Archive

What’s Up With Featured Blogs?

WordPress.com provides the capability for users to browse blog posts by clicking on a subject tag. After clicking on a tag of interest, the results page displays a bunch of blog posts that authors have marked with that tag. As the (egotistical and self-serving) screen snippet below illustrates, the first listed blog post at the top of the page is somehow designated as the “featured blog“.

Out of curiosity (which is judged as a sin inside of most religious and corpo institutions), I briefly searched for the criteria/algorithm that wordpress.com uses to select the “featured blog” of the day, but I couldn’t find it. However, I did find a bunch of vain, self-congratulatory posts just like this yawner.

Priority List

In his brilliant and elegant essay, “Capitalism is Dead. Long Live Capitalism“, Gary Hamel laments about the deterioration of capitalism into those other bad, highly inequitable, anti-American “isms”. He says:

So why do fewer than four out of ten consumers in the developed world believe that large corporations make a “somewhat” or “generally” positive contribution to society? Why is it that only 19% of Americans tell pollsters they have “quite a lot” or a “great deal” of confidence in big business?

In Gary’s opinion, the reason is……

… the unwillingness of executives to confront the changing expectations of their stakeholders. In recent years, consumers and citizens have become increasingly disgruntled with the implicit contract that governs the rights and obligations of society’s most powerful economic actors—large corporations. To many, the bargain seems one-sided—it’s worked well for CEOs and shareholders, but not so well for everyone else.

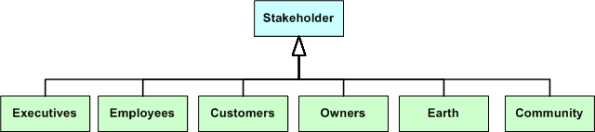

This lead-in dovetails into the idea of a “CEO stakeholder priority list“. The UML class diagram below shows six types of corpo stakeholders. Of course, the six types were arbitrarily picked by me and there may be others on the same level of abstraction that you think are missing. Notice that the “earth” is a passive stakeholder that can’t directly and instantaneously exert pressure on the way corpricracies behave; unlike the other people-type stakeholders.

Now, check out some sample CEO stakeholder priority lists below. With 6 stakeholders types, the number of unique lists is quite a lot: 6! = 6 x 5 x 4 x 3 x 2 = 720. I just semi-randomly concocted these three specific sample lists so that I can continue babbling on while hoping that you’re still reading my drivel.

My own unscholarly opinion is that the vast majority of CEOs, their appointed-yes-men VP teams, and their hand picked boards of directors either consciously or unconsciously operate according to the blue list (or any other instance that prioritizes the “executives” stakeholder first). My opinion aligns with Mr. Hamel’s assertion that too many corpo captains are making decisions that materially favor themselves (first) and their shareholders while disproportionately harming the other stakeholder types.

But wait, hasn’t this always been the case with capitalism? If so, why has it suddenly become fashionable for dweebs like me to vilify corpricracies that operate in accordance with the blue list?

In closing, I feel the need to repeat the best quote in Hamel’s blarticle:

There are CEOs who still cling to the belief that a company is first and foremost an economic entity rather than a social one. – Gary Hamel

To those CEOs who still think that the word “social” equates to communism, get over it and move into this century.

I’m The Right Guy At The Right Time

From a recent article (I forgot to bookmark the link – D’oh!) describing the large backlog of IPOs still scheduled for this year, I discovered that GM’s (supposed) resurrection is expected to be the largest. It’s estimated that the “Government Motors” IPO will raise $15B dollars, but none of it will come from me and you’ll understand why in the narrative that follows.

From the same article, I also learned that GM is being led by its fourth CEO in 18 months, Mr. Daniel Akerson. Guess what? Mr. Akerson is an aged and most probably out-of-touch white dude just like all the other recent esteemed GM CEOs. Guess what? Mr. Akerson also speaks in the same, self-centered, corpo tongue as most stereotypical Tayloristic CEOs:

I’m the right guy at the right time.

I’m looking out the front windshield.

GM’s products are second to none.

GM’s global manufacturing structure is the envy of the industry.

I did not get to where I am in life by being deaf, dumb, and blind.

I wish the company well, but, uh, I ain’t gonna invest in GM. Are you?

