Archive

Two Charts

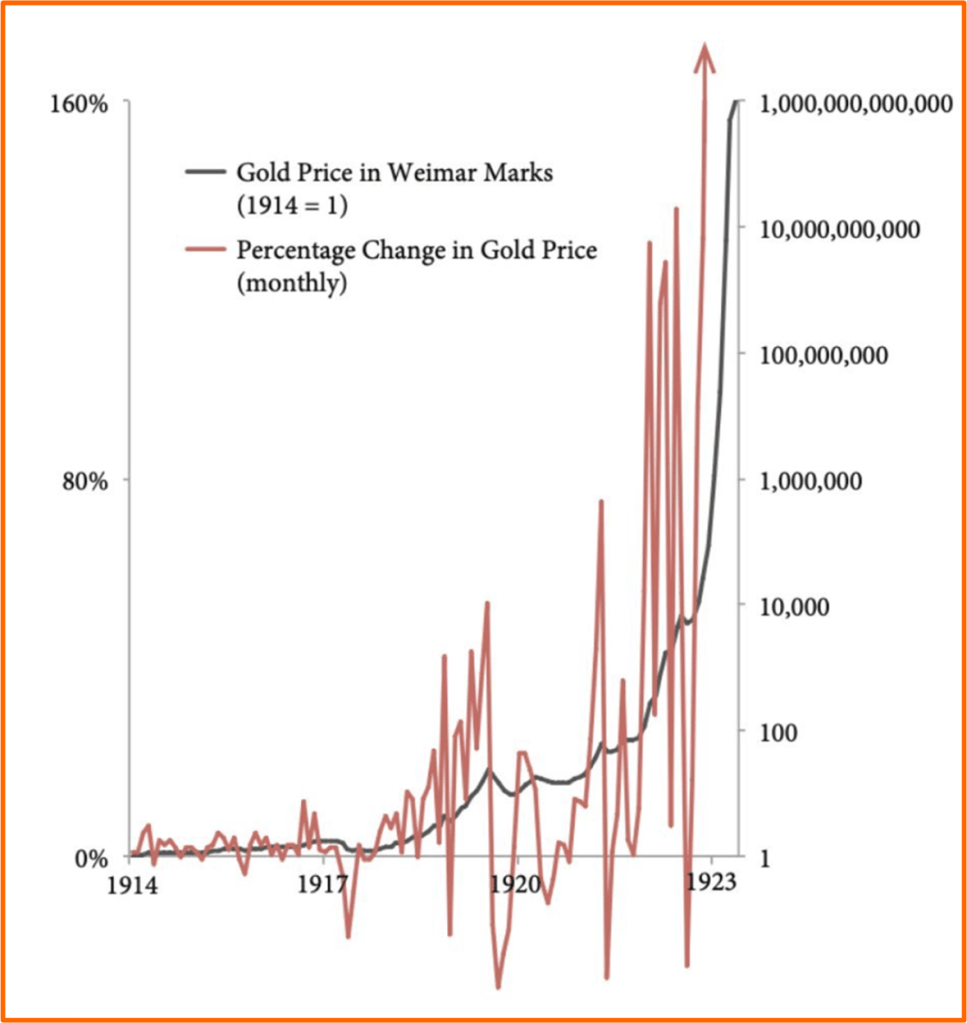

I can’t get the 2 charts below outta my surgically repaired head (see last pic below) today. On the top we see all the “value” stored in a melting ponzi paper-currency game which is debased 7%/year on average via money supply growth (forget about the rigged 3.0% CPI that the pols try to make you believe every year). Prices are up by 25% since 2021).

In the top left corner we see a tiny sliver of the monster $900T asset market value currently stored in Bitcoin’s tiny little sub $2T space. A 10x rise in price from here at $90k would only stuff $20T more into the space. Hence, that’s what people mean by Bitcoin being the greatest asymmetric trade of all time and why some predict $1M Bitcoin in the not too distant future.

It still blows me away how early it is in the evolution and adoption of BTC, but when the world is undergoing a major scientific revolution it gets turned upside down and the entrenched interests get exposed and expelled. In Thomas Kuhn’s eye opening “The Structure of Scientific Revolutions” he points out all the major historical paradigm shifts and they all resonate with his logic.

