Archive

A Valiant Try

Google recently re-appointed Larry Page as it’s CEO after a 10 year hiatus. From the following blurb in “The Product Shakeup At Google Begins”, it seems like Google is valiantly trying to return to its roots:

(Larry) Page famously has a low opinion of managers, especially product managers who try to tell engineers what to do. “People don’t want to be managed,” he is quoted in Steven Levy’s new book, In the Plex. Page is a big believer in self-management. At one point early on in the company’s history, he and Brin tried to get rid of all managers.

Even though it is certainly impractical to get rid of all managers once an org grows to a certain size, ya gotta love the irony of anti-management CEOs like Page, Nayar, and Semler, no? With guys like that watching over an org, you can be confident that they’ll be vigilant in keeping the manager-to-worker ratio low and that they’ll make sure managers do more than just plan, watch, control, command, and evaluate others. Of course, this philosophy doesn’t guarantee success, but it sure does make working for a company more enjoyable for the majority of people who work there – not just the management minority.

Rising Inequity

While stumbling along the jagged trail of life, I tripped over this FastCompany.com post: Infographic of the Day: 15 Facts About America’s Income Inequality.

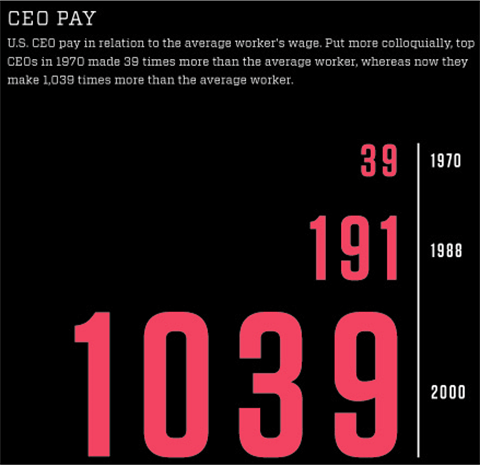

For instance, did you know that the average CEO’s pay is 1,039 times more generous than that of the average worker? And it’s not as if we’ve always lived that way. Forty years ago, CEOs were only being paid 39 times that of the average worker. Some companies these days are tying CEO pay to the pay of the least compensated employee at the same company. Clearly not that many.

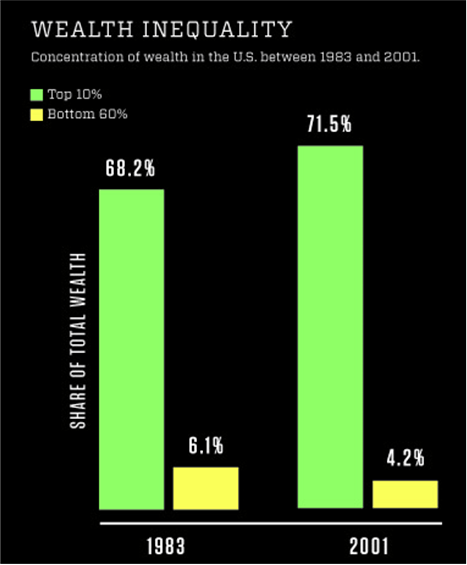

And though GDP has risen, wages have remained stagnant (except for those CEOs), which has contributed to the top 10% of the wealthiest Americans controlling nearly three-quarters of all the money in America.

Note that over the decades between the inequity measurements, control of the federal government has flip-flopped back and forth between the democratic and the republican parties. So much for blaming one side over the other. The only equity in this post is that both parties are equally inept at running the country, no?

It doesn’t have to be yours, of course, but BD00’s opinion is that no matter what type of “ism” system of governance is used to tie people together, when some critical threshold of top-to-bottom inequity is exceeded, a revolution by the governees against the governors is sure to follow. In the grand ole USA, do you think we are close to the precipice?

