Archive

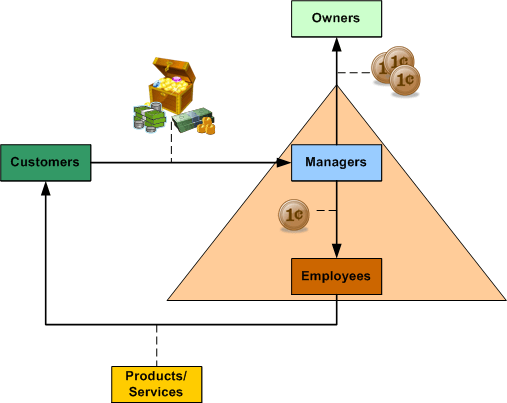

The Principle Objective

The principle objective of a system is what it does, not what its designers, controllers, and/or maintainers say it does. Thus, the principle objective of most corpocratic systems is not to maximize shareholder value, but to maximize the standard of living and quality of work life of those who manage the corpocracy…

The principal objective of corporate executives is to provide themselves with the standard of living and quality of work life to which they aspire. – Addison, Herbert; Ackoff, Russell (2011-11-30). Ackoff’s F/Laws: The Cake (Kindle Locations 1003-1004). Triarchy Press. Kindle Edition.

It seems amazing that the non-executive stakeholders of these institutions don’t point out this discrepancy when the wheels start falling off – or even earlier, when the wheels are still firmly attached. Err, on second thought, it’s not amazing. The 100 year old “system” demands that silence is expected on the matter, no?

Baggage From The Past

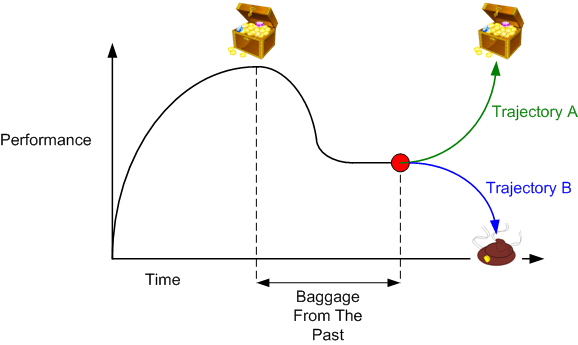

BD00, the wise ass, oops, I mean the wise child that he is, maintains that it’s much more challenging to restore a fallen org to success than it is to bootstrap a startup org to success.

Unlike established orgs, startups are populated by a small group of highly enthused people with a common bond and they don’t have a history of under performance to contend with (yet) as they move forward.

It’s BD00’s belief that leadership teams who turn around fallen stars are more deserving of kudos than heroic startup teams.

It’s BD00’s belief that leadership teams who turn around fallen stars are more deserving of kudos than heroic startup teams.

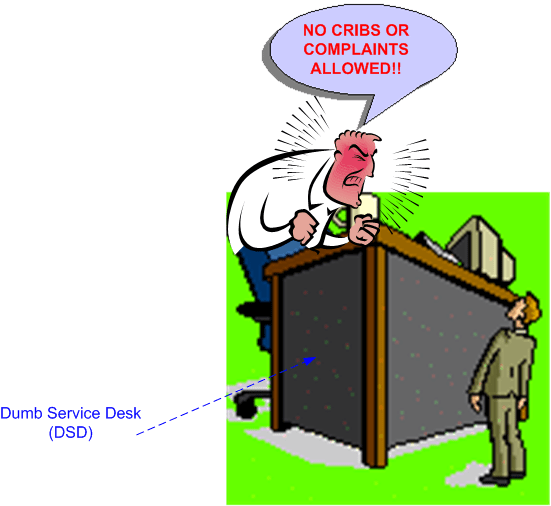

Cribs And Complaints

HCL Technologies CEO Vineet Nayar‘s “Employees First, Customers Second” is one of the most refreshing business books I’ve read in awhile. One of the bold measures the HCLT leadership team considered implementing to meet their goal of “increasing trust through transparency” was to put up an intranet web site called “U & I“. After weighing the pros and (considerable) cons, the HCLT leadership team decided to go for it. Sure enough, the naysayers (Vineet calls naysayers the “Yes, But“s) were right:

The U&I site was clogged with cribs and complaints, harangues and imprecations that the company was wrong about everything. The continents and questions came pouring in and would not stop. Most of what people said was true. Much of it hurt.