No Spin From Greenspun

Jessica Livingston interviews a boatload of founders (32 to be exact) of startup companies in her book “Founders At Work“. The most fascinating interview that I’ve read to date is with Phil Greenspun. It’s especially fascinating because it strongly reinforces “my belief system” that most corpo SCOLs are incompetent and most venture capitalists are obsessed with greed. You know how it is, relentlessly seeking out and amassing stories and evidence that irrefutably “prove” that you’re right while ignoring any and all disconfirming evidence to the contrary.

After reading the Livingston-Greenspun dialog, I was so giddy with ego-inflating joy that I wanted to copy and paste the entire interview into this post. However, I thought that would be too extravagant and probably a copyright law violation to boot. Here are some jucilicious fragments that prove beyond a shadow of a doubt that I’m absolutely right and anyone who disagrees with me is absolutely wrong. Hah Hah! Nyuk, nyuk, nyuk!

We talked to a headhunting firm, and the guy was candid with me and said, “Look, we can’t recruit a COO for you because anybody who is capable of doing that job for a company at your level would demand to be the CEO.” And I thought, “That’s kind of crazy. How could they be the CEO? They don’t know the business or the customers. How could we just plunk them down?” In retrospect, that was pretty good thinking; look at Microsoft: it took them 20 years to hand off from Bill Gates to Steve Ballmer. He needed 20 years of training to take that job. Jack Welch was at GE for 20 years before he became CEO. Sometimes it does work, but I think for these fragile little companies, just putting a generic manager at the top is oftentimes disastrous.

The guys on my Board had been employees all of their lives. You can’t turn an employee into a businessman. The employee only cares about making his boss happy. The customer might be unhappy and the shareholders are taking a beating, but if the boss is happy, the employee gets a raise.

Some of my cofounders and more experienced folks were also stretched pretty thin because of the growth. I thought, “We just need the insta-manager solution.” Which, in retrospect, is ridiculous. How could someone who didn’t know anything about the company, the customers, and the software be the CEO?

A lot of the traditional skills of a manager were kind of irrelevant when you only have two or three-person teams building something. So it was almost more like you were better off hiring a process control person or factory quality expert instead of a big executive type.

The CEO was a guy who had never been a CEO of any organization before, and he brought in his friend to be CFO. His buddy didn’t have an accounting degree and he was really bad with numbers. He couldn’t think with numbers, he couldn’t do a spreadsheet model accurately. That generated a lot of acrimony at the board meetings. I would say, “Things are going badly.” And he’d say, “Look at this beautiful spreadsheet. Look at these numbers; it’s going great.” In 5 minutes I had found ten fundamental errors in the assumptions of this spreadsheet, so I didn’t think it would be wise to use it to make business decisions. But they couldn’t see it. None of the other people on the board were engineers, so they thought, “Well, he’s the CFO, so let’s rely on his numbers.” Having inaccurate numbers kept people from making good decisions. They just thought I was a nasty and unpleasant person, criticizing this guy’s numbers, because they couldn’t see the errors. From an MIT School of Engineering standpoint, they were all innumerate.

Meanwhile, because these people didn’t know anything about the business, they were continuing to lose a lot of money. They hired a vice president of marketing who would come in at 10 a.m., leave at 3 p.m. to play basketball, and had no ideas. He wanted to change the company’s name. This was a product that was in use in 10,000 sites worldwide—so at least 10,000 programmers knew it as the ArsDigita Community System. There were thousands and thousands of people who had come to our face-to-face seminars. There were probably 100,000 people worldwide who knew of us, because it was all free. And he said, “We should change the company name because, when we hire these sales-people and they’re cold-calling customers, it will be hard for the customer to write down the name; they’ll have to spell it out.” And they did hire these professional salespeople to go around and harass potential customers, but they never really sold anything.

Me And My Stuff

Because it stirred up some internal energy, I intuitively navigated into this link from a recent, Mr. Creative Class, Richard Florida tweet (Pod People < PopMatters). The quote that opens the piece:

The problem in our culture is not so much that there is too much stuff but that we are afflicted with insatiable egocentricity, which the stuff merely reflects. – Rob Horning,

really zinged me. Reading that quote triggered a Vulcan mind-meld (Bzzzzzt!) in my head with a recent quote that I saw from someone else (whom I don’t remember, but wish I did): “when the last tree is gone and the last drop of water is undrinkable, maybe we’ll finally realize that we can’t eat money“.

Alright, alright. Call me a self-righteous, hippocritical-institutional-paycheck-eating, (blah, blah, blah), tree-hugger if you’d like, but that’s the way I felt in the moment; even if that’s the way I wasn’t supposed to feel – according to you.

