Miraculous Recovery

It’s a miracle, a true blue spectacle, a miracle come true – Barry Manilow

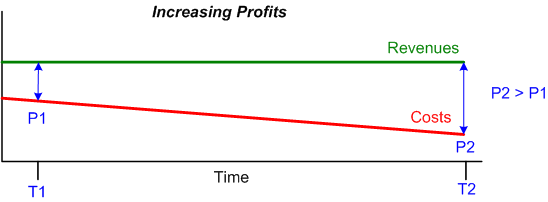

The business equation is as simple as can be: profits = revenues – costs. For the moment, assume that increasing revenues is not in the cards. Thus, as the graph below shows, the only way of increasing profits is to reduce costs.

By far, the quickest, most efficient, and least challenging method of reducing costs is by shrinking the org. However, the well known unintended consequences of reducing costs by jettisoning people are:

- increased workload on those producers “lucky enough” to remain

- the loss of bottom up trust and loyalty,

- lowered morale, increased apathy and skepticism

- less engagement, lowered productivity

- the loss of even more good people seeking out a better future

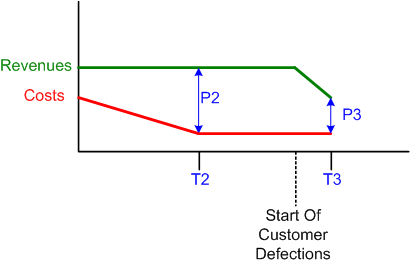

Unless these not-so-visible unintended consequences are compensated for (which they usually aren’t), the increase in profits may be short-lived. Sometime later, revenues may start decreasing as a result of customer defections triggered by deteriorating product and service quality.

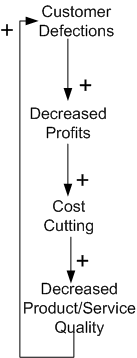

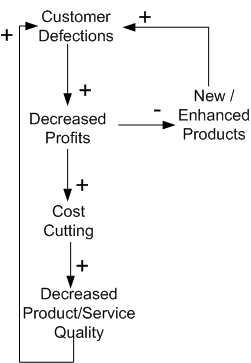

As the system dynamics influence diagram below shows, the start of customer defections may trigger a vicious downward spiral into oblivion in the form of a positive feedback loop. An increase in customer defections leads to an acceleration in the decrease in profits, which leads to an increase in cost cutting measures, which accelerates decreased product/service quality, which increases the number of customer defections.

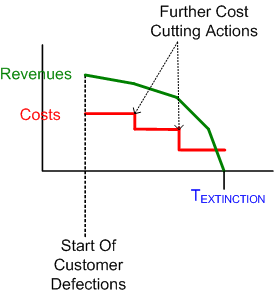

Once the vicious cycle commences, unless the loop is broken somehow, the extinction of the org and all of its “innards” is a forgone conclusion:

So, how can the cycle be broken? Well duh, by increasing revenues. So, how can revenues be increased? By somehow “miraculously”:

- Creating new products/services that customers want and competitors don’t have yet

- Enhancing the existing product/service portfolio to distinguish the org’s offerings from the moo herd’s crappy products/services

But wait, you say. How can an org enhance their products and/or create new ones with no capital to invest because of decreasing (or no) profits? Then, uh, that’s where the “miraculously” comes in.

In a tough business environment, it doesn’t take much to cut costs (that’s what dime-a-dozen MBAs and mercenary hatchet men are for). It takes talent, ingenuity, lots of luck, and real leadership to increase revenues when little to no investment resources are available. No matter how sincere, text book exhortations, rah rah speeches, and appeals for increased focus/dedication/loyalty (with no reciprocating commitment for compensation should the ship be righted), aren’t characteristic of real leadership. They’re manifestations of fear.

Oh my, it’s about time that more people notice that and actually shout it out loud. I can see that phenomenon every other day in every other industry done by every other company. They won’t get what they aim at with that kind of “strategy”; a colleague of mine remarked lately that “Value engineering” means death to many good pruducts.

Another outcome of the assumption of linearity (of revenues, in this case).

Sigh.

Thanks for commenting Chris.