Archive

To The Moon Alice!

Using the information below as a reference point,

let’s do some rounding and truncating and assume the following:

- The total market capitalization of gold is $10T

- The total market capitalization of negative interest bonds is $10T

With 15M BTC in circulation, the current market capitalization of Bitcoin is around $10B. If (when?) Bitcoin eventually manages to steal just 10% of the market capitalization from each of those two assets, its market cap would balloon to $2T, resulting in a gain of 200X. Yepp, that’s “X” and not “%”.

Bitcoin’s current price per USD is around $750. Multiplying this price by 200 yields a new price of $150,000 per BTC.

Of course, the BTC price could collapse to $0 at any point in time. However, since its launch in 2009, it has been declared “dead” by various experts over 106 times – and still counting.

If you’ve got $750 of play money laying around, fuggedaboud searching for the next Amazon/Apple/Google/Netflix to invest in and hoping that the esteemed management of your new investment doesn’t fuck up for a decade. Consider doing the following instead:

- Opening an account on a reputable Bitcoin exchange (I use coinbase.com (USD-to-BTC exchange fee of 1%)).

- Buying 1 Bitcoin

- Becoming your own bank and immediately moving your 1 BTC out of your online exchange wallet and into your own PC-based wallet (I use Electrum), or mobile phone-based wallet (I use Blockchain), or hardware-based wallet (I use Trezor).

If BTC collapses or (more likely) you screw up taking full personal control over your BTC, your maximum loss will be $750. However, your upside is “to the moon Alice!“.

A New Alternative

Humor me for a moment and assume that you knew your country’s fiat currency was going to collapse soon.

The traditional response to such an impending calamity would be to exchange all your fiat currency for a precious metal, especially gold.

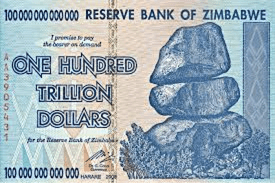

An alternative way to preserve your wealth in an apocalyptic world would be to exchange your fiat currency for a cryptocurrency, of which Bitcoin is king. If you didn’t take any action whatsoever, your accumulated wealth would disappear in a hyperinflationaty crisis – either slowly or instantaneously. Just ask the citizens of Nigeria, Venezuela, Brazil, Argentina, Zimbabwe or any other country with incompetent, corrupt governments that rack up huge debts and continuously devalue their currency.

The problems with holding physical gold bars are: storing them, transporting them, defending them against theft, and accurately dividing them up to pay others for food/services.

With Bitcoin and other cryptocurrencies, these problems are almost non-existent. You can store the majority of your cryptocoins in a tiny, easy to hide, encrypted and password protected, hardware wallet (Trezor, Ledger, Keepkey, etc). You can periodically transfer small mounts to your cell phone wallet to pay for food and other daily expenses.

So, what would YOU do if you knew for certain that your national currency was about to go poof? Isn’t it about time you started learning about the future of money, cryptocurrencies? I suggest you start with YouTube. There are tons of introductory Bitcoin videos to watch.

Bypassing The Riskiest Link

On the left, we have the traditional method of investment. An investor buys stock in a company that makes a product or service. The investor trusts that both the company’s executives and the company’s product offerings will generate increasing wealth over time.

As the right hand side of the diagram shows, a Bitcoin investor can bypass the riskiest link in the investment chain – a Bitcoin company’s management. Rather than being concerned about executive incompetence (like Mt. Gox and all the other Bitcoin companies that have gone bust), a Bitcoin investor can buy and hold bitcoins directly – just like he/she can buy gold. Indeed, I have been slowly buying up some Bitcoins over the last 6 months as a speculative investment – just in case we have another 2008-like financial meltdown in the future.

Even if Bitcoin doesn’t succeed as a widespread currency of exchange or unit of account, it can succeed as a store of “perceived value” – just like gold. Like gold and unlike fiat currency, Bitcoin is guaranteed to be scarce. But unlike gold, Bitcoin is easily and quickly transportable, cheap to store, and highly divisible.

Pseudonymous, Not Anonymous

Since cash is “anonymous“, hard-core criminals like drug dealers and terrorists prefer to transact in cash:

Unlike what many uninformed people think (thanks to the mainstream press and political sound-bytes), Bitcoin is NOT anonymous. Bitcoin is “pseudonymous“.

Unlike cash, each bitcoin is tethered to an address that is visible to anyone, anywhere, anytime. Every transaction is stored in the immutable, publicly visible, Bitcoin blockchain. And there are many Blockchain forensic analysis programs that can trace the path of every bitcoin ever mined from address to address.