However, instead of placing draconian constraints on the type of inputs “allowed“, arbitrarily picking and choosing which questions to answer, or taking the site down, Vineet et al stuck with it and reaped the benefits of throwing themselves into the fire. Here’s one example of a tough question that triggered an insight in the leadership team:

“Why must we spend so much time doing tasks required by the enabling functions? Shouldn’t human resources be supporting me, so I can support customers better? They seem to have an inordinate amount of power, considering the value they add to the customer.”

This question suggested that organizational power should be proportionate to one’s ability to add value, rather than by one’s position on the pyramid. We found that the employees in the value zone were as accountable to finance, human resources, training and development, quality, administration, and other enabling functions as they were to their immediate managers. Although these functions were supposed to be supporting the employees in the value zone, the reality was sometimes different.

That question led to the formation of the Smart Service Desk (SSD), which helped the company improve its operations, morale, and financial performance.

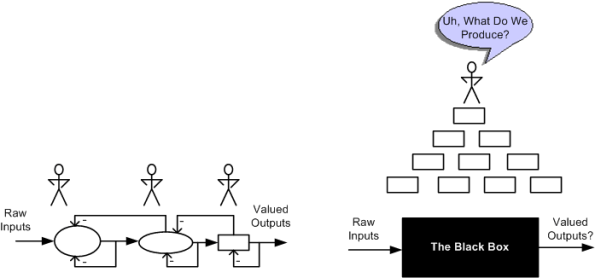

So, how did the SSD work, you ask? It worked like this: SSD. Not like this:

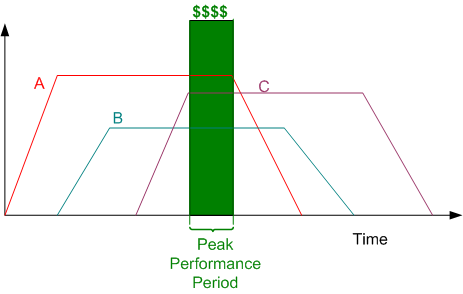

Sustained Viability

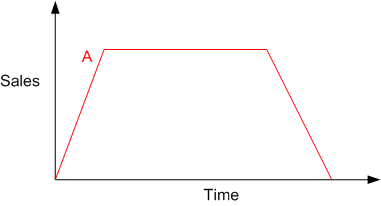

The figure below shows the sales-vs-time trend chart of a one hit wonder company. The sales from product “A” ramp up, settle out, and then ramp down.

The ramp up, steady-state, and ramp down time intervals in which sales > $0 varies wildly from one company to another and depends on many factors: how easy the product is to copy, whether the product is obsoleted by another product, how big the market is, whether or not the product keeps evolving to meet new customer demands; yada, yada, yada.

The ramp up, steady-state, and ramp down time intervals in which sales > $0 varies wildly from one company to another and depends on many factors: how easy the product is to copy, whether the product is obsoleted by another product, how big the market is, whether or not the product keeps evolving to meet new customer demands; yada, yada, yada.

To maintain sustained viability and to avoid being a one hit wonder company, new products must be continuously developed to offset the eventual decline in sales from the aging one hitter. The longer the “flat” segment of sustained sales is, the easier it is to become fat/happy/complacent and stop creating and innovating.

The figure below traces the rise and fall of a three hit company. The green vertical lines are snapshots of the company’s sales at four different points in time.

At the peak of success, all three products have leveled off at their maximum sales levels and the good times are a rollin’. Then, for an unknown reason(s), the product pipeline is suddenly empty, and one by one, sales start decreasing for each product.

