Archive

Full Transparency

Besides being the first fully distributed, peer-to-peer cryptocurrency, every aspect of bitcoin is fully transparent to anyone who wants to study the protocol rules for security/safety or peruse the “blockchain” in real-time on the web.

The blockchain is a living, dynamic, accounting ledger upon which every single network transaction has been, and is being, recorded in real-time. Thousands of cooperating Bitcoin “miners”, via an innovative, incentive-based, decision process that solves the Two Generals problem toil away 24 X 7 without ever sleeping. They are robot accountants that race against each other to verify the validity of “blocks” of transactions. Each winner gets to place its block at the head of the blockchain and collects a reward for its hard work. The reward consists of some newly minted bitcoins (25 BTC per block as of today) and a nominal fee from each transaction that appears in the block.

Once a block gets added to the blockchain, all the miners diligently get back to work on the next block of incoming transactions – no coffee breaks or water cooler gossiping for them. They’re all business and they don’t need any stinkin’ motivational speeches or performance improvement plans imposed on them by know-it-all supervisors and HR Nazis. The miner workforce is a tyrant manager’s dream team. 🙂

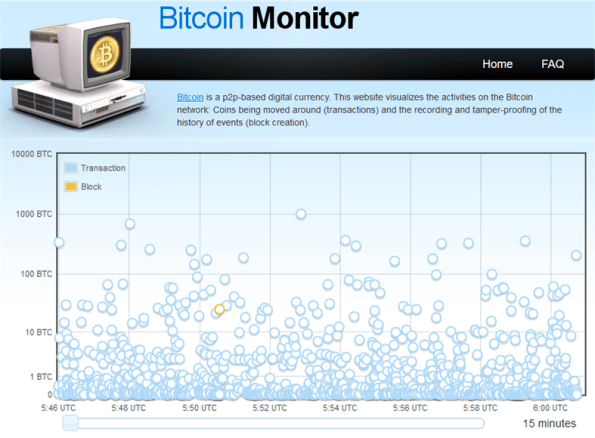

As you can see from the 15 minute snapshot below (snipped from Bitcoinmonitor.com), there were thousands of bitcoin transactions taking place as I wrote this post.

Notice the 1000 BTC transaction in the middle of the chart. At $200 BTC/USD, that represents a $200,000 transfer. If you watch the chart long enough, you’ll see some 10,000 BTC transactions taking place. Sheesh! Also notice that at the 5:51 UTC mark a lucky bitcoin miner has successfully added its block to the blockchain and collected its reward. Good for him/her!

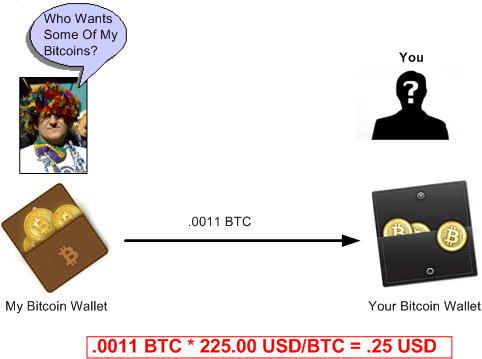

Since I think the Bitcoinmonitor.com site is really useful, I sent the site owner a token of appreciation – in BTC of course:

And of course, I didn’t have to disclose any personal credit card information to do it. The ability to execute micro-payments instantaneously like I just did is one of the (many) big pluses propelling Bitcoin forward.

And of course, I didn’t have to disclose any personal credit card information to do it. The ability to execute micro-payments instantaneously like I just did is one of the (many) big pluses propelling Bitcoin forward.

The Bitcoin Timeline

From “Bitcoin For The Befuddled“, I give you the path from paper-to-reality of a potentially world-changing technology:

An Invitation

If you’re curious about the Bitcoin phenomenon and you want to experiment with the technology, Bulldozer00 has an invitation for you.

The first person (that BD00 “knows“) to create their first bitcoin wallet and post a valid bitcoin address in the comments section of this post will get approximately .25 USD worth of bitcoin (1,100 bits) from BD00.

By “knows“, BD00 means that he has previously interacted with you either:

- via face-to-face conversation,

- via your perusal of this blog,

- via Twitter, or

- via LinkedIn.

BTW, in case you want to shower BD00 with some of your own bitcoins, here is one of my bitcoin addresses:

- 1hv77dKah7tkMYxtUASpLZSeUJ7xHDLKQ

Come on. Don’t be a chicken. Give it a try. I promise that you’ll like it and you’ll get hooked, just like BD00 did!

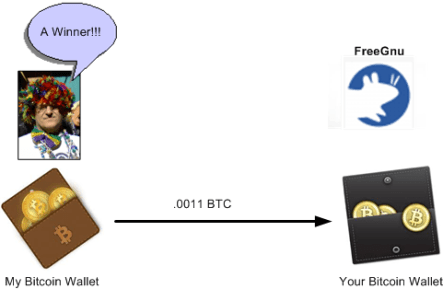

IMPORTANT UPDATE: At 12:30 PM EST, BD00 sent 1100 uBTC to FreeGnu:

Peer To Peer, No Middleman

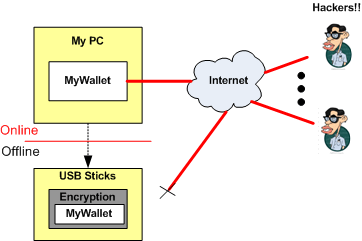

During my current foray into the bitcoin system, I made my first peer-to-peer transfer. After exchanging some USD for some bitcoin on Coinbase.com, I moved my bitcoin out of my account’s wallet on the site and into the encrypted wallet on my PC:

It was incredibly easy to execute the transfer – and there were no “wire” fees involved. Coinbase.com made their money off of me by charging a 1% fee when I initially exchanged my USD for BTC. In addition, they paid the minisicule transaction fee that keeps the bitcoin network humming along with the thousands of co-operating “miner” computers that implement, verify, and confirm transactions.

