Opening The Gates

Because it’s such a mind-blowing idea, and the first time they hear about it is usually through a short, negative press story, most people are initially repulsed by Bitcoin (like I was!). As you’re about to see, even really smart people fall into the “Bitcoin is evil” trap when the subject is broached.

The following excerpt, which gracefully closes Nathaniel Popper‘s must-read book, “Digital Gold“, shows how uber-philanthropist Bill Gates was initially perturbed when Xapo CEO and Bitcoin advocate Wences Casares suggested that Bitcoin could be used to further the Bill & Melinda Gates Foundation‘s mission to “unlock the possibility inside every individual“:

In the hallway walking to lunch, after the Bezos-Buffett conversation, Wences spotted Bill Gates, who had been notably reticent about Bitcoin. Wences knew that Gates’s multibillion-dollar foundation had been making a big push to get people in the developing world connected financially, and Wences approached him to explain why Bitcoin might help his cause. As soon as Wences broached the topic, Gates’s face clouded over, and there was a note of anger in his voice as he told Wences that the foundation would never use an anonymous money to further its cause. Wences was somewhat taken aback, but this was not the first time he had been challenged by a powerful person. He quickly said that Bitcoin could indeed be used anonymously— but so could cash. And Bitcoin services could easily be set up so that users were not anonymous. He then spoke directly to the work that Gates was doing, and noted that the foundation had been pushing people in poor countries into expensive digital services that came with lots of fees each time they were used. The famous M-Pesa system allowed Kenyans to hold and spend money on their cell phones, but charged a fee each time. “You are spending billions to make poor people poorer,” Wences said. Gates didn’t just roll over. He vigorously defended the work his foundation had already done, but Gates was less hostile than he had been a few moments earlier, and seemed to evince a certain respect for Wences’s chutzpah. Wences saw the crowd that was watching the conversation, and knew he had to be careful about antagonizing Bill Gates, especially in front of others. But Wences had another point he wanted to make. He knew that back in the early days of the Internet, Gates had initially bet against the open Internet and built a closed network for Microsoft that was similar to Compuserve and Prodigy— it linked computers to a central server, with news and other information, but not to the broader Internet, as the TCP/ IP protocol allowed. “To me it feels like you are trying to get the whole world connected with something like Compuserve when everyone already has access to TCP/ IP,” he said, and then paused anxiously to see what kind of response he would get. What he heard back from Gates was more than he could have reasonably hoped for. “You know what? I told the foundation not to touch Bitcoin and that may have been a mistake,” Gates said, amicably. “We are going to call you.” After Wences got back to California, he received an e-mail from the Gates Foundation, looking to set up a time to talk. Not long after that, Gates made his first public comments praising at least some of the concepts behind Bitcoin, if not the anonymity. And so Bitcoin and its believers attracted one more person who was willing to give this new technology a look, and remain open to the possibility that the whole thing wasn’t, at least, entirely crazy.

Playing Nice

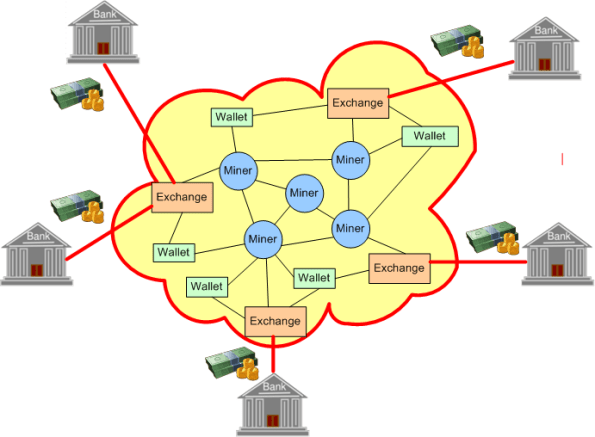

The figure below shows a simplified view of the ever growing, world-wide, Bitcoin network. Miners are awarded bitcoins for keeping the network secure and maintaining the immutable integrity of the blockchain. Mobile, PC, and web-based wallets exchange bitcoins with each other in a fluid, borderless, friction-free environment unencumbered by centralized institutions.

In the picture, the Bitcoin economy is a closed system. For it to really thrive and zoom to the moon, it must interface with, and “play nice” with, the existing international finance system. Fiat currencies, which will never cease to exist, must make their way into the system and bitcoins must make their way out of the system.

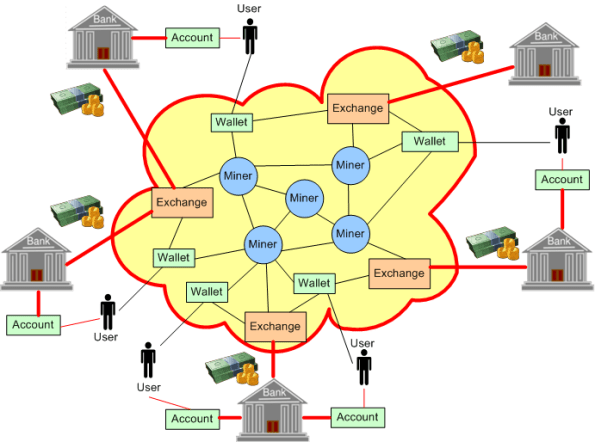

As the next figure illustrates, the purpose of BTC exchanges (Coinbase, Bitstamp, Kraken, etc) is to bridge the tenuous interface gap between traditional, highly regulated, centralized, banking systems and the decentralized Bitcoin network.

Users open an account on a bitcoin exchange, link it with their bank account, and trade dollars for bitcoin:

Since bitcoin transfers are blazingly fast and they can be used seamlessly and cheaply for both legitimate and criminal purposes, governments are right to be wary of the latter use cases. Thus, bitcoin exchanges, unlike the Bitcoin network itself, can be shutdown due to non-compliance with money laundering laws.

Since the laws of thermodynamics dictate that closed systems eventually die a slow death, opening up the Bitcoin system to the traditional world of finance and playing nice with its regulators is a win for both law abiding individuals who want more control over their money, and governments who want to stamp out criminal activity on the network.

Teeny Tiny Link

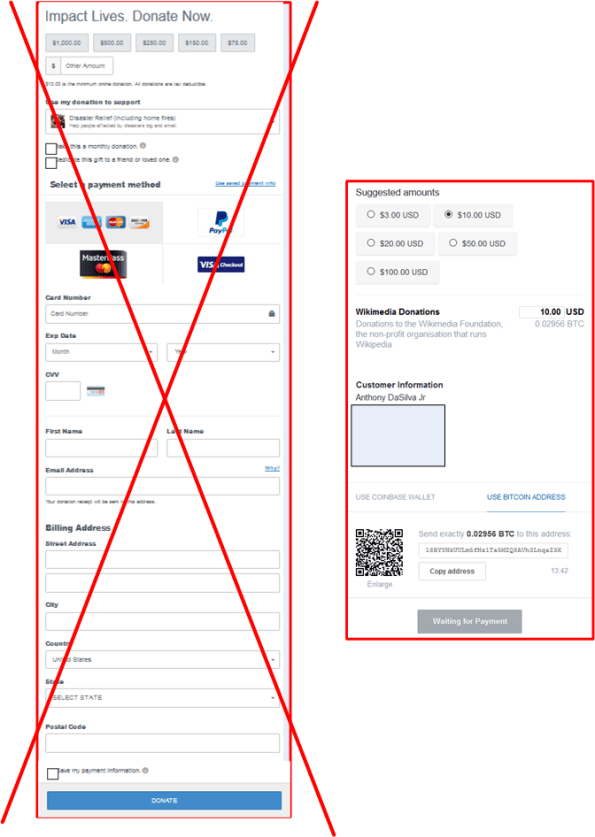

Since I use Firefox as my everyday browser, I decided to respond to the above annual Mozilla.org fundraiser e-mail by donating some bitcoin this year instead of using paypal or a credit card. As you can see from the following graphic, it wasn’t so easy to find the bitcoin link.

Upon clicking the teeny tiny bitcoin link, the following dialog box appeared:

Upon clicking the teeny tiny bitcoin link, the following dialog box appeared:

Notice that the only customer information I had to provide was my e-mail address; no physical address, telephone number, credit card number, card code, and expiration date were required.

Too Good To Die

On the one hand, the Bitcoin community thinks it doesn’t matter who the real Satoshi Nakamoto is. On the other hand, the less-informed press seems to think it does matter.

To the Bitcoin community, Bitcoin has come of age and has passed the threshold where it requires a creator to nurture its growth. The community is large enough and smart enough to move the technology forward without the real Satoshi directing the show.

To the press, the speculation that one Bitcoin address on the blockchain attributed to the real Satoshi has over 1 million BTC attached to it means that it does matter. The logic is that if those 1 million BTC are sold in a short period of time, the BTC price will collapse.

After assessing all the evidence to date, I (like most of the BTC community) don’t believe Aussie Craig Wright is the real Satoshi Nakamoto. Even if Mr. Wright is the real deal, I’m with the BTC community on the opinion that it doesn’t matter.

I don’t care if Mr. Wright is the real Satoshi and sells all of his 1 million BTC on the open market in one transaction. Sure, the sale would tank the price, but like it has done after the forceful Silk Road web site closure and the Mt. Gox implosion, Bitcoin will bounce back and inexorably continue to rise in price and slowly infiltrate the mainstream. Bitcoin is anti-fragile because it is simply too good for humanity to die anytime soon – if ever. BUT, as always, I could be wrong and I’m prepared to lose my Bitcoin investment in its entirety.

Hoarding AND Spending

Since I’m loooong on Bitcoin, I’ve stashed away some coins in an offline wallet as an investment in the future success of the currency. However, since I also want to actively help the Bitcoin economy flourish and accelerate mainstream acceptance of the technology, I keep some spending money on hand in my mobile Blockchain and online Coinbase.com wallets.