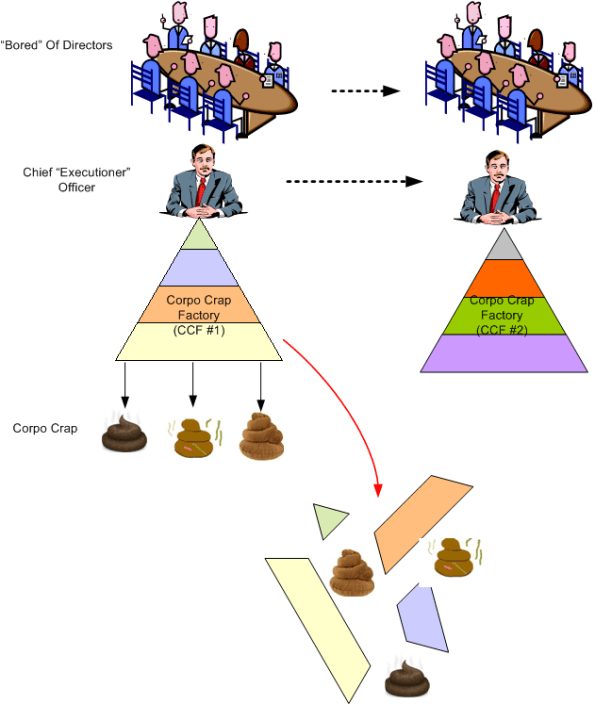

Judgment, Integrity, Credibility, Honesty, And $53M

The often (but not always) incestuous relationship between hand picked corpo board of directors yes-men and CEOs has come to the fore again: “HP orders probe into Hurd’s departure”. Why would Hewlett Packard, as represented by its board of derelicts, I mean directors, investigate their own handling of Hurd’s dismissal? They’re not doing it because it’s the right thing to do. They’re only doing it because they’re being forced to:

“HP’s plan for an outside investigation follows a lawsuit in San Jose, Calif., by shareholders who allege that the company’s directors wasted money by giving Hurd $53 million in severance.”

Yepp, a gift of $53 million to Mr. Hurd for exhibiting:

A profound lack of judgment. It (Hurd’s dismissal) had to do with integrity, it had to do with credibility and it had to do with honesty.” – Mike Holston, HP’s general counsel

After doling out that kind of dough, can’t the same be said about HP’s board? Well, that’s what we may find out after the dust settles. In the meantime, HP’s board may have gotten what they deserved. Mr. Hurd has Madoff nicely by skidaddling over to one of HP’s biggest competitors, Oracle Inc. He and his buddy, Oracle oracle Larry Ellison, sure do know how to make money.

“Mark did a brilliant job at HP and I expect he’ll do even better at Oracle,” said CEO Larry Ellison in a statement.

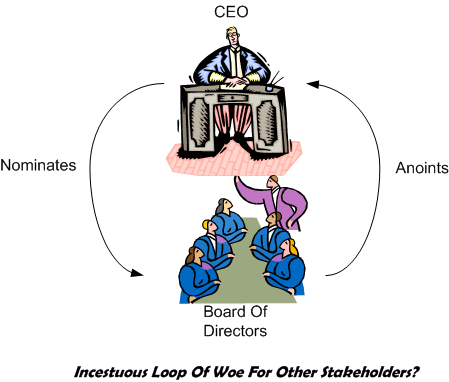

The real question is: “How isolated are these types of incidents?“. Just because they get reported in the press doesn’t mean that dishonesty runs rampant in the bozone layers of big business. Nevertheless, it begs the question: “Is the taken-for-granted, rarely-questioned process in which CEOs and boards of directors are chosen broken?“. Boards anoint CEOs (who coincidentally are often the chairman of the board) and CEOs nominate board members for election. What do you think of the process? How can it be made better?

A Life Changing Experience?

The article “Undercover Boss’ role opens Republic Airways CEO’s eyes” describes what Republic Airways CEO Bryan Bedford learned while participating on the show “Undercover Boss“. In the show, CEOs go undercover and work on the front lines as a DORK in disguise.

Here’s one thing Mr. Bedford said of his experience:

“What was eye-opening, the most noticeable thing was just the disconnect and (poor) communication between the management team and front-line employees,” Bedford said.

I don’t know what was so eye opening about it. As usual, I just don’t get it. Do you? Do you now understand the meaning of one of the profanely endearing acronyms, CGH, that I often use in this boisterous blog?

Moving on, here’s some more unsurprising (at least to me) commentary :

While working in different roles for the company — including cleaning aircraft, checking baggage, dumping aircraft toilets and standing at the ticket counter — he asked fellow employees why they didn’t take their complaints to management to implore change. The same response came time and time again: “No, I’ve talked to management about this stuff, and they never listen,” Bedford said.

