Market Dominance Or Market Niche, I’m In

Over time, all fiat currencies are either slowly or quickly debased by governments who mandate them as legal tender for paying taxes. When it suits their political agenda, central authorities dilute the value of their fiat currency by cranking up the printing presses to spew out new paper notes. Thus, fiat currencies have never been a good long term store of value.

Gold, on the other hand is much more scarce than paper that can be printed on a whim by central authorities. It’s much more expensive and time consuming to dig gold out of the ground than loading ink and wood pulp into the printing presses and pushing the ON button. Thus, relative to fiat currency, gold is an excellent store of value over the long term. However, due to physical constraints, using gold for day to day transactions is not as practical or fluid as using fiat paper currencies.

Bitcoin, unlike any monetary system invented over 5,000 years of human history, has the potential to function BOTH as a great store of value AND as a seamless medium of exchange for day to day transactions without any centralized, elitist, “supervision and control“.

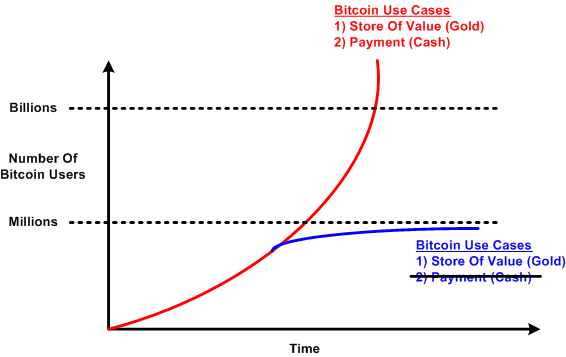

The figure below shows the ideal scenario for Bitcoin to destroy the existing, entrenched, archaic, global financial system run by bureaucrats and rich, elitist bankers who can crash a financial system while suffering no consequences themselves.

As more and more “regular people” like you and me become aware of Bitcoin’s unprecedented potential to kill two birds with one stone without any centralized authority meddling in our affairs, more and more people will try to start using bitcoin for daily transactions AND to store their wealth.

Assuming (and at this point in time it’s a huge assumption) that the decentralized Bitcoin system can naturally scale in parallel with an explosive rise in the number of enlightened users, the path to billions of willing new users worldwide as shown in the above figure is a slam dunk.

But alas, as currently designed and implemented, the decentralized Bitcoin network cannot support exponential growth to billions of users. The base protocol must be changed somehow to accommodate layer two applications for a graceful, timely, move from millions to billions of world wide users. The bottom line is that Bitcoin needs to change to scale.

Because of a nasty, 2+ year old, scaling war being waged between two internally polarized factions of the Bitcoin community (SegWit vs. XT/Classic/BU armies), the lack of change in the system software has imposed a hard ceiling on the number of users the system is providing value to – stunting the growth and uptake of one of the world’s greatest inventions. Keeping the system software unchanged as more users attempt to come on board has led to: network saturation, increasing average per-transaction fees of up to $1, and per-transaction confirmation times on the order of days.

As the figure below depicts, the lack of a consensus scaling solution has at least temporarily suspended movement toward the holy grail envisioned by Bitcoin’s creator, Satoshi Nakamoto: the use of Bitcoin by billions of people as “a peer-to-peer electronic cash system“. The rising fees and confirmation times have turned off millions of newbies initially attracted to the system because of its potential to satisfy the requirements of the payment use case.

I’m into Bitcoin for the long haul. If it crashes to $0 or stays stuck in the million user niche of solely serving as a “a peer-to-peer electronic store of value system“, I’m in. What about you?

Electronic Cash Or Electronic Gold?

Here’s my personal take on the SegWit (fixed, small block size) vs. Bitcoin Unlimited (dynamically determined block size) war of attrition that keeps raging on within the Bitcoin community:

- SegWit => Steers Bitcoin off of the “electronic cash” path Satoshi Nakamoto originally started it on, and towards an “electronic gold” niche that hard-limits the number of people that can use Bitcoin gainfully.

