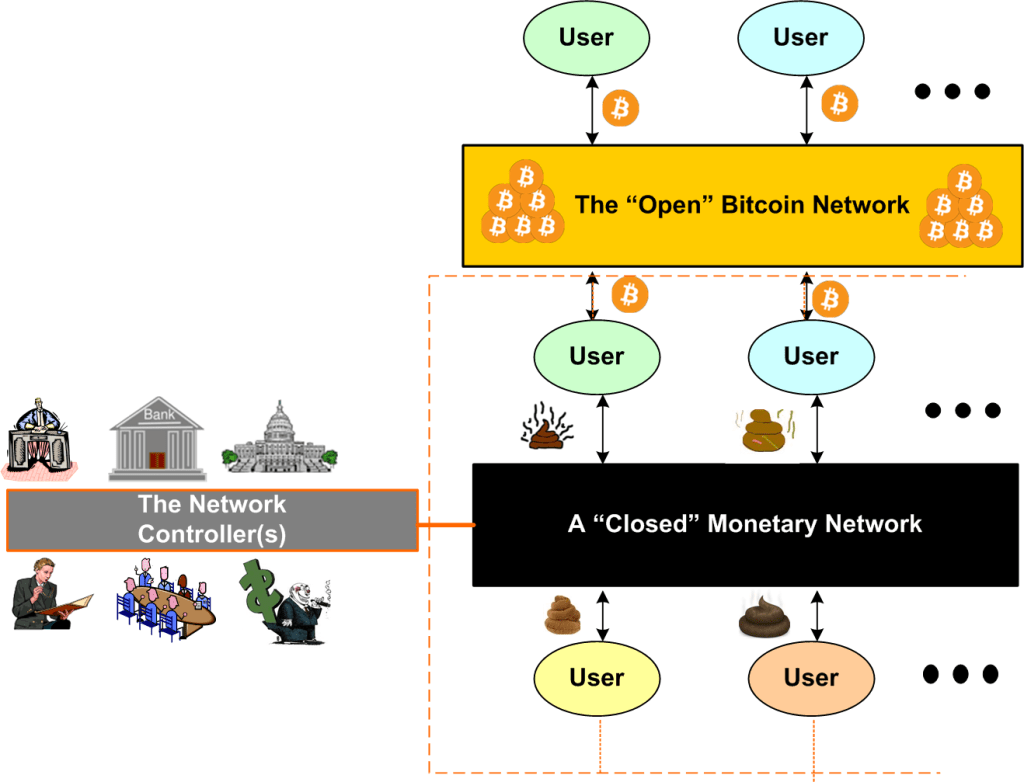

Before the Bitcoin Immaculate Conception was birthed into the world by Satoshi Nakamoto on Jan 3rd, 2009, we only had, and still do have, and still will have, a world filled with closed, monetary networks like this:

Because the only commodity on earth that no one can get enough of is “money“, and money is, um, really important for surviving and thriving, these old and “morally leaky” network quagmires are closely monitored and controlled via elite, privileged, and corruptible cabals. These cabals grant membership and usage capabilities to users who meet the requirements for membership (or those who covertly bribe their way in).

In addition to these cabal-controlled networks, the world now has the first open, permissionless, monetary network, which, of course, is the Bitcoin network.

That’s it, that’s the post. I’m cutting off early because the Emperor once again lit my feet on fire. I gotta go “toke” up and slather some Australian Dream cream on my toes to temporarily forget about my closely-coupled relationship with him once again.

Oh, and one last pic for you to ponder before I go. As increasingly more closed-network users discover the freedom from “moral hazard” that the Bitcoin network freely offers to every soul on the planet, the more they’ll want to plug into it and move some value into it as a welcome hedge against unscrupulous cabals.

Bitcoin Volatility? What Volatility?

Besides the same old, same old, “Bitcoin is boiling the oceans!” scare tactic, another common theme employed by anti-bitcoiners to scare people away from embracing Bitcoin as a Store of Value (SoV) is the old “unlike gold, it’s too volatile to be worthy as an SoV!“.