Wow. Huge surprise, no? Why won’t the BMs, BUTTs, and CCRATs in the fatty middle org layers listen to, and act on, DICforce inputs? Because it would require hard work and it could make them look bad. You know, their image of being infallibly in charge might suffer: “Damn the org, it’s all about me and my success“.

“Are you here to build a career or to build an organization?” – Peter Block

I’m almost done with this rant, so bear with me just a couple of more sentences. Summing up his experience, Mr. Bedford relates his epiphany:

When you are actually working side by side and hearing about their struggles, it’s very personal. It’s life-changing. You can never go back to thinking of them as anything other than family.

So, six months from now, after returning to the same-old, same-old business as usual (operating off spreadsheets and powerpoints, communicating solely with his hand picked yes-men junta, caving to pressure from Wall St. and shareholders) do you think Bryan will remember what he said? I hope so, but I doubt it. He’s human just like you and (maybe) me.

How about you? Even if he/she wanted to, would your CEO, or even your immediate manager, be capable of doing your job in order to experience your frustrations at the inefficiency, dysfunction, and red tape that engulfs you?

Priority List

In his brilliant and elegant essay, “Capitalism is Dead. Long Live Capitalism“, Gary Hamel laments about the deterioration of capitalism into those other bad, highly inequitable, anti-American “isms”. He says:

So why do fewer than four out of ten consumers in the developed world believe that large corporations make a “somewhat” or “generally” positive contribution to society? Why is it that only 19% of Americans tell pollsters they have “quite a lot” or a “great deal” of confidence in big business?

In Gary’s opinion, the reason is……

… the unwillingness of executives to confront the changing expectations of their stakeholders. In recent years, consumers and citizens have become increasingly disgruntled with the implicit contract that governs the rights and obligations of society’s most powerful economic actors—large corporations. To many, the bargain seems one-sided—it’s worked well for CEOs and shareholders, but not so well for everyone else.

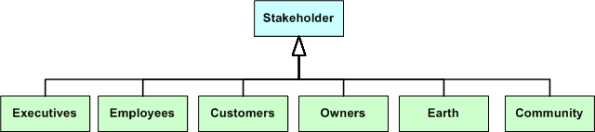

This lead-in dovetails into the idea of a “CEO stakeholder priority list“. The UML class diagram below shows six types of corpo stakeholders. Of course, the six types were arbitrarily picked by me and there may be others on the same level of abstraction that you think are missing. Notice that the “earth” is a passive stakeholder that can’t directly and instantaneously exert pressure on the way corpricracies behave; unlike the other people-type stakeholders.

Now, check out some sample CEO stakeholder priority lists below. With 6 stakeholders types, the number of unique lists is quite a lot: 6! = 6 x 5 x 4 x 3 x 2 = 720. I just semi-randomly concocted these three specific sample lists so that I can continue babbling on while hoping that you’re still reading my drivel.

My own unscholarly opinion is that the vast majority of CEOs, their appointed-yes-men VP teams, and their hand picked boards of directors either consciously or unconsciously operate according to the blue list (or any other instance that prioritizes the “executives” stakeholder first). My opinion aligns with Mr. Hamel’s assertion that too many corpo captains are making decisions that materially favor themselves (first) and their shareholders while disproportionately harming the other stakeholder types.

But wait, hasn’t this always been the case with capitalism? If so, why has it suddenly become fashionable for dweebs like me to vilify corpricracies that operate in accordance with the blue list?

In closing, I feel the need to repeat the best quote in Hamel’s blarticle:

There are CEOs who still cling to the belief that a company is first and foremost an economic entity rather than a social one. – Gary Hamel

To those CEOs who still think that the word “social” equates to communism, get over it and move into this century.

I’m The Right Guy At The Right Time

From a recent article (I forgot to bookmark the link – D’oh!) describing the large backlog of IPOs still scheduled for this year, I discovered that GM’s (supposed) resurrection is expected to be the largest. It’s estimated that the “Government Motors” IPO will raise $15B dollars, but none of it will come from me and you’ll understand why in the narrative that follows.

From the same article, I also learned that GM is being led by its fourth CEO in 18 months, Mr. Daniel Akerson. Guess what? Mr. Akerson is an aged and most probably out-of-touch white dude just like all the other recent esteemed GM CEOs. Guess what? Mr. Akerson also speaks in the same, self-centered, corpo tongue as most stereotypical Tayloristic CEOs:

I’m the right guy at the right time.