- Bitcoin Unlimited => Keeps Bitcoin on the “electronic cash” path, providing 2 billion “unbanked” people with the opportunity to bootstrap themselves out of poverty, participate in commerce, and boost the global economy.

Three Options

The bitcoin core development team chose to implement the top option. The bitcoin XT, Classic, and Unlimited development teams chose to implement the middle option. Sadly, no team chose to implement the bottom option.

Two years ago, the XT, Classic, and BU camp(s) saw the high Tx fees and long confirmation times we have in place today – it was clear as day. But rather than paying attention to their concerns and incorporating a max block size increase into their SegWit design, the majority of the Core team and their backers chose to ignore, censor, and ostracize anyone who didn’t agree with their chosen path. As a result, we now have an existential crisis going on within the bitcoin community which may lead to the total collapse of the ground-breaking cryptocurrency. Bummer.

I’m With These Guys

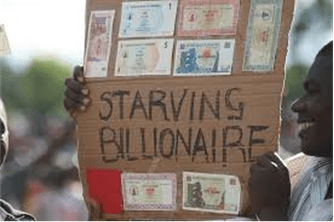

..and here’s why fees are skyrocketing as more and more “unbanked” people try to escape the tyranny of governments that continuously debase their fiat currencies…

Western Union, Bitcoin, And Mexico

The Crux Of The Problem

So, what’s this “Bitcoin scaling” hullaboo all about? Checkout this graphic that I snipped from the excellent movie “Banking On Bitcoin“:

No further comment needed.

Set The Price, Or Ask For An Estimate?

This tweet from a #NoEstimates advocate is interesting food for thought:

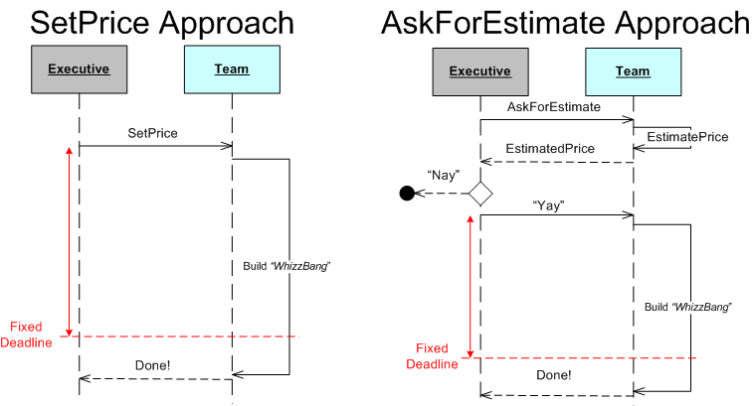

Let’s say you are one member of a software development team of 5, and each of your salaries is $100K per year. Now, assume that an executive in your org requests that your team build software product “WhizzBang” for $500K. If your team accepts the request, then your deadline date becomes automatically set in stone as one year from the selection date. If you don’t accept the request…. well, then you and your teammates should look for other work.

An alternative approach for getting “WhizzBang” built is for the executive to ask the team for an estimate of how long it will take to get the software built.

I, as a software developer, would prefer the bidirectional “asking for an estimate” approach rather than the unidirectional “setting of a price” approach. Neither approach is ideal, but the “asking for an estimate” approach gives me the opportunity to provide information to the executive that allows him/her to decide whether or not to move forward on his investment.

In either case, history sadly shows that neither approach is likely to lead to the derived deadline being met. In those cases where the deadline is met, the team has most likely worked tons of unpaid overtime over a sustained period of time and has cut quality corners to do so 😦

Bitcoin Movies

The latest BTC movie, “Banking On Bitcoin“, which was released on January 6th, has hit the top of the charts:

Of course, being a staunch Bitcoin fan, I loved it. I was disappointed, however, that neither Roger Ver nor Andreas Antonopoulos has any speaking scenes in the movie.