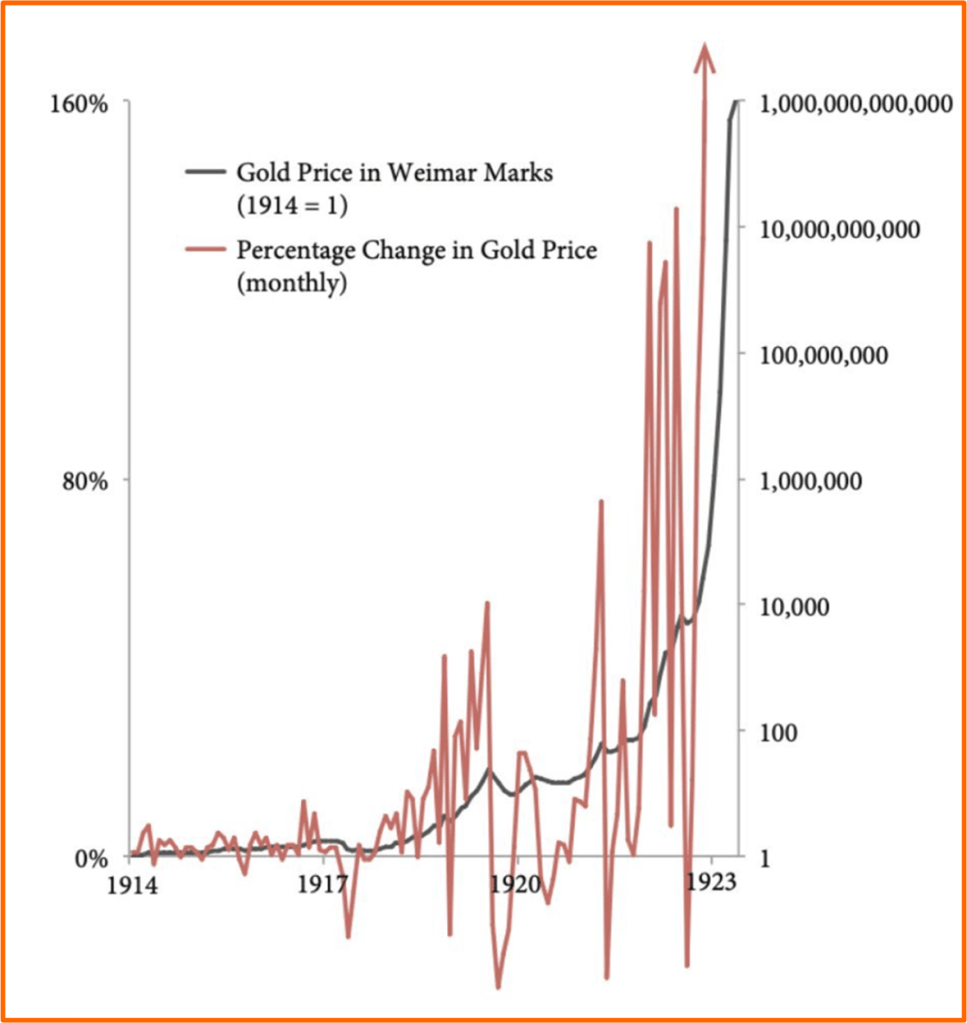

But wait, nothing is as it seems! Check out this graph of gold’s price volatility during the hyperinflation-ization of Weimar Germany before and after WWI.

Compare the period between 1914-1917, when there was essentially no volatility in the price of gold, to the war and post war years.

Overwhelmed by massive reparation payments imposed upon Germany by the avenging countries after the war ended, the purchasing power of German fiat went hyperbolically to zero as the country frantically tried to pay off its debt by printing fiat with reckless abandon. As expected by esteemed scholars like BD00, German hyperinflation then raged exponentially, destroyed the country, and catalyzed the subsequent rise of Hitler. Naturally, the price of gold took off as the German people rushed to exchange their increasingly useless paper for shiny rocks. But it surely wasn’t a smooth ride on the way up. It was a wild ass rollercoaster ride of massive volatility as the graph above shows.

So, if you believe this poorly researched BD00 post, Bitcoin’s current volatility does not disqualify it as an SoV. What makes Bitcoin the greatest SoV ever invented/discovered is the superiority of its monetary attributes as compared to gold and all other forms of so-called “hard” money.

Post post note : I finished this dumbass post just as an “edible” was starting to kick in. Since I can’t attribute the errors and mistakes herein to being psychotropically inebriated (aka “stoned”), I hereby attribute them to the chronically hemorrhaging lesions inside my brain.

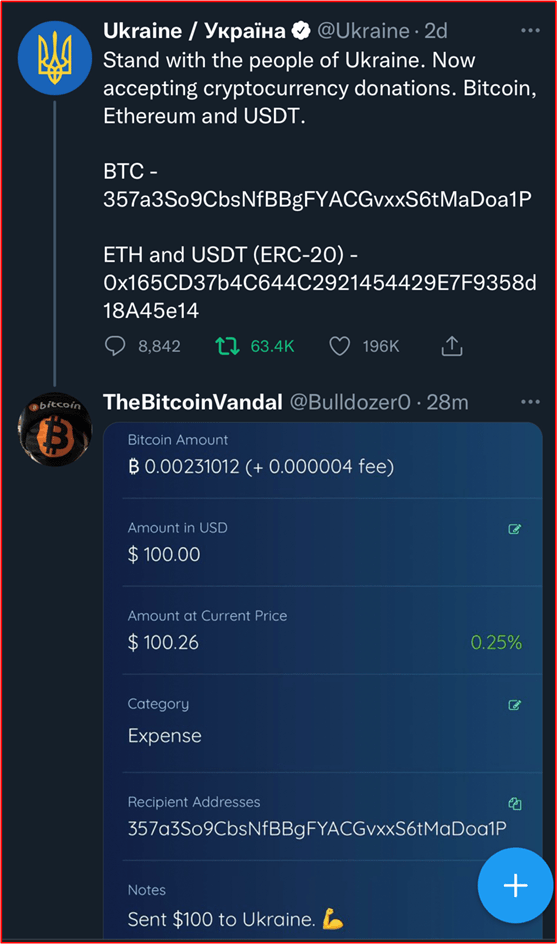

Ukraine And Bitcoin

I just sent $100 in Bitcoin to Ukraine without having to get any “official approvals”, or having to pay any ridiculous fees to rent-seeking middlemen like Western Union, or having to wait for days/weeks for the international transaction to clear. This is a glimpse into the future, which, of course, is already here – it’s just not evenly distributed according to William Gibson. I don’t know how or exactly when humanity will arrive there, but I’m confident it will.

Oh, and before I go, here’s another, bigger, reason Bitcoin will be recognized as the best money ever invented.

Bend It Like Bitcoin

Before reading further, don’t forget that BD00 makes schitt up when he’s too lazy to look up details on the topic he’s writing about.

