Archive

Two Charts

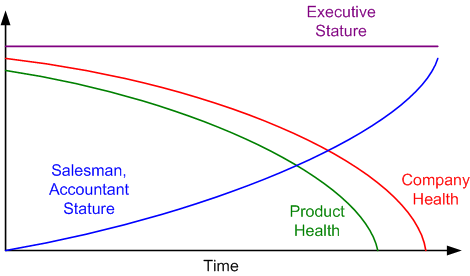

I can’t get the 2 charts below outta my surgically repaired head (see last pic below) today. On the top we see all the “value” stored in a melting ponzi paper-currency game which is debased 7%/year on average via money supply growth (forget about the rigged 3.0% CPI that the pols try to make you believe every year). Prices are up by 25% since 2021).

In the top left corner we see a tiny sliver of the monster $900T asset market value currently stored in Bitcoin’s tiny little sub $2T space. A 10x rise in price from here at $90k would only stuff $20T more into the space. Hence, that’s what people mean by Bitcoin being the greatest asymmetric trade of all time and why some predict $1M Bitcoin in the not too distant future.

It still blows me away how early it is in the evolution and adoption of BTC, but when the world is undergoing a major scientific revolution it gets turned upside down and the entrenched interests get exposed and expelled. In Thomas Kuhn’s eye opening “The Structure of Scientific Revolutions” he points out all the major historical paradigm shifts and they all resonate with his logic.

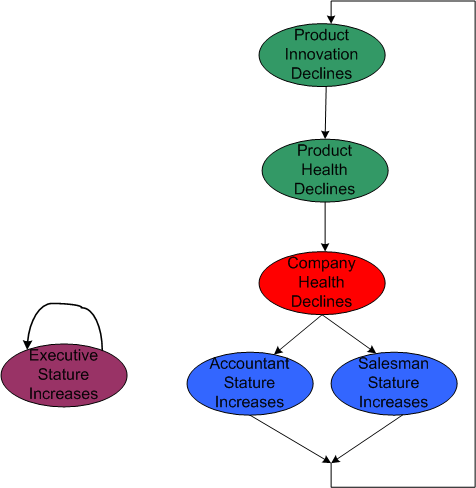

Next, we see how volatile the price of gold was in Weimar Germany against the German mark when the country exploded into hyperinflation. Who would’ve thought gold would be so volatile as a store of value. But in volatile times, everything becomes volatile. I don’t think the US will go hyper, but the macro economists I follow think 15-20% inflation is imminent, like next year. D’oh!

And third, we see why the rest of the fiat-paper brains don’t get it. Science progresses via a succession of funerals for the elite and smugly installed power base. Tick tock next block.

BTW, here’s my surgically repaired head, but that’s a story for another day.

Salesmen And Accountants

No one has ever failed to find the facts they are looking for. – Peter Drucker

Mr. Drucker may have gotten it wrong, at least in BD00’s case. It seems like the “facts” that I desperately need to continuously confirm my distorted world view come right up to me out of hiding and bite me in the bumpkiss. (If they don’t, I simply make some pseudo-facts up to feed the need).

Here’s one of the latest confirmations, and it’s in the form of another quote:

“It is difficult to get a man to understand something, when his salary depends upon his not understanding it.” – Upton Sinclair

Say what, you ask? That quote deftly closes this Forbes article written by “radical” Steve Denning: “Why Big Companies Die”.