Bitcoin <-> Cash exchanges are required to “know their customers“. So, when you sign up for an account at an exchange (like Coinbase.com), by law, you must supply personal information to the exchange (I had to upload a picture of my driver’s license).

As soon as a criminal decides to cash out bitcoins through an exchange, the game is over – it’s just a matter of time. Simply ask the jailed criminals who’ve used Bitcoin in their dealings how they ended up where they are.

So, criminals, stop tarnishing the image of the greatest innovation since the internet. Stay away from Bitcoin, you dumbasses.

The Waste Of Mining?

Fervent anti-bitcoiners have a bottomless cache of reasons for wanting Bitcoin to fail. One of their favorite fear-mongering strategies is to warn of “the impending ecological catastrophe” that they think will engulf the world if Bitcoin succeeds on a global scale.

In order for bitcoins to be created, they, like gold, need to be “mined“. However, unlike the physical mining required to unearth gold, virtual mining is required to “unearth” bitcoins. Virtual mining for bitcoins requires a large amount of electricity because Bitcoin miners race against each other using a computationally dense hashing algorithm to validate transactions and add a verified block to the immutable blockchain.

For its contributory work in helping to keep the blockchain secure, the winning miner of a block is rewarded with a spanking brand new batch of bitcoins (currently set to 25 bitcoins per block). After each block is added to the blockchain, the race to add the next block of transactions commences.

Unlike newly mined physical gold which require a costly post-mining process to bring the booty to market, newly minted virtual bitcoins can be used immediately – to pay a miner’s electrical bills, for example.

When asked about the cost of Bitcoin mining back in 2010, Bitcoin creator Satoshi Nakamoto had this to say:

What most people new to bitcoin fail to understand (but the banksters with a vested interested in maintaining the status quo do understand) is summarized nicely in Satoshi’s last two sentences:

The utility of the exchanges made possible by Bitcoin will far exceed the cost of electricity used. Therefore, not having Bitcoin would be the net waste.

Become An Instant Trillionaire!

For only $39.95 USD plus tax, you can become a trillionaire in Zimbabwe. Woot! The downside is that your trillion dollars won’t even be enough to buy a loaf of bread.

Since central bankers and free spending governments have been stoking the flame of inflation forever, people have been hoodwinked into thinking that inflation is, like gravity, a force we must live with.

In an inflationary environment, people, knowing their hard earned money will lose value over time (minute by minute in a hyper-inflationary apocalypse), are motivated to spend and borrow as soon as possible. Inflation works just like compound interest does – but in reverse. It doesn’t make economic sense to save for the future when you know that the $1 you earned today will be worth much less in 5-10-20-30 years.

Everyone knows that rampant inflation can quickly destroy a society, but to most textbook economists a “little” inflation is required to keep an economy growing by catalyzing buying, borrowing, and investing behaviors. But, how much is a “little” inflation?

With deflation, your money doesn’t just retain its value over time, its purchasing power increases. In contrast to a little inflation, classical economists theorize that any level of deflation is bad for economies because it encourages people to save their money (they call it “hoarding” to give it a negative connotation) and discourages investment in the future.

If deflation is so bad, why has it has worked so splendidly in the computer industry? Relentless price decreases for computer hardware over time has not stopped companies from competing with each other, or investing in new products, or innovating for the future. Deflation hasn’t stopped people from buying a $1000 computer today that they know will cost $500 next year.

Unlike all fiat currencies backed by “the full faith and credit” of untrustworthy governments, bitcoins are deflationary. The Bitcoin protocol is designed to dispassionately stop the minting presses when 21 million bitcoins have been created and issued. If you own some bitcoins and the Bitcoin economy manages to survive the mighty external AND internals forces vying to tear it apart, you’ll be a happy camper some time down the road.

Dead… Yet Again

Five years ago, Mike Hearn left a great job at Google and joined the small cadre of dedicated Bitcoin Core programmers that propelled the technology to where it is today – on the cusp of becoming a hugely disruptive force in the oligarchic, klepto-world of finance. However, in a highly publicized blog post, Mike said “good riddance” to Bitcoin. In a fit of disgust, he sold all his bitcoins and boldly declared the Bitcoin experiment a failure.

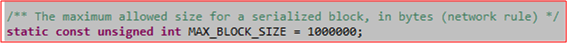

Mike threw in the towel because, after two years (and still counting), the rancorous “Maximum Block Size” (MBS) debate is still raging across a fractured Bitcoin community. Currently, the maximum transaction block size is hard-coded into the Bitcoin Core source code as 1MB.

