The Pre, The Local, The Central, The Post

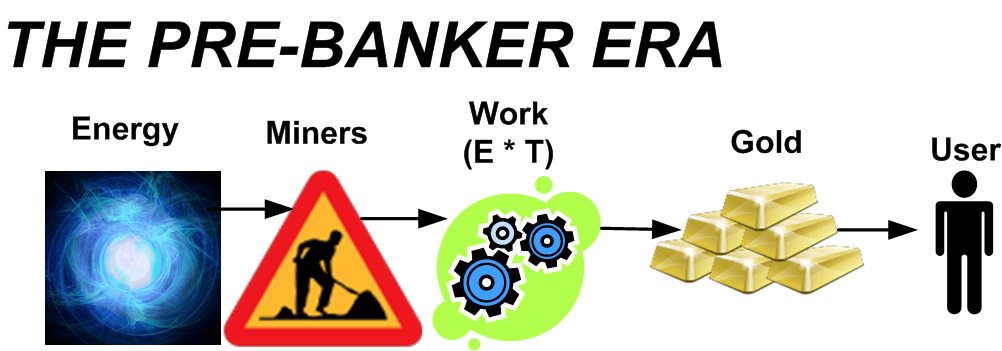

At first, we had the pre-banker era. Over thousands of years, the world slowly and haphazardly converged on gold as the most valuable form of global money compared to all other “hard” physical candidates (cows, sheep, shells, beads, rocks, salt, wheat, etc). People and nations exchanged gold more than any other medium of exchange to settle transactions. They “trusted” gold as a medium of exchange not because of any active, internal, functionality it provided (which is basically zero!), but because of the superiority of its built-in non-functional “ilities“: durability, portability, fungibility, divisibility, verifiability, scarce-ability. Haha, I know scarcity is not an “ility“, but I had to mangle the word and tack on the underappreciated “ility” suffix for consistency. The funny thing is that after 30+ years of developing software, the “ilities” have almost always been disrespected by both developers and managers. Everyone wanted the functionality, but no one wanted to pay for the “ilities”.

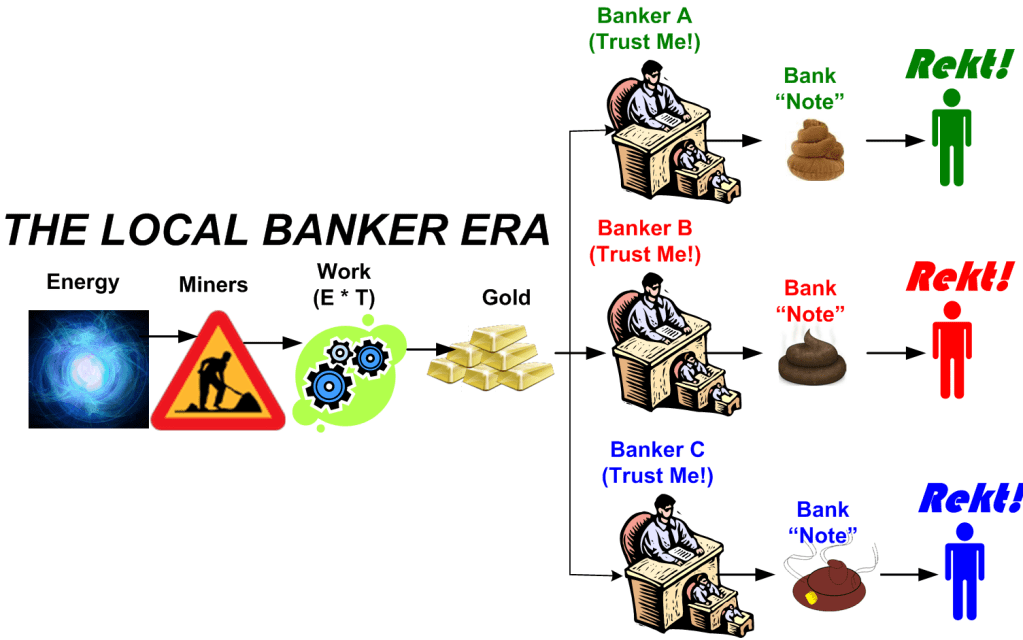

Over time, the banking industry arose. Rich people, who, by definition, accumulated lots of gold, could store their precious, but heavy, bulky, gold at a bank for security and receive an important-looking paper IOU in return. “Trust us” they said. If you want your gold, come back to us with the paper IOU and we’ll return your gold. LOL. These banks popped up everywhere and they all had their own unique IOU notes. Lots of banks with unscrupulous owners went bust by issuing more notes than gold deposits on hand. When people lost “trust” and they all tried to get their gold back, there wasn’t enough gold for everybody. Social unrest ensued.

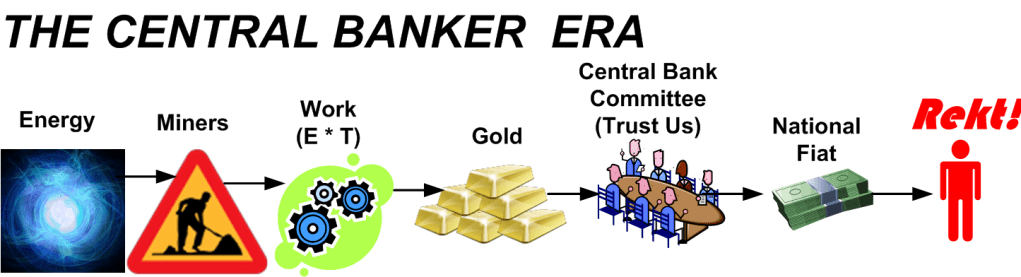

After the fragmented local bank era came the illustrious central banker phase where a group of unelected, politically appointed, bureaucratic, oracles surfaced every once in a while to say: “trust us”. LOL

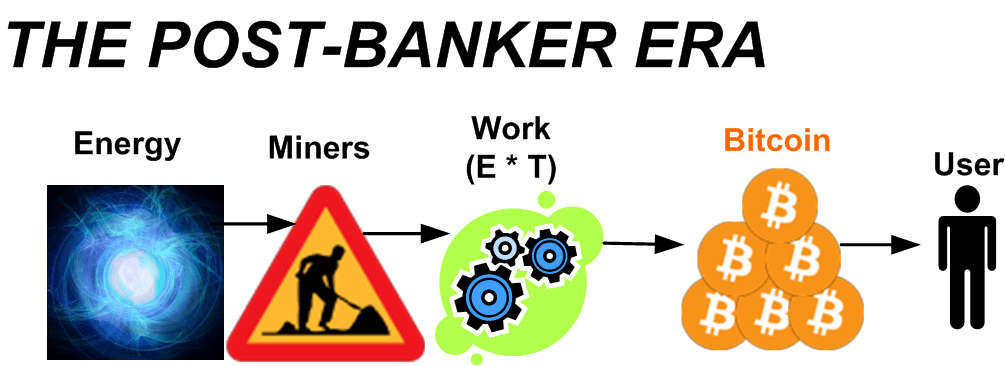

In the future, we will probably still have fiat-spewing central banks that squeeze your purchasing power from their paper IOUs by continuously printing free “money“, but we will also have a parallel, opt-in, Bitcoin-based, self-custodial, banking system in which no trust in third parties is required.

I love the following table and I’ve posted it before. I’m going to keep posting it every so-often because it really shows how Bitcoin wins the “ility” wars against gold, which in-turn wins the war against the worst form of money – sovereign fiat paper.