Ty Detmer

Remember Philadelphia Eagles quarterback Ty Detmer? The DETMER metric, which was introduced in yesterday’s post and stands for Decision-To-Meeting-Ratio, is named after Ty. Hah, hah – just joking. There’s no connection between Detmer and DETMER. DETMER is a bogus metric acronym that I concocted and, for some weird reason, Ty’s name repeatedly comes to my defective mind every time I think of it. Time for a straight jacket and meds?

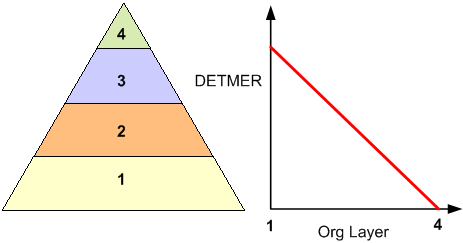

The figure below shows a madeup DETMER vs layer-of-importance curve for a typical corpricracy. The higher one moves up in the caste system, the more useless no-decision meetings one gets to attend. At these egofests, peer SCOLs psychologically duel with each other “under the covers” to prove “I’m great and you’re not“. It’s like a gaggle of peacocks struttin’ around in front of each other showing off how much prettier their plumes are. Of course, few if any important decisions are arrived at during these aristocratic social events. At the highest levels in the CCF, every hour of every day is booked with these “Dancing With The Czars” assemblies.

Dissed By Someone “Important”

The impeccably credentialed and self-revered Ian Mitroff dissed me out of the blue via a private message on LinkedIn:

“You are an absolute relativist which is not very interesting or relevant.”

Based on the following quote, Mr. Mitroff might label Shakespeare as an uninteresting, absolute relativist too:

There is nothing either good or bad, but thinking makes it so. – William Shakespeare

Damn it Willie, nothing is relative! It’s not good or bad, it’s one or the other. Since my judgment is infallible, it’s whichever I say it is.

Feeling compelled to reply to the self-anointed “father of crisis management“, my bruised and battered ego retorted with:

“I’m sorry, oh exalted professor. Thanks for your irrelevant opinion.”

Me thinks that Ian may be one of those professors that Ken Robinson says: “solely uses his body to transport his head around“. I hate to prematurely judge people, but it sure feels good to be bad.

“A conscience is what feels bad when everything else feels so good.” – Steven Wright

Delusions of Grandeur

In “Founders At Work“, Jessica Livingston interviews a boatload of company founders about their personal experiences with regard to starting their companies from the ground up. Paul Graham, who co-founded “ViaWeb” and sold it to Yahoo 3 years later for a cool $45M, was asked about his search for a CEO in the early days. Here’s what he said:

The problem with all of them was that they had delusions of grandeur. This was the beginning of the Internet Bubble, remember, and I think all of these guys saw themselves as some kind of grand CEO, while we programmers labored in the kitchen cooking the food and washing the dishes. If the deal were simply that the business guy would be the public face of the company, but we would be allowed to do what we wanted and make sure everything worked right, that would have been OK. But we were worried about what might happen if one of these guys wanted to actually be the chief executive officer and tell us what our strategy should be. We’d be hosed, because they didn’t know anything about computer stuff. – Paul Graham

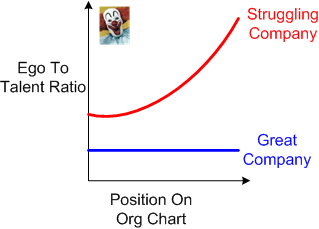

Ego To Talent Ratio

In Scott Berkun‘s “Managing Breakthrough Projects” video, Scott concocts a metric called the Ego-To-Talent ratio (ETTR). Here’s my highly unscientific and speculative curve that plots ETTR versus position on the company org chart.

See that bozo on the chart? That’s me. Where are you?

Hurd Joins The Herd

I was considering writing a blog post about the downfall of Hewlett Packard’s CEO Mark Hurd, but I decided to back off. I figured that all the credentialed and highly respected tech columnists and bloggers have covered this horror story from all angles.

So, instead of my usual rag, rag, rag…… whine, whine, whine….. toll-u-so, toll-u-so, toll-u-sow verbage, I’ve written an empty husk of a blog post. The accompanying picture sux too….

Nevertheless, I’ll be back on my high horse and raging against the machine soon.

Nevertheless, I’ll be back on my high horse and raging against the machine soon.