I’m looking out the front windshield.

GM’s products are second to none.

GM’s global manufacturing structure is the envy of the industry.

I did not get to where I am in life by being deaf, dumb, and blind.

I wish the company well, but, uh, I ain’t gonna invest in GM. Are you?

Directors Of Disasters Wanted

As the title of the following “Directors Are in Demand, Even if Companies Fail” NY Times article states, high paid, do nothing directors who snoozed while the companies they “directed” went right down the tubular chute are still being sought out to “help” corpo survivors prosper.

While in some cases investors are suing members of the boards of the failed companies, shareholder advocates have for the most part focused their energies on other issues. And public outrage over the financial crisis has been mainly focused on the executives in charge of firms like Bear and Lehman.

In many cases during the real estate bubble, directors approved the strategy that paved the way for executives to make risky investments on borrowed money.

In our corporate system the directors are supposed to be in charge, not the C.E.O., yet they rarely get any of the blame because they’re typically dominated by the C.E.O.

The incestuous inbreeding that goes on in the CEO and board of directors stratosphere is so powerful that not even an A-bomb can break the lovefest. Of course, the classic response of board members from failed CCFs (which does have a grain of truth in the unlikely case where they’ve learned something from the failure) is that their hands-on experience will save their new CCFs from suffering the same fate. Uh, OK.

Is This A CEO Talking?

From Who’ll Catalyze Change: Us or Them? – Harvard Business Review, HCL Technologies CEO Vineet Nayar says:

We at HCL have embraced a philosophy that’s based on an inversion of the management pyramid, with managers becoming as responsible to employees as employees are to managers.

Vineet’s joking, right? Nah, he’s fibbing to cover up the reality that he rules with a Stalinistic iron fist at HCL, no? This joker follows up with an even bigger whopper:

Too many people caution us about acting on instinct and conviction. But we must surround ourselves with employees that dare to try new things in new ways. They may not achieve perfect results, but if they focus on getting better each day with one more attempt, they will solve many problems that appear unsolvable.

Acting on “instinct and conviction” and not on objectively measured scientific “proof” (that really camouflages subjective, random, self-serving, opinion)? WTF? This Vineet dude needs to be cast out of the guild of management and “put in his place“, no?

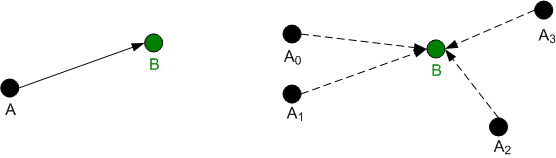

Where Is Point A?

In the “Managing The Unmanageable” techonomy video discussion, HCL Technologies CEO Vineet Nayar says something like: “If your people don’t know where point A is, then they won’t know how to get to point B“. Vineet said this in response to a question regarding the concern that the more transparent your company is, the more your competitors can copy you. Vineet, along with the other two 21st century CEOs on the panel stated that the benefits of transparency far out weigh the risks of “giving away the family jewels“.

Look at the figure below. On the left side, through transparency and continuous full disclosure, your people know where you are (point A) and your people know where you and they want to be in the future (point B). Thus, you and your people can figure out what problems need to be solved and what new actions need to be taken. On the right side of the figure, everyone knows where point B is, but nobody (except for maybe a “select few” high up in the CCH) knows where they’re starting from. Where the frig is point A?

Related Articles

- Techonomy – Managing the Unmanageable: The New Empowered Workforce (nextbigfuture.com)

- Why HCL Technologies puts employees ahead of customers (tech.fortune.cnn.com)

- Techonomy: a new philosophy of progress (petervan.wordpress.com)

Get Back To Work, Slackers

Penny Herscher, CEO of FirstRain, states in her blog:

We’ve made a terrific change this year to our vacation policy – which is basically not to have one…. We have a very intense culture today. People work hard, they work long hours inside and outside “normal business hours”, from home, from airplanes, and we don’t clock or watch the hours they work. So if we don’t clock the hours they are here, why should we clock the hours they are not? Why should we be tracking paperwork and forms when an employee takes the day off but we don’t do the same for when they work over a weekend.

She’s joking right? Trusting your employees and giving them total responsibility for managing their time? No way bro. That’s just not how it’s done! Poor FirstRain. Productivity is going to plummet and a trip to bankruptcy court is forthcoming, no?