The best part of the movie is the segment on the first attempt in the nation to formally regulate Bitcoin. The effort was led by Ben Lawsky, New York State’s first Superintendent of Financial Services. The resulting set of regulatory requirements, which apply to New York state businesses and individuals, can be found in the “BitLicense“. BitLicense is so onerous and bureaucratic that many Bitcoin companies fled the state when it went into effect. From Wikipedia:

It came into effect on August 8, 2015. At least ten[4] bitcoin companies announced they were stopping all business in New York State because of the new regulations.[5][6] The New York Business Journal called this the “Great Bitcoin Exodus”.[5]

In a classic, self-serving, crony capitalist move, after leaving his government post, Mr. Lawsy started a consulting company which provides $ervices to help companies apply for BitLicenses.

Here are the other excellent Bitcoin movies that I’ve watched over the past year:

Amazon Prime customers please take note that ALL of these movies are available to you at no additional charge. I enlarged the graphic for “The End Of Money As We Know It” because it is currently my all time favorite.

The Fees Are Too Damn High!

Remember this guy?

Well, Roger Ver (a.k.a Bitcoin Jesus) has a similar beef:

I’ve been a fan of Roger Ver ever since I got sucked down into the Bitcoin rabbit hole well over a year ago. His passionate, pro-Bitcoin words and startup investments have helped Bitcoin grow to where it is today. Roger has also been the most vocal Bitcoin celebrity to rage against the Bitcoin Core development team’s refusal to raise the maximum block size above 1MB.

Hard-limiting the maximum block size to 1MB causes more competition among users to get their transactions into a block – which causes the average per-block user fee to rise – which causes fewer people worldwide to use Bitcoin as “money” – which stunts the global growth of Bitcoin. In the worst case, fees may get so high so that we only see wealthy people using Bitcoin in the future.

As Roger has said, the more expensive it is to use a thing, the fewer the people are who will use the thing. Economics 101.

To support Roger’s claim, I submit a relatively recent tweet of his for your perusal:

And, if you navigate to the Bitcoin transaction that Roger links to in the tweet, you’ll see this:

At the time of the tweet, the BTC price was hovering around $1000 USD. Thus, the fee of 72 millibits that his company, Bitcoin.com, paid, translated to around $70+ USD. However, at 89KB in size, it sure is a big ass transaction to stuff into a block. 🙂

Advice From An Elite For Elites To Avoid Being Ripped Off By Elites

I just finished reading James Rickards’ “The Road To Ruin“. It was an interesting read in that he used: past events (1998 LTCM meltdown, 2008 crash), complexity and chaos theory, “fat tailed” power law distributions, and Bayesian statistics logic to build a fairly compelling case for the next impending global financial meltdown to be catalyzed by global elites. In his view, the US dollar will collapse and be replaced as the world’s reserve currency by the International Monetary Fund’s Special Drawing Rights (SDR) notes.

The fact that Mr. Rickards worked for the LTCM hedge fund when it imploded in 1998 makes him a complicit elite in my eyes. It makes me wonder if he was an unwitting co-architect of that disaster.

After building his case that the mother of all financial collapses is on our doorstep, Mr. Rickards states that there are three ways to to financially survive the debacle: buy fine art, land, and gold before your dollars become worthless. What a letdown. Buying art, land, and (less so) gold is not much of an option for the average Joe Schmoe with a modest amount of savings. It’s simply advice from an elite for elites to avoid being ripped off by other elites.

Strangely, Mr. Rickards doesn’t ever mention buying cryptocurrencies like Bitcoin as an option to ride out the next collapse – which shows me that he’s a dinosaur who needs to move into the 21st century. Cryptocurrencies are a viable hedge against financial calamity for the average Joe like you and me. Maybe Mr. Rickards will do his research and discover this fact before he pens his next doom-and-gloom book…..