Archive

Contrasting Customers

Much of the sage advice given by modern day business gurus like Tom Peters, Gary Hamel, Seth Godin, et al, is targeted at companies that sell to individual consumers. If you sell big, expensive, complex, and long-lived products to government groups, then much of their advice is not applicable.

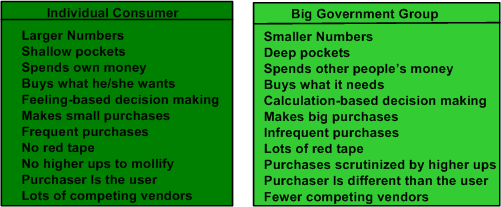

The graphic below shows just some of the enormous contrasts between these two customer classes. Obviously, the number of individual consumers dwarfs the number of potential government groups. I think that this discrepancy is the major reason why the modern day business experts don’t try too hard at dispensing advice geared toward big system vendors.

One thing that both customer classes have in common is this:

If your product portfolio sux, you are in big trouble.

It doesn’t matter how skilled and talented your marketeers and business development people are. You’re doomed if your product doesn’t perform as expected. At best, your business will muddle along forever amongst the ranks of the mediocre. You will be boring, irrelevant, and uninspiring to all the stakeholders involved in your enterprise. Purgatory city. At worst, crisis management is the order of the day and bankruptcy is just a step or two away.

Can you think of other contrasting attributes between these two vastly different customer categories?

Adjacent Customers

One way to grow and expand a business is to probe and explore the needs and wants of adjacent customers. Assume that the vast majority of your customers are behemoth national governments who have the ability to generate their own revenue streams via the power of taxation. Unlike individual consumers, who are fickle and tighter with the dollar because they actually earn their money through (hopefully) honest work, revenue streams sourced from national governments are much larger and easier to tap into for big product manufacturers.

So what are some potential adjacent customers for a big and complex system manufacturer? The figure below shows some ideas.

Regarding new customers for your company, it seems reasonable to rule out individual consumers, not-for-profit organizations, and small private organizations. Even though the numbers of customers in those categories are huge, they either don’t have the deep pockets that can sustain your business, or they have no need for your big system products .

One could think of smaller, more numerous local governments as adjacent customer markets. It may be a further stretch, but big publicly held Fortune 500 companies may also be considered as potential adjacent customers. However, you may need to invest in, and development, smaller and less expensive adjacent products to serve these new markets.

Here’s the catch. Without allocating and directing any Business Development (BD) or Internal Research and Development (IR&D) resources to the task of probing, sensing, and exploring the needs and wants of these adjacent customer groups, there’s virtually no chance that you’re going to acquire new customers in these adjacent markets. They’re not just gonna show up out of nowhere at your doorstep with a bundle of money asking for your products. Duhhhh!