Archive

Forrest Gumption

A gumption trap is an event or mindset that can cause a person to lose enthusiasm and become discouraged from starting or continuing a project. – Wikipedia

Some people credit Robert Pirsig with coining the term “gumption trap“. In his inimitable book, “Zen And The Art Of Motorcycle Maintenance“, he wrote a brilliant section classifying, listing, and explaining a gaggle of gumption traps. Two in particular stood out to BD00: anxiety and boredom.

Anxiety

You’re so sure you’ll do everything wrong you’re afraid to do anything at all. Often this, rather than “laziness,” is the real reason you find it hard to get started. This gumption trap of anxiety, which results from overmotivation, can lead to all kinds of errors of excessive fussiness. You fix things that don’t need fixing, and chase after imaginary ailments. You jump to wild conclusions and build all kinds of errors into the

machinesoftware because of your own nervousness. These errors, when made, tend to confirm your original underestimation of yourself. This leads to more errors, which lead to more underestimation, in a self-stoking cycle. The best way to break this cycle, I think, is to work out your anxieties on paper. Read every book and magazine you can on the subject. Your anxiety makes this easy and the more you read the more you calm down. You should remember that it’s peace of mind you’re after and not justa fixed machinehigh quality software. When beginning arepairjob you can list everything you’re going to do on little slips of paper which you then organize into proper sequence. You discover that you organize and then reorganize the sequence again and again as more and more ideas come to you. The time spent this way usually more than pays for itself in time saved on themachineproject and prevents you from doing fidgety things that create problems later on.Boredom

Boredom is the opposite of anxiety and commonly goes with ego problems. Boredom means you’re off the Quality track, you’re not seeing things freshly, you’ve lost your “beginner’s mind” and your

motorcycleproject is in great danger. Boredom means your gumption supply is low and must be replenished before anything else is done.

BD00 gets ensnared in the anxiety-gumption-trap whenever he finds himself marooned inside his head ruminating over a concern. On the other hand, BD00 rarely gets caught up in the boredom-gumption-trap. Not because he’s conquered his big, fat, ego, but because his curiosity and longing for understanding never wanes. He can’t even remember the last time he was bored. And to BD00, that’s a good thing.

How about you, dear reader? Which of these diametrically opposed gumption traps are you most susceptible to?

Never Woulda Thunk It

Just Like Tim

I’m intellectually lazy. I’m a fan of empiricism; it’s just a drag to have to practice. If you’re anything like me, you don’t make up your mind about important issues by doing original research, poring over primary sources and coming to your own conclusions; you listen to people who claim to know what they’re talking about—“experts”—and try to determine which of them is more credible. You do your best to gauge who’s authentically well-informed and unbiased, who has an agenda and what it is—who’s a corporate flack, a partisan hack, or a wacko. – Tim Kreider (We Learn Nothing).

Who amongst us is not like Tim? Thanks to the web, even though accessibility to primary sources and original research is at unprecedentedly high levels, there’s just not enough time to perform “due diligence” in order to form (so-called) objective opinions on issues that tug at our souls. Whether we admit it or not, we all use a form of the BD00 bozometer, which is reproduced below for your viewing displeasure.

If you’re a regular reader of this blawg, then you’ve probably pegged BD00 as “Is A Bozo” – and you’re right!

The Peanut, The Tini, And The Look

My fave ritual happens every Friday evening as soon as I get home from work. It goes like this:

1) As soon as I get into the house, my best buddy, my dog Morrie, saunters over to the sliding door that opens out onto my deck and plants his butt below the door handle.

2) While Morrie, tail a waggin’ and eyes alight, sits patiently at the door, he watches me sloowly fix up a multi-shot, dirty, vodka martini.

3) After draining the shaker into my ‘tini chalice, I walk over to Morrie and hand him his rubber “peanut“. Then I slide the door open.

4) As soon as the door is open barely wide enough for him to get through, Morrie bolts over to our sacred spot in the corner of the yard. He then drops the peanut, sits, and looks at me with great anticipation.

5) With ‘tini in hand, I coolly strut over to “our” spot and pick up the peanut.

6) I proceed to play fetch with Morrie over and over and over till I’m done sipping my ‘tini, which, due to the capacity of my chalice, can take quite a long period of time.

7) I pickup the peanut and walk back into the house while Morrie stays put at our sacred spot and gives me his WTF! look.

8) After a few minutes of misplaced “hope“, Morrie dejectedly concludes that we’re done. Then he stretches into his inimitable four point football stance, pees, and comes back into the house.

What’s your fave ritual?

The BD00 Brand

For the past coupla years, “brand” has been a buzzword of choice in the mainstream of business propaganda. Some people on LinkedIn.com even tout themselves as “branding experts” like BD00:

If I see another brand new article or book ad about “branding“, I’m gonna ralph.

Respectable And Family-Oriented

For your viewing pleasure, here are some pix that BD00 snapped down in Nawlins‘ during Mardi Gras 2013. The scoundrel sent me many more pix, butt, uh, I chose not to hoist them on this respectable and family-oriented blawg.

Stingy And Uncooperative

As a temporary reprieve from writing preposterously heretical posts on dysfunctional management and biased opinion pieces on software development, I axed myself: “What different topic can I squirt out into the ether today?” Then, out of nowhere, the eery and scary theme song from the oooold Twilight Zone TV series started playing in my head – doo doo doo doo, doo doo doo doo, doo doo doo doo….. WAAAGH! As a result, I thought: “What is my favorite TV series theme song?“.

After waiting for a slew of other songs to spontaneously start coursing through my diseased neural circuitry in rapid succession, only one other tune started up: the theme from the old “Hawaii Five-O” show – which I don’t even like. Then, a progression of visual snapshots from old TV series like “Lost In Space“, “The Mod Squad“, “All In The Family“, “Sanford & Son“, and “The Jeffersons” appeared. However, except for the latter’s unforgettable but meh “Movin’ On Up” song, the tunes didn’t come along for the ride with the pictures. D’oh!

So, for now, until I can think of a better one (which may be freakin’ never), my fave TV theme song is the theme from……

What is your fave TV theme song? When you came up with it, did your memory freely expose a boatload of candidates, or was it stingy and uncooperative during the search, like mine?

The Skeptical Empiricist

Thanks to my friend at ThinkPurpose.com, I discovered a bona-fide “skeptical empiricist“:

As a skeptical empiricist I prefer the experiments of empirical psychology to the theories-based MRI scans of neurobiologists, even if the former appear less “scientific” to the public. – Nassim Taleb

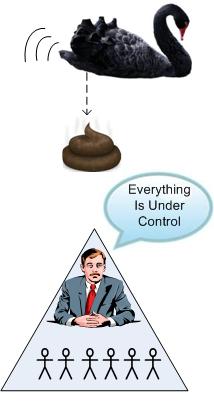

In his refreshingly original and caustic book, “The Black Swan“, this former Wall St. quant convincingly trashes the ubiquitous Gaussian probability distribution because of its lack of scalability and utter failure to account for “Black Swans“. Mr. Taleb also disses those statisticians, Nobel prize-winning economists, and planners that make predictions based on the reductionist properties of the taken-for-granted Gaussian probability distribution.

According to Mr. Taleb, a Black Swan is an event with these three attributes: unpredictability, consequences, and retrospective explainability. A prime example of a Black Swan is the 9/11 terrorist attack. Note that the housing bubble was not a Black Swan – since many people predicted it was coming.

Throughout his tome, Nassim exhibits some profound insight and wisdom across a wide range of topics. Here are just some of the many snippets that resonated with me.

Humans will believe anything you say provided you do not exhibit the smallest shadow of diffidence; like animals, they can detect the smallest crack in your confidence before you express it. The trick is to be as smooth as possible in personal manners.

The problem with business people… is that if you act like a loser they will treat you as a loser—you set the yardstick yourself. There is no absolute measure of good or bad. It is not what you are telling people, it is how you are saying it.

Now contemplate epistemic humility. Think of someone heavily introspective, tortured by the awareness of his own ignorance. He lacks the courage of the idiot, yet has the rare guts to say “I don’t know.” He does not mind looking like a fool or, worse, an ignoramus. He hesitates, he will not commit, and he agonizes over the consequences of being wrong. He introspects, introspects, and introspects until he reaches physical and nervous exhaustion.

Forecasting by bureaucrats tends to be used for anxiety relief rather than for adequate policy making.

By removing the ten biggest one-day moves from the U.S. stock market over the past fifty years, we see a huge difference in returns—and yet conventional finance sees these one-day jumps as mere anomalies.

…it is contagion that determines the fate of a theory in social science, not its validity.

…there was a strange cohabitation of technical skills and absence of understanding that you find in idiot savants.

Missing a train is only painful if you run after it! Likewise, not matching the idea of success others expect from you is only painful if that’s what you are seeking.

The Achilles’ heel of capitalism is that if you make corporations compete, it is sometimes the one that is most exposed to the negative Black Swan that will appear to be the most fit for survival.

Nobel, Or Un-Noble ?

From Nassim Taleb’s “The Black Swan“:

And now a brief history of the “Nobel” Prize in economics, which was established by the Bank of Sweden in honor of Alfred Nobel, who may be, according to his family who wants the prize abolished, now rolling in his grave with disgust. An activist family member calls the prize a public relations coup by economists aiming to put their field on a higher footing than it deserves. True, the prize has gone to some valuable thinkers, such as the empirical psychologist Daniel Kahneman and the thinking economist Friedrich Hayek. But the committee has gotten into the habit of handing out Nobel Prizes to those who “bring rigor” to the process with pseudoscience and phony mathematics. – Taleb, Nassim Nicholas. The Black Swan: Second Edition.

One example (out of several) that Mr. Taleb uses to back his disrespectful opinion of the vaunted Nobel prize in economics is the tale of prize winners Robert Merton, Jr., and Myron Scholes. Robert and Myron worked for Long Term Capital Management LP in the late 90’s. Of course, since they had a rigorously tight and academically peer reviewed modeling strategy, they were touted as geniuses and lots of people threw money at them in the hopes of making a killing in the financial markets. However, a combination of events lying outside of their impeccably rigorous, Gaussian-based, award-winning, often-copied, financial models caused the company to go ka-boom! Because of the massive 4.6 billion dollar loss (suffered in only 4 months) authored by these perceived Gods, the US Federal Reserve sensed that an LTCM bankruptcy could topple the entire financial system. Thus, the Fed orchestrated a huge bailout by a consortium of Wall St. and international banks.

The attempt by the guild of economics to elevate themselves to a level of respect higher than they deserve reminds me of this quote by Sam Culbert about the Gestapo, uh, I mean (in)Human(e) Resource departments in “Get Rid Of The Performance Appraisal” :

So in return for being the cheerleaders for management, the (HR) department that permits management abuse and cleans up after its mistakes, it gets a seat at the big boys’ table.

But so…. freakin’…. what! Every individual, group, and institution has an innate need to survive and thrive before the grim reaper comes a callin’ fer us down the road. It’s simply that the tactics and methods that we use to achieve our needs differ. Obviously, BD00 (and most likely you too) are “above” all the unfairness and inequity in the world. We’re fair and just and we deserve better. We’re not like the guild of economists or the Gestapo HR departments in corpocracies. Damn it, we’re better than “them“! The behaviors we exercise in order to survive and thrive are always noble; never un-noble (cough, cough).