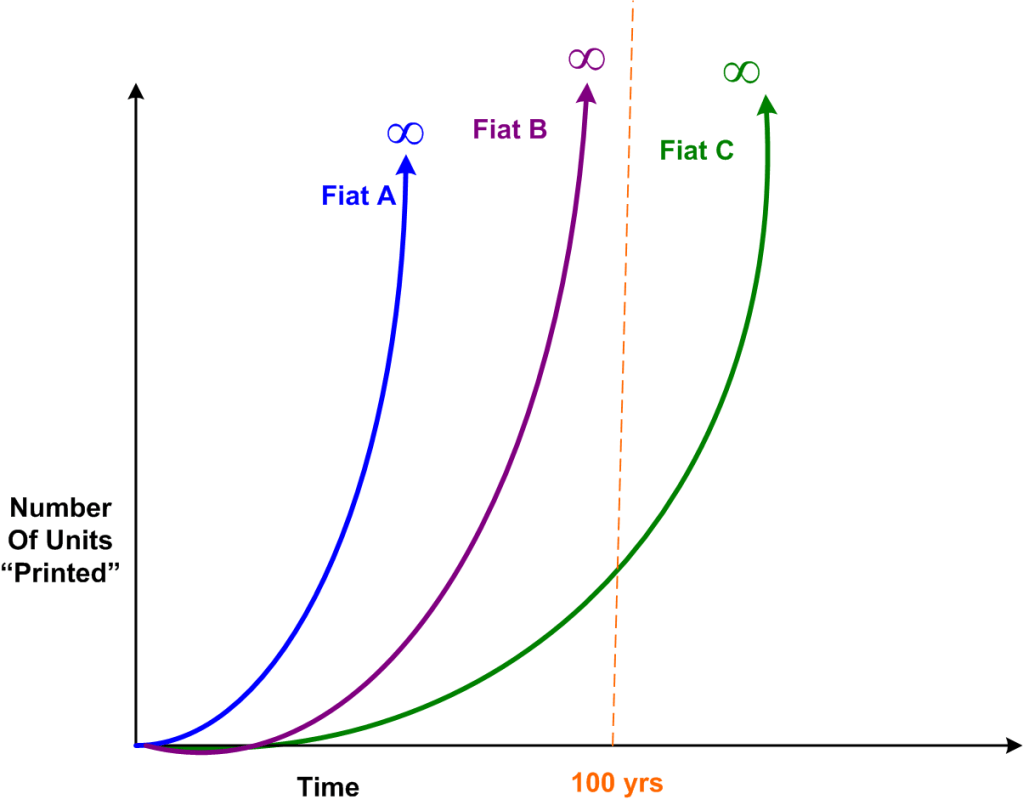

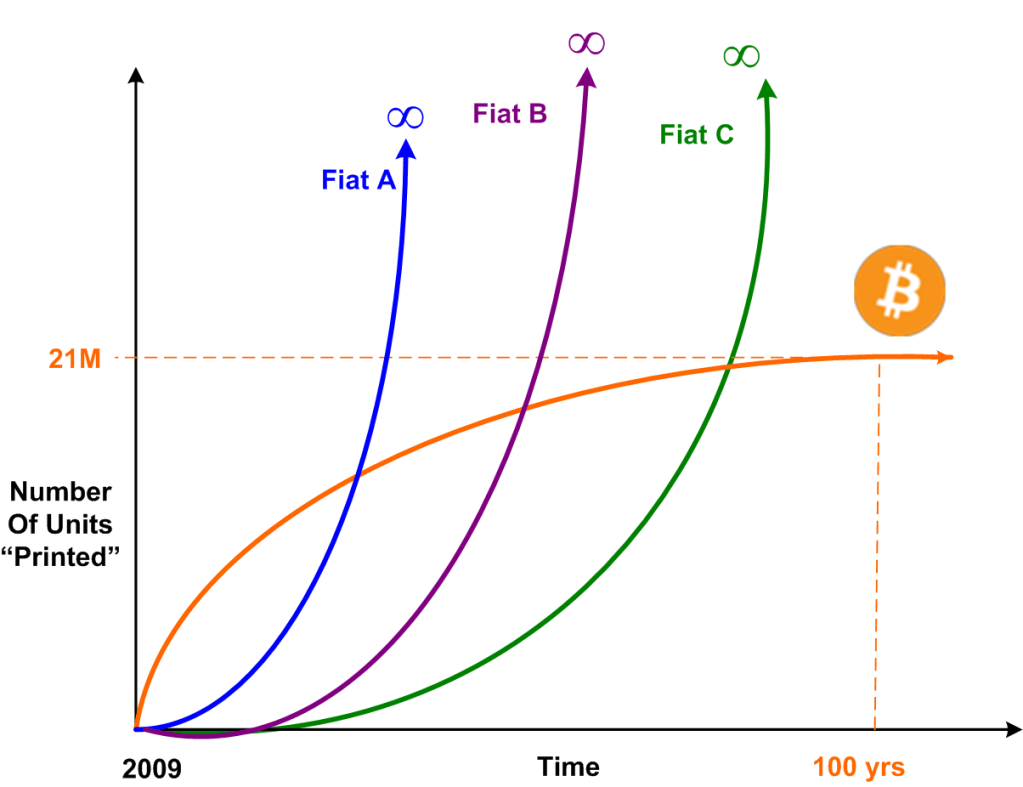

With that out of the way, the graphic below shows what happens in all fiat-based, nation-states over time. Since politicians are too chicken to raise taxes for projects they believe will help the country prosper, they continuously borrow money with no intention of ever paying it back. Wouldn’t it be nice if citizens could borrow money without ever having to pay it back? The politicians borrow money from the public and, when the public doesn’t want to part with their fiat because of “trust” issues, the central bank waltzes in and prints money out of thin air to soak up the unwanted debt. Wouldn’t it be nice if citizens could print their own money out of thin air whenever they wanted instead of having to work their asses off for it?

As the money printers go “burrrrrrr” and the money supply gets exponentially inflated like that guy in the Monty Python movie, the purchasing power of each fiat unit decreases until the system implodes. I read, in one of the many fine Bitcoin books, that no known fiat-based systems have ever survived 100 years.

So, how does Bitcoin break the mold on the exponential fiat model of destruction? Bitcoin’s 21M hard limit may (and should) convince some fiat-based nation-states to assume fiscal responsibility and bend their curves to the right to avoid a massive loss via capital flight into Bitcoin and other stores of value.

For those nation-states that don’t assume fiscal responsibility and stop their reckless paper printing, Bitcoin will suck up all the purchasing power as the fiat holders jump ship into the safety of the Bitcoin network.

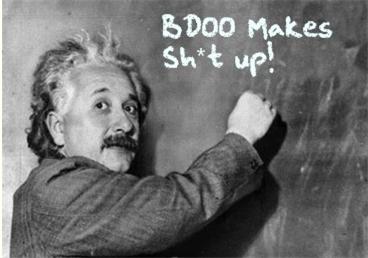

Bitcoin Vandal Out Of Control

As you can see below, the Bitcoin Vandal, modeling one of the new soldier helmets in the forthcoming “Squid Game II” movie, has been quite active as of late. The desecration of private property at the behest of the Emperor Of All Maladies will continue unabated until… it doesn’t.