So what’s the point of this inane post? Hell, I don’t freakin’ know. I was just doodlin’ around with visio, sketchin’ away, makin’ stuff up, and these graphs emerged from the wild blue yonder. Sorry for wastin’ your time. It wasn’t a waste of mine.

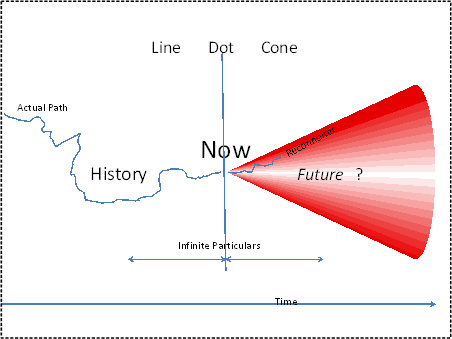

Exactly Two Years Hence

Before going any further, make a note of today’s date. Now, if you want to follow the timeline of a sad story, then perform the following procedure while noting the date of each post:

1 Read this post: My Company

2 Then read this post: The End Of An Era

3 Then read this post: Heartbroken, But Hopeful

So, what does the future hold? Hell, I don’t freakin’ know. My friend Bill Livingston‘s line-dot-cone sketch says it all:

Miraculous Recovery

It’s a miracle, a true blue spectacle, a miracle come true – Barry Manilow

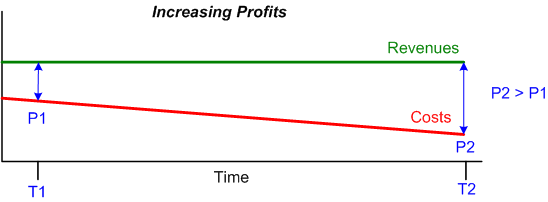

The business equation is as simple as can be: profits = revenues – costs. For the moment, assume that increasing revenues is not in the cards. Thus, as the graph below shows, the only way of increasing profits is to reduce costs.

By far, the quickest, most efficient, and least challenging method of reducing costs is by shrinking the org. However, the well known unintended consequences of reducing costs by jettisoning people are:

- increased workload on those producers “lucky enough” to remain

- the loss of bottom up trust and loyalty,

- lowered morale, increased apathy and skepticism

- less engagement, lowered productivity

- the loss of even more good people seeking out a better future

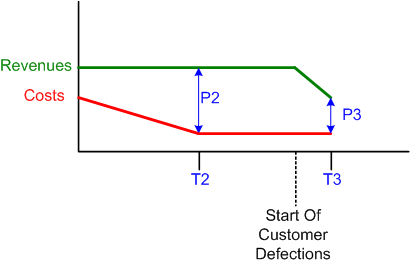

Unless these not-so-visible unintended consequences are compensated for (which they usually aren’t), the increase in profits may be short-lived. Sometime later, revenues may start decreasing as a result of customer defections triggered by deteriorating product and service quality.

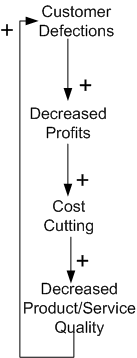

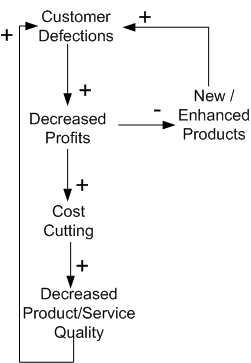

As the system dynamics influence diagram below shows, the start of customer defections may trigger a vicious downward spiral into oblivion in the form of a positive feedback loop. An increase in customer defections leads to an acceleration in the decrease in profits, which leads to an increase in cost cutting measures, which accelerates decreased product/service quality, which increases the number of customer defections.