This 1MB max size handcuffs the protocol’s throughput to approximately 7 transactions per second. Compared to established payment systems like PayPal, which can handle hundreds of thousand of transactions per second, 7 tps is a drop in the bucket and a major hindrance to scaling Bitcoin up to hundreds of millions of users (the current estimate of users is (I think) around 1 million).

In one MBS camp, we have those who want to keep the maximum block size as is and concoct some fancy-schmancy, risky, pervasive code changes to scale Bitcoin up. In the other camp, we have the “Keep It Simple, Stupid” (KISS) group, of which Mike Hearn was a member. Unlike the former group, which likes to jawbone a lot without releasing any code, the KISS group, led by Mike and Gavin Andresen, actually released working code that allows for larger block sizes in the form of “Bitcoin XT“.

But alas, Bitcoin XT did not succeed. Not enough miners chose to run the code. Incredibly, those miners and businesses that did deploy Bitcoin XT were hit with DDoS attacks from advocates of the fancy-schmancy camp.

Shortly after Mike’s post went public, the doomsayers came out of the woodwork yet again. The press has had a field day:

- FastCompany: Bitcoin A “Failed” Experiment, Says Departing Developer

- Business Insider: A lead developer just quit bitcoin, saying it ‘failed’

- New York Times: A Bitcoin Believer’s Crisis Of Faith

- Reuters: Lead developer quits bitcoin saying it ‘has failed’

- The Guardian: Senior bitcoin developer says currency ‘failed experiment’

- Forbes: Bitcoin Declared An “Inescapable Failure”

- Fortune: Prominent Bitcoin Developer Declares the Digital Currency a Failure

I guess it’s time to add to the 88 obituaries already documented on the “Bitcoin Obituaries” site. Mike’s post isn’t featured there yet, but I’m guessing it will be soon. As for me, I’m stickin’ with Bitcoin for the long haul – boom or bust.

What’s Not To Like?

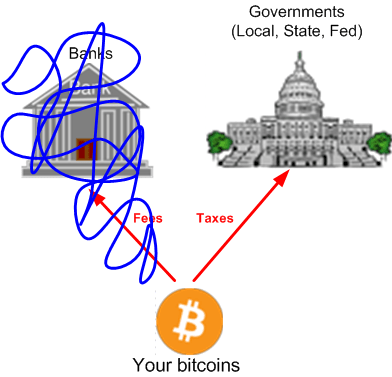

With regard to your money, here is the status quo:

The greatest threat to the well being of your pocketbook is not shown on the figure. It’s the fact that (despite “regulations“) the banks can loan out and/or invest a large fraction of the money you have deposited in their virtual “vaults” in all kinds of schemes that are highly risky to you… but not to them (thanks to the bailout and get-out-of-jail free cards they’re allowed to possess).

I’m not a right wing libertarian, so I don’t mind paying taxes to the government. However, since the banks have the power to play dice with my money, I do mind paying fees to fuel their reckless lending and investment practices.

As an alternative to the status quo, Bitcoin has the potential to entirely erase the shady banking industry as we know it from the landscape:

So, what’s not to like?

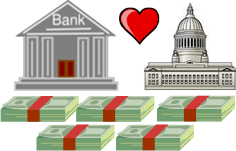

Bedfellows

In theory, central banks are supposed to act independently of governments for the good of the national economy. In practice, central banks and governments jump right into bed with each other when either of them finds itself in a financial pickle.

When privately funded banks need bailing out because of idiotic, greed-driven behavior, the central bank uses fear-mongering to act on their behalf and get the government to bail them out with our hard earned money. On the other hand, when the government needs money to finance massive wars and welfare programs they know they can’t afford, the central bank simply prints money out of thin air to finance the reckless behavior – the inflation tax.

The precious metals, of which gold is king, have always served as the ultimate hedge against fiat currency collapse. That’s why the price of gold rises whenever the populace’s faith in fiat currency decreases.

Since the birth and continuous rise of Bitcoin, the average Joe Schmoe now has 2 ways of protecting himself against greedy bankstas and irresponsible politicians. Mr. Schmoe can use the Gold and Bitcoin dynamic duo to keep a watchful eye on “those in charge” of your long-term financial fate.

“The threat of Bitcoin places constraints on monetary policy. In jurisdictions that finance large amounts of government spending through the inflation tax, such a constraint may become binding”. – VP of the federal reserve bank of St. Louis

Bitcoin is an even better hedge than gold against nefarious institutional monetary behavior. Bitcoin is waaaay more difficult for deadbeat governments to steal from its people to pay off bad debts. Bitcoin is for the little person, like me….. and you?