Dead… Yet Again

Five years ago, Mike Hearn left a great job at Google and joined the small cadre of dedicated Bitcoin Core programmers that propelled the technology to where it is today – on the cusp of becoming a hugely disruptive force in the oligarchic, klepto-world of finance. However, in a highly publicized blog post, Mike said “good riddance” to Bitcoin. In a fit of disgust, he sold all his bitcoins and boldly declared the Bitcoin experiment a failure.

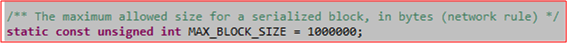

Mike threw in the towel because, after two years (and still counting), the rancorous “Maximum Block Size” (MBS) debate is still raging across a fractured Bitcoin community. Currently, the maximum transaction block size is hard-coded into the Bitcoin Core source code as 1MB.

This 1MB max size handcuffs the protocol’s throughput to approximately 7 transactions per second. Compared to established payment systems like PayPal, which can handle hundreds of thousand of transactions per second, 7 tps is a drop in the bucket and a major hindrance to scaling Bitcoin up to hundreds of millions of users (the current estimate of users is (I think) around 1 million).

In one MBS camp, we have those who want to keep the maximum block size as is and concoct some fancy-schmancy, risky, pervasive code changes to scale Bitcoin up. In the other camp, we have the “Keep It Simple, Stupid” (KISS) group, of which Mike Hearn was a member. Unlike the former group, which likes to jawbone a lot without releasing any code, the KISS group, led by Mike and Gavin Andresen, actually released working code that allows for larger block sizes in the form of “Bitcoin XT“.

But alas, Bitcoin XT did not succeed. Not enough miners chose to run the code. Incredibly, those miners and businesses that did deploy Bitcoin XT were hit with DDoS attacks from advocates of the fancy-schmancy camp.

Shortly after Mike’s post went public, the doomsayers came out of the woodwork yet again. The press has had a field day:

- FastCompany: Bitcoin A “Failed” Experiment, Says Departing Developer

- Business Insider: A lead developer just quit bitcoin, saying it ‘failed’

- New York Times: A Bitcoin Believer’s Crisis Of Faith

- Reuters: Lead developer quits bitcoin saying it ‘has failed’

- The Guardian: Senior bitcoin developer says currency ‘failed experiment’

- Forbes: Bitcoin Declared An “Inescapable Failure”

- Fortune: Prominent Bitcoin Developer Declares the Digital Currency a Failure

I guess it’s time to add to the 88 obituaries already documented on the “Bitcoin Obituaries” site. Mike’s post isn’t featured there yet, but I’m guessing it will be soon. As for me, I’m stickin’ with Bitcoin for the long haul – boom or bust.

What’s Not To Like?

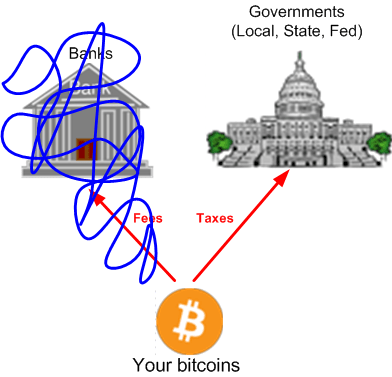

With regard to your money, here is the status quo:

The greatest threat to the well being of your pocketbook is not shown on the figure. It’s the fact that (despite “regulations“) the banks can loan out and/or invest a large fraction of the money you have deposited in their virtual “vaults” in all kinds of schemes that are highly risky to you… but not to them (thanks to the bailout and get-out-of-jail free cards they’re allowed to possess).

I’m not a right wing libertarian, so I don’t mind paying taxes to the government. However, since the banks have the power to play dice with my money, I do mind paying fees to fuel their reckless lending and investment practices.

As an alternative to the status quo, Bitcoin has the potential to entirely erase the shady banking industry as we know it from the landscape:

So, what’s not to like?

Bedfellows

In theory, central banks are supposed to act independently of governments for the good of the national economy. In practice, central banks and governments jump right into bed with each other when either of them finds itself in a financial pickle.

When privately funded banks need bailing out because of idiotic, greed-driven behavior, the central bank uses fear-mongering to act on their behalf and get the government to bail them out with our hard earned money. On the other hand, when the government needs money to finance massive wars and welfare programs they know they can’t afford, the central bank simply prints money out of thin air to finance the reckless behavior – the inflation tax.