As of today, I’ve only purchased one retail item with some of the BTC I have available for day-to-day commerce. However, I’ve sent $1 worth of BTC to several online friends so that they can personally discover and experiment with the technology. Interestingly, and indicative of the innocent ignorance that keeps Bitcoin flying under the radar for the mainstream individual, some people have “ignored” my $1 offer. They simply:

- have never heard about Bitcoin at all, or

- they don’t know enough about Bitcoin to understand its potential to make the world a more equitable and peaceful place, or

- they’ve only been exposed to Bitcoin’s negative publicity (the collapse of Mt. Gox, the extortion scams, the use of BTC to buy guns/drugs on Silk Road) and are afraid to join the community

By far, my most frequent usage of BTC as a currency has been to donate small amounts ($1-$5-$10-$25) to non-profit causes and send tips to people that I deem deserving: Wikipedia, Tor, Andreas Antonopoulis, a volunteer-operated Electrum wallet server, etc. If you’re reading this post and you’re associated with a non-profit org that doesn’t accept Bitcoin as a method of donation, you may want to reassess your situation.

The advantage of using Bitcoin over traditional credit cards for donations is huge. By using BTC, I don’t have to expose my credit card details to the payees and I can yield as much or as little personal information as I choose to. There are no long, multi-box, online forms to fill out. I simply copy & paste the recipient’s BTC address into my wallet’s send box, specify the amount to donate, enter my wallet PIN, and click “send“. I’ve discovered that I’ve been donating more with Bitcoin than by using traditional, 50 year old, insecure payment mechanisms. And that’s a good thing, no?

So, I’m not just a BTC “speculator” or “hoarder“, I’m an (almost) everyday user – like you might be one day too. 🙂

Did He, Or Didn’t he?

As the Crypto mailing list exchange snippet below indicates, Satoshi Nakamoto wrote all of the Bitcoin Core C++ source code prior to writing his world-changing white paper.

Hmmm, I wonder if Satoshi used TDD to develop his masterpiece? I also wonder: whether he meticulously tracked his velocity with a burndown chart; what obstacles his scrum master removed during the effort; and how his retrospectives improved the process.

Questions? Uh, Oh!

Companies are always trying to project the false illusion of being there for “you“. It’s all about “you“, dear customer, and since we care about “you“, we’ll make money as a side benefit. You —> profits.

However, unsurprisingly, I’ve found over decades of experience that most haven’t been telling the truth…

Gee, I wonder why that is? Has your experience been different than mine?

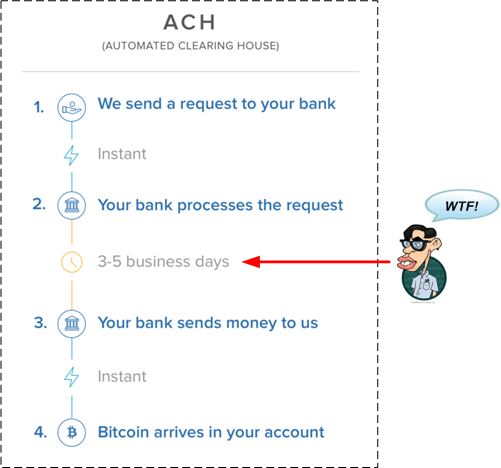

The Mysterious ACH Delay

One of the FAQs on Coinbase.com and other Bitcoin exchanges is: “Why does it take so long to get my bitcoins?“. As the graphic below illustrates, the delay is due to the ancient “Automated Clearing House” (ACH) system that banks employ to process money transfers.

Prior to grokking the topic and personally experimenting with the technology, most people will probably say (as with anything radically new and different) that Bitcoin is too complicated for them. But hey, those same people (like me) most likely have no idea what goes on behind the scenes during the mysterious ACH delay when they use the current, antiquated banking system. And yet, they initiate this complicated process every time they move money between financial institutions. International money movement via wire transfer is an even more perplexing, costly, and delay-inducing process.

As the bitcoin user experience improves as a result of the innovation taking place in the industry, the complexity of bitcoin technology will fade into the background; just like the opaque, byzantinian complexity of the current financial system technology has been pushed behind the scenes.

Instantaneous Entrepreneurship

The best way to acquire Bitcoins is to earn them. If you have a skill, service, or goods to sell, you can instantaneously start your own business. If you accept Bitcoins, no bank or credit card company approvals/fees are required. You can be your own bank. Simply setup a web site, advertise your stuff, and hoist your bitcoin address and/or its QR code on the site.

Of course, if the price of Bitcoin goes to zero, and there is a non-trivial chance it will, all your effort will have been wasted. But hey, entrepreneurship is all about putting skin in the game and taking risks. As for me, I’ll continue exchanging dollars for Bitcoins on Coinbase.com.

The Bitcoin Ambassador

Many people in the bitcoin community call Roger Ver the “Bitcoin Jesus“. I call Andreas Antonopoulos the “Bitcoin Ambassador“. I do this because I’ve seen him eloquently mesmerize the Canadian and Australian governments on what bitcoin is and why its benefits far outweigh its costs.

After watching the following fascinating videos, you can judge for yourself whether I’m right or wrong.

If you’re a bitcoin fan and you appreciate his passionate efforts to disarm the most hostile forces against widespread bitcoin adoption – national governments, hustle on over to Andreas’s site and show your appreciation by sending him a bitcoin tip.