Like many people who trust private banks to store their cash, many people trust middleman sites like (highly regarded) coinbase.com to store their bitcoin. However, because of the Mt. Gox fiasco and the current lack of regulation in the brave new bitcoin world, I’ve chosen to cut out the middleman and keep my BTC locally – and offline.

Imagine that I was a migrant worker and I wanted to send some money home to my family in my country of origin. As long as my family had access to the internet, I would be able to instantly send them some bitcoin exactly like I transferred bitcoin between my wallets: direct, instantaneous, peer-to-peer, and without any middleman or accompanying fees.

The 80-20 Investment Strategy

Instead of following standard Markowitz “portfolio theory“ and allocating your investments across low/medium/high risk financial products according to your age group, Nassim Taleb has suggested that investors adhere to the 80-20 rule: invest 80% of your funds in the most conservative products available (e.g. US treasury bills) and the other 20% in the wildest, riskiest investments that you can find (e.g. startup funding).

Wild and risky investments are those that may go to zero but they also have a small chance of going through the roof. The odds that they go to zero are much greater than the odds of them skyrocketing to Mars.

Mr. Taleb’s thinking is that in a black swan triggered extreme financial crisis (e.g. the crash of 2008), a Markowitz-type portfolio will get demolished across the board. The 80% portion of an 80-20 portfolio susceptible to the black swan will suffer too, but because of its extreme conservative nature the likelihood of massive devastation is much less than for the Markowitz mix. For the remaining 20% segment, the black swan event may actually turn out to be a white swan (e.g. shorting the bull market before the 2008 crash).

I’m too chicken to buck the herd’s “age-based allocation” investment strategy, but I have set aside a small stash of “play money” that I’m willing to lose entirely on a wild and crazy investment.

After a fair amount of grokking, the wild and crazy investment I’ve chosen to risk my play money pool with is….. the fledgling Bitcoin movement.

I am by no means a libertarian ideologue (I lean toward the left), but the Bitcoin movement is fascinating to me for the following reason (plucked from the book “Digital Gold” by Nathaniel Popper):

“The root problem with conventional currency is all the trust that’s required to make it work,” Satoshi (the mysterious, unknown creator of the peer-to-peer Bitcoin network protocol) wrote. “The central bank must be trusted not to debase the currency.” The issue that Satoshi referred to here—currency debasement—was, in fact, a problem with existing monetary systems that had much more potential widespread appeal, especially in the wake of the government-sponsored bank bailouts that had occurred just a few months earlier in the United States. Many believe that the end of the gold standard (by Nixon in the 70s) allowed central banks to print money with no restraint, hurting the long-term value of the dollar and allowing for unbridled government spending.

Another reason why I’m drawn to the bitcoin community is the potential of the system to help the poor – those people who do not have access to bank accounts or credit cards and are forced to deal in cash. The increasing uptake of Bitcoin in Argentina, whose government is notoriousy fiscally irresponsible with its peso currency, is enough evidence for me to believe that the Bitcoin network will do for money what the internet has done for information.

The thing that makes Bitcoin a wild and crazy investment is that….

Bitcoin itself is always one big hack away from total failure.

Since the literal disappearance of 100s of millions of dollars worth of Bitcoins from the Mt. Gox implosion and the high profile “Silk Road” disaster did not kill Bitcoin in the crib, it illustrates the underlying strength and robustness of the system. Thus, I made the first of several Bitcoin buys through the Coinbase exchange:

My strategy is to buy and hold for the long, long term. Oh, and to insulate myself from another Mt. Gox type debacle, I’m moving my Bitcoins off of the Coinbase site and into my own personal Bitcoin wallet as soon as I receive them.

If you want to start grokking Bitcoin for yourself, I suggest looking at the following resources that won me over:

Book: Digital Gold – Nathaniel Popper

EconTalk Podcast: Wences Casares on Bitcoin and Xapo

EconTalk Podcast: Nathaniel Popper on Bitcoin and Digital Gold

The Perfect Person

After listening to two terrific Russ Roberts podcasts on the bitcoin movement, I’ve been grokking the subject for a couple of weeks now. As a result, I created a bitcoin wallet on Xapo.com, which netted me 50 bits worth of bitcoin:

I also started reading “Digital Gold“. The book tells the fascinating story of how the fledgling bitcoin community got started from day one and how it has progressed in fits and starts to where it is today.

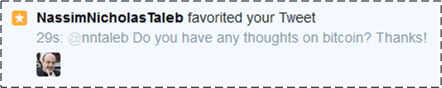

While browsing my twitter feed, it somehow dawned on me that Nassim Taleb would be the perfect person to ask about bitcoin. When I did so, all I got was this lousy tee shirt 🙂