The precious metals, of which gold is king, have always served as the ultimate hedge against fiat currency collapse. That’s why the price of gold rises whenever the populace’s faith in fiat currency decreases.

Since the birth and continuous rise of Bitcoin, the average Joe Schmoe now has 2 ways of protecting himself against greedy bankstas and irresponsible politicians. Mr. Schmoe can use the Gold and Bitcoin dynamic duo to keep a watchful eye on “those in charge” of your long-term financial fate.

“The threat of Bitcoin places constraints on monetary policy. In jurisdictions that finance large amounts of government spending through the inflation tax, such a constraint may become binding”. – VP of the federal reserve bank of St. Louis

Bitcoin is an even better hedge than gold against nefarious institutional monetary behavior. Bitcoin is waaaay more difficult for deadbeat governments to steal from its people to pay off bad debts. Bitcoin is for the little person, like me….. and you?

All Fluff, No Substance

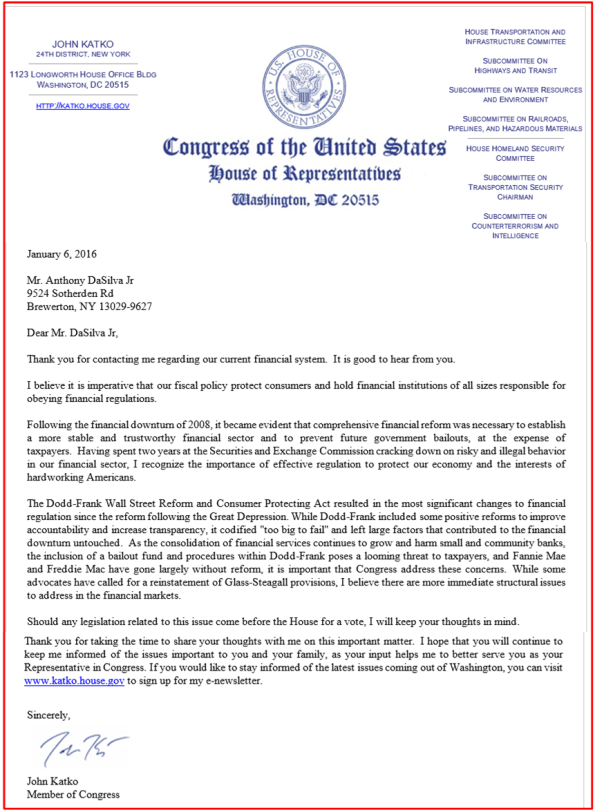

So, I finally decided to get off my ass. I wrote to my US congressman (John Katko) and both of my US senators (Chuck Schumer, Kirsten Gillibrand) about an issue that has been of burning concern to me for over seven years. Specifically, I asked them what they were doing about the fact that the banks who triggered the financial calamity of 2008 are much BIGGER now than they were back then.

The first response I received was from my US congressman:

I interpreted Mr. Katko’s response as all fluff and no substance. Thus, I wrote back:

When(?) Mr. Katko’s staff responds to my attempt to pierce through the fluff, I’ll post it here.

Fire!

Uh oh, Bitcoin is not only on the radar screen, it’s now being targeted as an enemy to be blown out of the sky. Central bankers in the developing world, which is by far Bitcoin’s best use case for serving as an alternative currency of exchange, are getting desperate to maintain unfettered control over who stays rich and who stays poor. Thus, they’re deploying the highly successful, well worn, time-tested, strategy of instilling fear in their captive audience:

- Kenya’s central bank is taking out newspapers ads to warn against buying Bitcoin

- Armenian Central Bank Says Stay Away from Bitcoin

If you read those stories, you’ll notice that only the downside of Bitcoin is presented. But how could anyone expect otherwise from powerful central bankers with a vested interest in maintaining the status quo?

No Assassins, Please!

In the long run, Bitcoin can succeed either:

- As a convenient global currency of exchange (in parallel with inflation-prone national fiat currencies),

- As a store of “perceived” value (serving as a hedge (like gold) against fiat currency devaluation or outright collapse)

- Both 1. and 2.

Of course, BTC itself can collapse at any moment to zero; nada; goose-egg-city.

BD00 thinks that if Bitcoin does indeed succeed, the odds are better that it will do so as 2 over 1, or as 2 over both 1 and 2. And if it does, it may steal some market share from gold.

To further explore the assumption of success “as a store of perceived value“, consider the approximate numbers in the box below. Based on these numbers, Bitcoin’s market capitalization is currently a minuscule fraction of gold’s market capitalization: .1 percent.