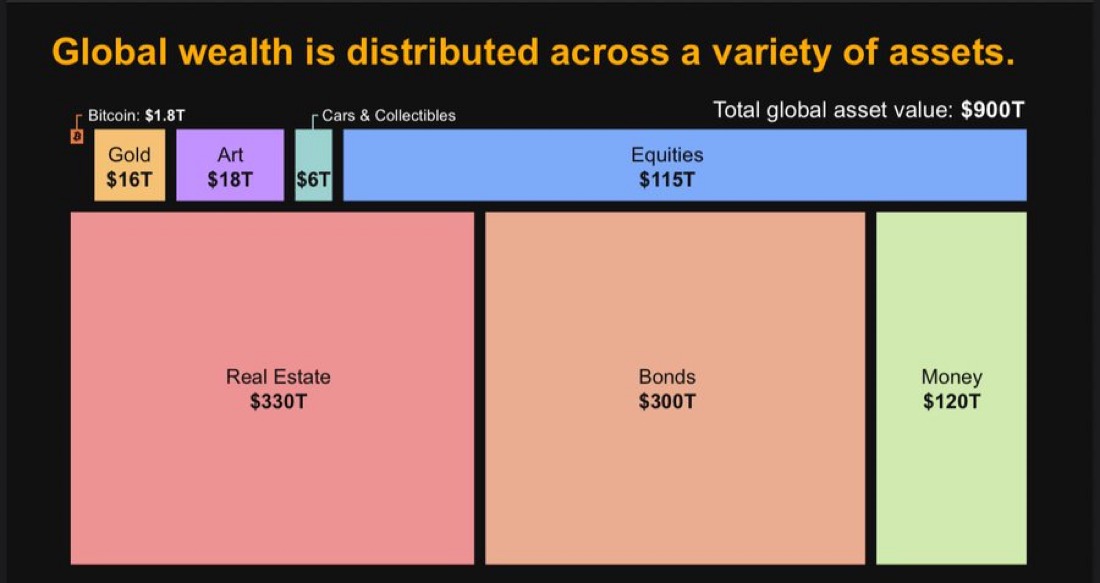

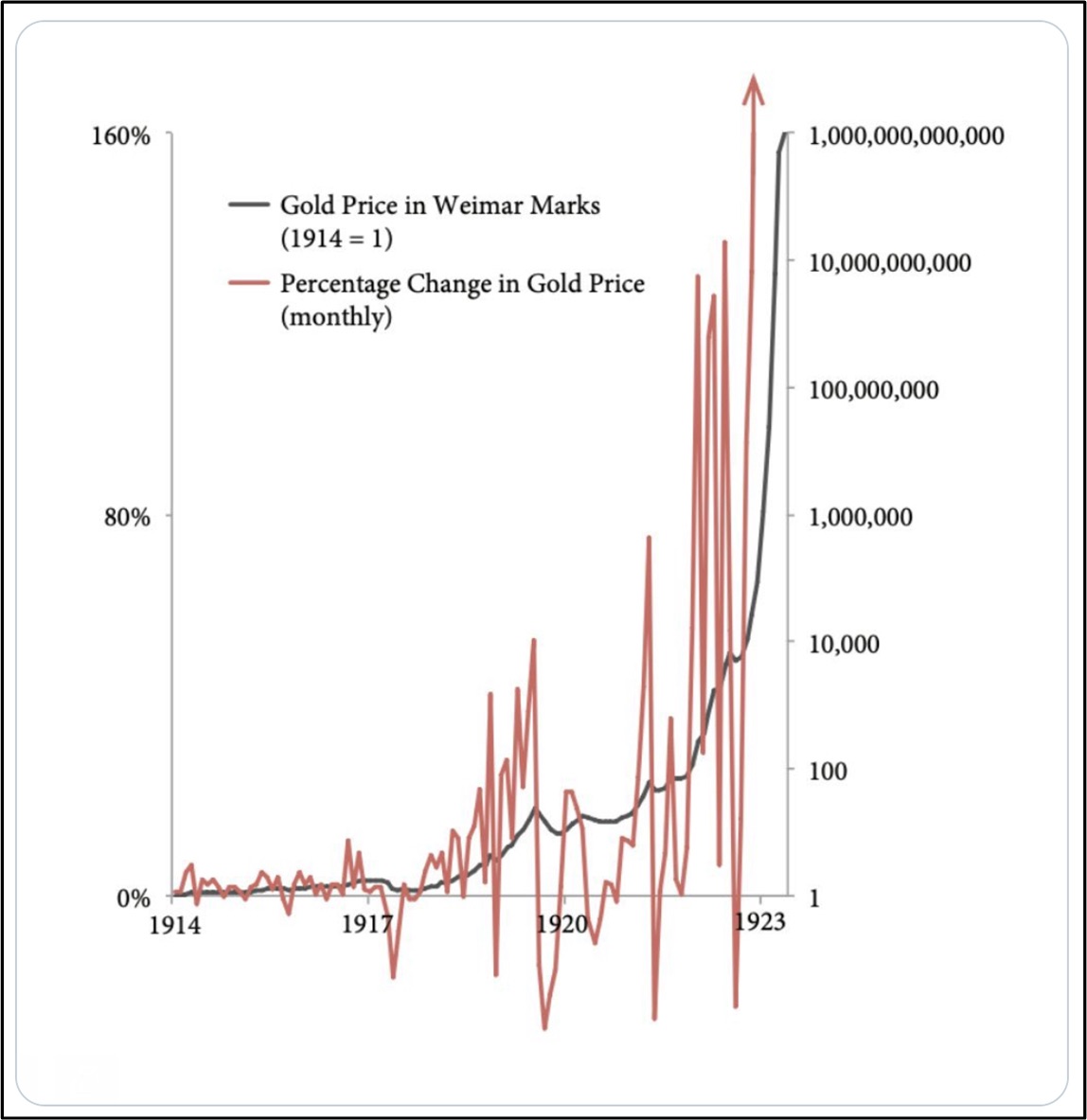

Next, we see how volatile the price of gold was in Weimar Germany against the German mark when the country exploded into hyperinflation. Who would’ve thought gold would be so volatile as a store of value. But in volatile times, everything becomes volatile. I don’t think the US will go hyper, but the macro economists I follow think 15-20% inflation is imminent, like next year. D’oh!

And third, we see why the rest of the fiat-paper brains don’t get it. Science progresses via a succession of funerals for the elite and smugly installed power base. Tick tock next block.

BTW, here’s my surgically repaired head, but that’s a story for another day.

Bitcoin Volatility? What Volatility?

Besides the same old, same old, “Bitcoin is boiling the oceans!” scare tactic, another common theme employed by anti-bitcoiners to scare people away from embracing Bitcoin as a Store of Value (SoV) is the old “unlike gold, it’s too volatile to be worthy as an SoV!“.

But wait, nothing is as it seems! Check out this graph of gold’s price volatility during the hyperinflation-ization of Weimar Germany before and after WWI.

Compare the period between 1914-1917, when there was essentially no volatility in the price of gold, to the war and post war years.

Overwhelmed by massive reparation payments imposed upon Germany by the avenging countries after the war ended, the purchasing power of German fiat went hyperbolically to zero as the country frantically tried to pay off its debt by printing fiat with reckless abandon. As expected by esteemed scholars like BD00, German hyperinflation then raged exponentially, destroyed the country, and catalyzed the subsequent rise of Hitler. Naturally, the price of gold took off as the German people rushed to exchange their increasingly useless paper for shiny rocks. But it surely wasn’t a smooth ride on the way up. It was a wild ass rollercoaster ride of massive volatility as the graph above shows.

So, if you believe this poorly researched BD00 post, Bitcoin’s current volatility does not disqualify it as an SoV. What makes Bitcoin the greatest SoV ever invented/discovered is the superiority of its monetary attributes as compared to gold and all other forms of so-called “hard” money.

Post post note : I finished this dumbass post just as an “edible” was starting to kick in. Since I can’t attribute the errors and mistakes herein to being psychotropically inebriated (aka “stoned”), I hereby attribute them to the chronically hemorrhaging lesions inside my brain.