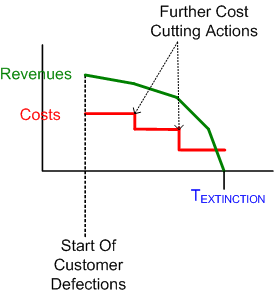

Once the vicious cycle commences, unless the loop is broken somehow, the extinction of the org and all of its “innards” is a forgone conclusion:

So, how can the cycle be broken? Well duh, by increasing revenues. So, how can revenues be increased? By somehow “miraculously”:

- Creating new products/services that customers want and competitors don’t have yet

- Enhancing the existing product/service portfolio to distinguish the org’s offerings from the moo herd’s crappy products/services

But wait, you say. How can an org enhance their products and/or create new ones with no capital to invest because of decreasing (or no) profits? Then, uh, that’s where the “miraculously” comes in.

In a tough business environment, it doesn’t take much to cut costs (that’s what dime-a-dozen MBAs and mercenary hatchet men are for). It takes talent, ingenuity, lots of luck, and real leadership to increase revenues when little to no investment resources are available. No matter how sincere, text book exhortations, rah rah speeches, and appeals for increased focus/dedication/loyalty (with no reciprocating commitment for compensation should the ship be righted), aren’t characteristic of real leadership. They’re manifestations of fear.

Executive Proposal

The lowly esteemed and dishonorable BD00 proposes to executives everywhere:

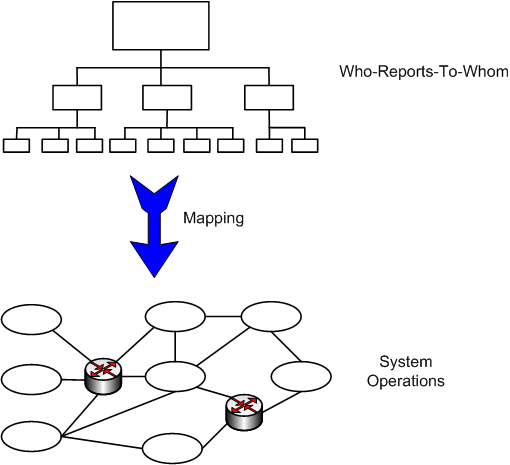

Whenever you change your org, supply the minions with TWO complementary org charts: the usual (yawn) who-reports-to-whom chart and a system operational structure chart.

Creating the first one is an easy task; the second one, not-so. That’s why you’ve never seen one.

The funny thing is, every borg has a “System Operational Structure” chart regardless of whether it’s known or (most likely) not. Reshuffling the “Who-Reports-To-Whom” chart without knowing and consulting with the “Systems Operational Structure” chart doesn’t improve operations (unless the reshuffler gets lucky), it justs changes who to blame when sub par performance persists after the latest and greatest reshuffle.

Something’s Uh Foot?

It’s my understanding that the financial crisis was precipitated by the concoction of exotic investment instruments like derivatives and derivatives of derivatives that not even quantum physicists could understand.

Well, it looks like the shenanigans may not be over. Take a look at this sampling of astronomically high paying jobs from LinkedIn.com for C++ programmers:

Did the financial industry learn a lesson from the global debacle, or was it back to business as usual when the dust settled? Hell, I don’t know. That’s why I’m askin’ you.

Fuzzy And Clear

The higher one ascends up the corpo ladder, the fuzzier one’s view becomes regarding how the enterprise works and what mania takes place down in the boiler rooms. On the other hand, who reports to whom becomes clearer and clearer and perversely more important than nurturing continuous improvement and innovation. These effects can be called “losing touch with reality” and “perverse inversion of importance“.

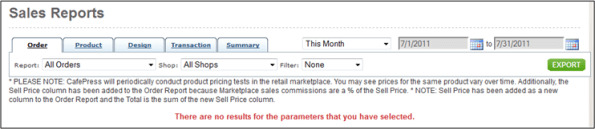

Zero Revenue, Zero Cost

Since my cafepress.com T-shirt shop, “The Frontal Assault Idiot“, opened to rave reviews earlier this month, the dough has been rolling in. Check out the orders report below (especially the notice in red) for the fiscal month of July 2011. LOL!

I guess I’ll have to bring in some hot shot consultants to help me get my expenses down and fend off my creditors. But wait! There are no expenses. I can stay in business. Whoo Hoo!