Next, consider the following table:

If Bitcoin manages to “steal” 5% of the gold market (meaning that 5% of all gold holders decide to exchange their gold for BTC), each $500 BTC you own today will be worth $25,000 when the 5% market share threshold is crossed.

So, what advantages does BTC offer over gold to entice the goldbugs to convert?

- BTC is infinitely more transportable than gold, especially in larger amounts, from any location in the world to any other location in the world. All one needs is an internet connection to execute a global transfer much faster, and at a lower cost, than shipping physical gold artifacts.

- BTC is much more accurately divisible than gold: 1 satoshi = .00000001 BTC

- Even though gold is scarce, BTC is more scarce. After the 21 millionth BTC is minted sometime in the year 2140, that’s it. Fini. No more BTC will be mined.

- You can store and guard your BTC yourself (if you choose to) in lieu of paying a “trusted” third party to store and guard your physical gold bars. It’s also much easier to guard a tiny BTC cold storage device in your possession than a cache of weighty gold bars.

Based on reasoning similar to that given in this post, Bitcoin advocate Wences Casares recommends people consider investing 1% of their savings in BTC. As you might surmise, BD00 also recommends the same advice. That way, if you lose your entire BTC investment, you won’t be itching to hire an assassin to inflict a slooow and painful death upon me.

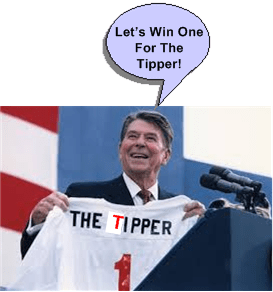

Let It Grow

Merry Christmas and happy holidays dear reader(s)!!!!!

You can tip John for this brilliant song at https://letstalkbitcoin.com/blog/post/holiday-bitcoin-song-let-it-grow

Sixty-Seven Cents

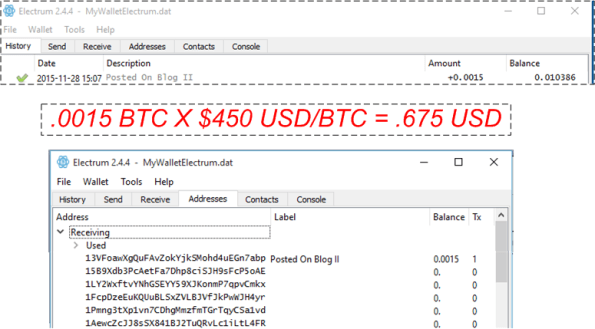

In all my years of blasphemous blogging, I’ve never made any money off of my writing “talent” – until recently.

As the figure below illustrates, I received my first bitcoin tip on November 28, 2015 (a day that will live in infamy!). The top snippet shows that someone sent 1.5 millibits of BTC to the bitcoin address in my Electrum wallet that I’ve labeled “Posted On Blog II“. The bottom snippet shows the exact bitcoin address that maps onto the text label – which you can also see in the right hand column of this page below the QR code graphic.

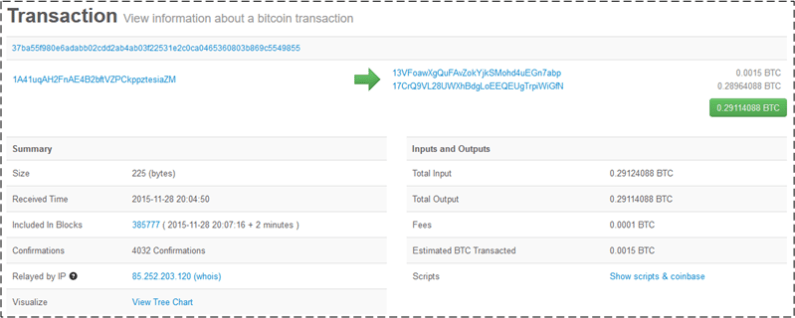

Since the Bitcoin blockchain is publicly visible to ALL people, 24 X 7, forever, I looked up the transaction details on Blockchain.info:

On the tip date, I published a tribute to Andreas Antonopoulos titled “The Bitcoin Ambassador“. Thus, I suspect it was Andreas himself who tipped me from his bitcoin address at 1A41uqAH2FnAE4B2bftVZPCkppztesiaZM. If the address is one of yours, then thank you Andreas. If not, then thanks to whoever did so.

As you might have concluded, I won’t be quitting my day job anytime soon to vigorously pursue a latent career in writing.