Archive

Hopping On The Anti-Fragile Bandwagon

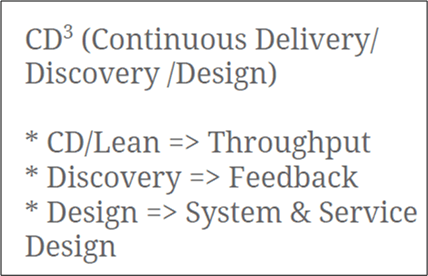

Since Martin Fowler works there, I thought ThoughtWorks Inc. must be great. However, after watching two of his fellow ThoughtWorkers give a talk titled “From Agility To Anti-Fragility“, I’m having second thoughts. The video was a relatively lame attempt to jam-fit Nassim Taleb’s authentic ideas on anti-fragility into the software development process. Expectedly, near the end of the talk the presenters introduced their “new” process for making your borg anti-fragile: “Continuous Delivery/Discovery/Design“. Lookie here, it even has a superscript in its title:

Having read Mr. Taleb’s four fascinating books, the one hour and twenty-six minute talk was essentially a synopsis of his latest book, “Anti-Fragile“. That was the good part. The ThoughtWorkers’ attempts to concoct techniques that supposedly add anti-fragility to the software development process introduced nothing new. They simply interlaced a few crummy slides with well-known agile practices (small teams, no specialists, short increments, co-located teams, etc) with the good slides explaining optionality, black/grey swans, convexity vs concavity, hormesis, and levels of randomness.

Designed To Be Fooled

Bravery, courage, self-confrontation, acceptance-of-limitations? WTF! BD00 doesn’t possess any of those attributes. But when the ink dries on this blog post, he’ll go back to foolishly thinking he does (what about you?). Mr. Taleb is right – mother nature is a tricky be-otch.

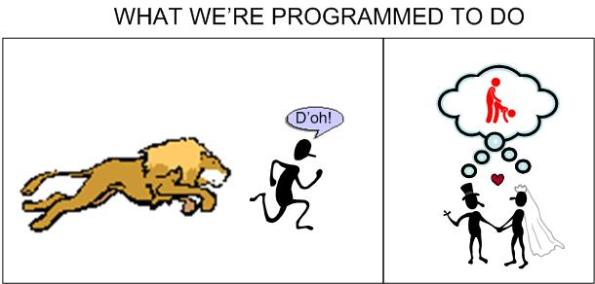

The Evolution Of Thinking

Nassim Taleb nails it with this simple but profound sentence:

Our minds are not quite designed to understand how the world works, but, rather, to get out of trouble rapidly and have progeny. – Nassim Taleb (Fooled By Randomness)

We human beings are so full of ourselves. With much hubris, we auto-assume that we are above all other life forms just because we can “think“. We concoct immortal and all-powerful gods in our minds who we “think” are watching over our well-being (but not the well being of those we don’t like). Then, when something terrible happens, we wonder “why” our gods could allow such a tragedy. Instead, maybe we should contemplate “why not?“.

The ability to “think” has unquestioningly made life more comfortable locally for the human race over time. However, it’s questionable whether “thinking” has made human life more comfortable globally. Unlike a “mindless” swarm of locusts that ravish the environment with a vengeance, we “mindful” humans seem to be ravishing our environment and other fellow humans at an increasingly alarming rate as our “thinking” supposedly evolves.

The Skeptical Empiricist

Thanks to my friend at ThinkPurpose.com, I discovered a bona-fide “skeptical empiricist“:

As a skeptical empiricist I prefer the experiments of empirical psychology to the theories-based MRI scans of neurobiologists, even if the former appear less “scientific” to the public. – Nassim Taleb

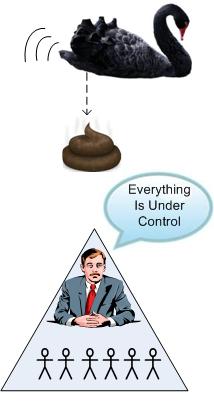

In his refreshingly original and caustic book, “The Black Swan“, this former Wall St. quant convincingly trashes the ubiquitous Gaussian probability distribution because of its lack of scalability and utter failure to account for “Black Swans“. Mr. Taleb also disses those statisticians, Nobel prize-winning economists, and planners that make predictions based on the reductionist properties of the taken-for-granted Gaussian probability distribution.

According to Mr. Taleb, a Black Swan is an event with these three attributes: unpredictability, consequences, and retrospective explainability. A prime example of a Black Swan is the 9/11 terrorist attack. Note that the housing bubble was not a Black Swan – since many people predicted it was coming.

Throughout his tome, Nassim exhibits some profound insight and wisdom across a wide range of topics. Here are just some of the many snippets that resonated with me.

Humans will believe anything you say provided you do not exhibit the smallest shadow of diffidence; like animals, they can detect the smallest crack in your confidence before you express it. The trick is to be as smooth as possible in personal manners.

The problem with business people… is that if you act like a loser they will treat you as a loser—you set the yardstick yourself. There is no absolute measure of good or bad. It is not what you are telling people, it is how you are saying it.

Now contemplate epistemic humility. Think of someone heavily introspective, tortured by the awareness of his own ignorance. He lacks the courage of the idiot, yet has the rare guts to say “I don’t know.” He does not mind looking like a fool or, worse, an ignoramus. He hesitates, he will not commit, and he agonizes over the consequences of being wrong. He introspects, introspects, and introspects until he reaches physical and nervous exhaustion.

Forecasting by bureaucrats tends to be used for anxiety relief rather than for adequate policy making.

By removing the ten biggest one-day moves from the U.S. stock market over the past fifty years, we see a huge difference in returns—and yet conventional finance sees these one-day jumps as mere anomalies.

…it is contagion that determines the fate of a theory in social science, not its validity.

…there was a strange cohabitation of technical skills and absence of understanding that you find in idiot savants.

Missing a train is only painful if you run after it! Likewise, not matching the idea of success others expect from you is only painful if that’s what you are seeking.

The Achilles’ heel of capitalism is that if you make corporations compete, it is sometimes the one that is most exposed to the negative Black Swan that will appear to be the most fit for survival.