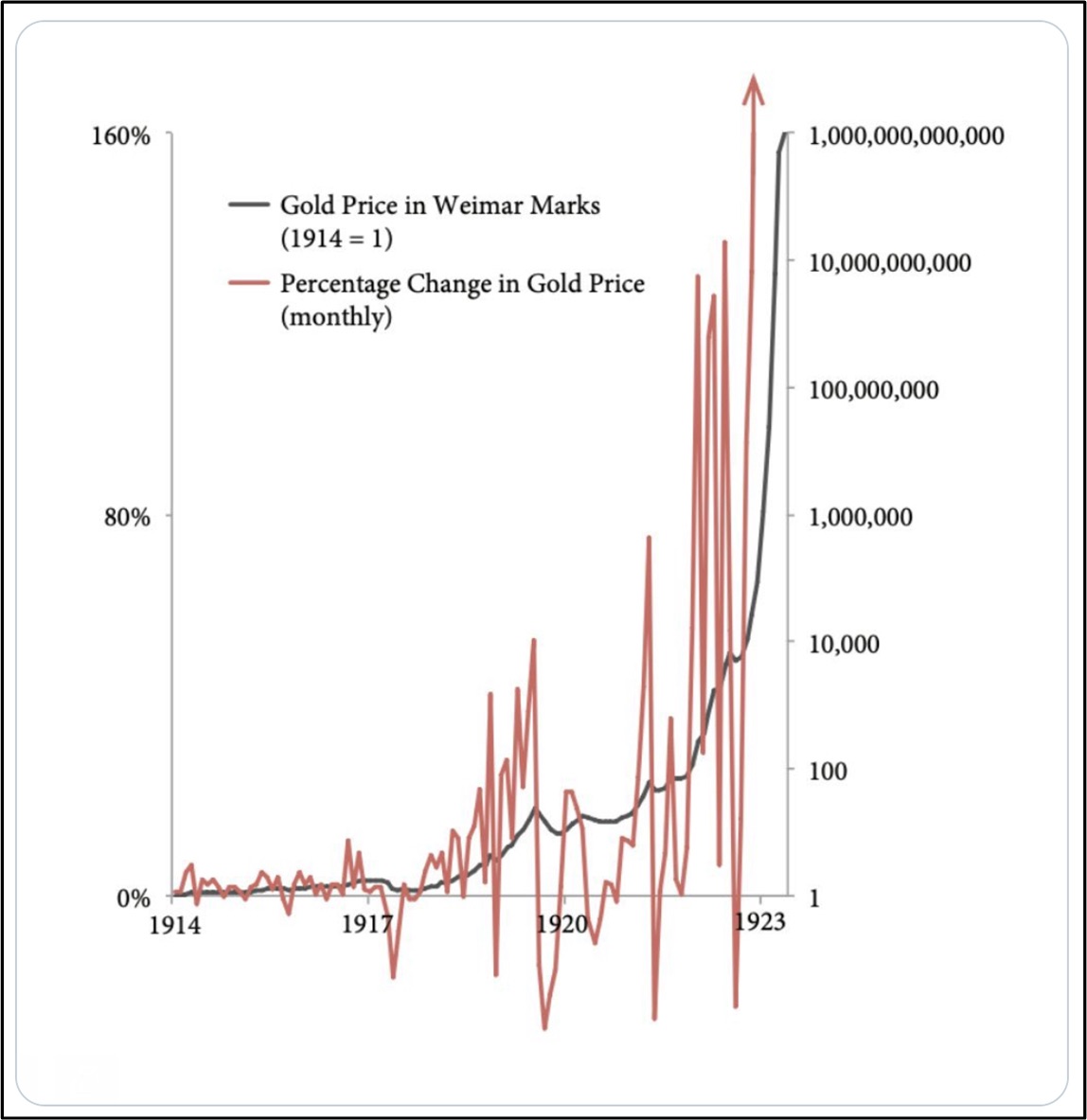

Quoting Steve Jobs on where salesmen come into play, and adding his own two cents on where accountants come into play, “rad” Steve describes an oft repeated pattern of corpo demise:

“The company does a great job, innovates and becomes a monopoly or close to it in some field, and then the quality of the product becomes less important. The company starts valuing the great salesman, because they’re the ones who can move the needle on revenues. So salesmen are put in charge, and product engineers and designers feel demoted: Their efforts are no longer at the white-hot center of the company’s daily life. They “turn off.”” – Steve Jobs

“The activities of these people (the accountants) further dispirit the creators, the product engineers and designers, and also crimp the firm’s ability to add value to its customers. But because the accountants appear to be adding to the firm’s short-term profitability, as a class they are also celebrated and well-rewarded, even as their activities systematically kill the firm’s future.” – Steve Denning

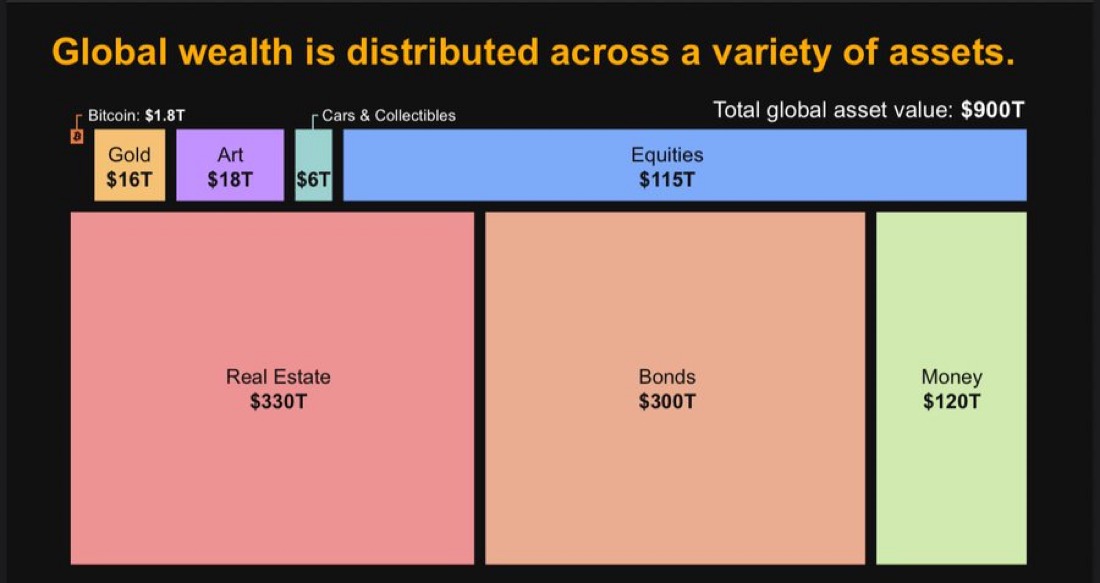

The dorky BD00 graph below attempts to map the above words onto an unscaled timeline.

Or, if you prefer, here’s an alternative view of this unconscious pattern of demise: