Archive

Bedfellows

In theory, central banks are supposed to act independently of governments for the good of the national economy. In practice, central banks and governments jump right into bed with each other when either of them finds itself in a financial pickle.

When privately funded banks need bailing out because of idiotic, greed-driven behavior, the central bank uses fear-mongering to act on their behalf and get the government to bail them out with our hard earned money. On the other hand, when the government needs money to finance massive wars and welfare programs they know they can’t afford, the central bank simply prints money out of thin air to finance the reckless behavior – the inflation tax.

The precious metals, of which gold is king, have always served as the ultimate hedge against fiat currency collapse. That’s why the price of gold rises whenever the populace’s faith in fiat currency decreases.

Since the birth and continuous rise of Bitcoin, the average Joe Schmoe now has 2 ways of protecting himself against greedy bankstas and irresponsible politicians. Mr. Schmoe can use the Gold and Bitcoin dynamic duo to keep a watchful eye on “those in charge” of your long-term financial fate.

“The threat of Bitcoin places constraints on monetary policy. In jurisdictions that finance large amounts of government spending through the inflation tax, such a constraint may become binding”. – VP of the federal reserve bank of St. Louis

Bitcoin is an even better hedge than gold against nefarious institutional monetary behavior. Bitcoin is waaaay more difficult for deadbeat governments to steal from its people to pay off bad debts. Bitcoin is for the little person, like me….. and you?

Fire!

Uh oh, Bitcoin is not only on the radar screen, it’s now being targeted as an enemy to be blown out of the sky. Central bankers in the developing world, which is by far Bitcoin’s best use case for serving as an alternative currency of exchange, are getting desperate to maintain unfettered control over who stays rich and who stays poor. Thus, they’re deploying the highly successful, well worn, time-tested, strategy of instilling fear in their captive audience:

- Kenya’s central bank is taking out newspapers ads to warn against buying Bitcoin

- Armenian Central Bank Says Stay Away from Bitcoin

If you read those stories, you’ll notice that only the downside of Bitcoin is presented. But how could anyone expect otherwise from powerful central bankers with a vested interest in maintaining the status quo?

No Assassins, Please!

In the long run, Bitcoin can succeed either:

- As a convenient global currency of exchange (in parallel with inflation-prone national fiat currencies),

- As a store of “perceived” value (serving as a hedge (like gold) against fiat currency devaluation or outright collapse)

- Both 1. and 2.

Of course, BTC itself can collapse at any moment to zero; nada; goose-egg-city.

BD00 thinks that if Bitcoin does indeed succeed, the odds are better that it will do so as 2 over 1, or as 2 over both 1 and 2. And if it does, it may steal some market share from gold.

To further explore the assumption of success “as a store of perceived value“, consider the approximate numbers in the box below. Based on these numbers, Bitcoin’s market capitalization is currently a minuscule fraction of gold’s market capitalization: .1 percent.

Next, consider the following table:

If Bitcoin manages to “steal” 5% of the gold market (meaning that 5% of all gold holders decide to exchange their gold for BTC), each $500 BTC you own today will be worth $25,000 when the 5% market share threshold is crossed.

So, what advantages does BTC offer over gold to entice the goldbugs to convert?

- BTC is infinitely more transportable than gold, especially in larger amounts, from any location in the world to any other location in the world. All one needs is an internet connection to execute a global transfer much faster, and at a lower cost, than shipping physical gold artifacts.

- BTC is much more accurately divisible than gold: 1 satoshi = .00000001 BTC

- Even though gold is scarce, BTC is more scarce. After the 21 millionth BTC is minted sometime in the year 2140, that’s it. Fini. No more BTC will be mined.

- You can store and guard your BTC yourself (if you choose to) in lieu of paying a “trusted” third party to store and guard your physical gold bars. It’s also much easier to guard a tiny BTC cold storage device in your possession than a cache of weighty gold bars.

Based on reasoning similar to that given in this post, Bitcoin advocate Wences Casares recommends people consider investing 1% of their savings in BTC. As you might surmise, BD00 also recommends the same advice. That way, if you lose your entire BTC investment, you won’t be itching to hire an assassin to inflict a slooow and painful death upon me.

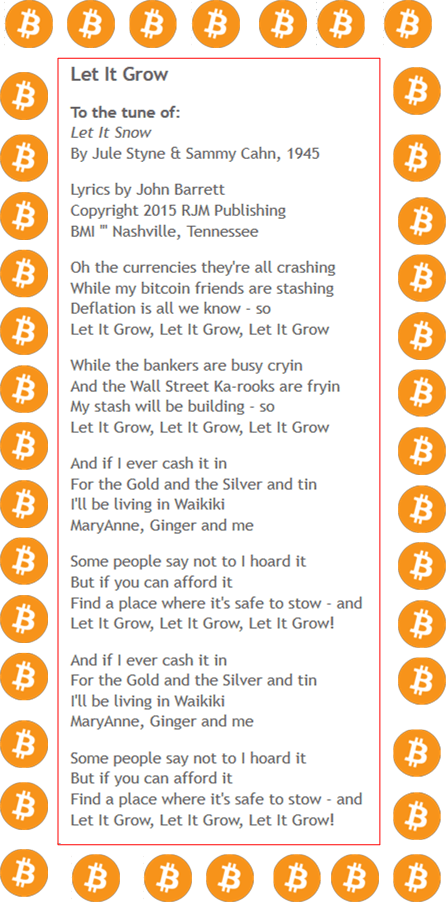

Let It Grow

Merry Christmas and happy holidays dear reader(s)!!!!!

You can tip John for this brilliant song at https://letstalkbitcoin.com/blog/post/holiday-bitcoin-song-let-it-grow

Sixty-Seven Cents

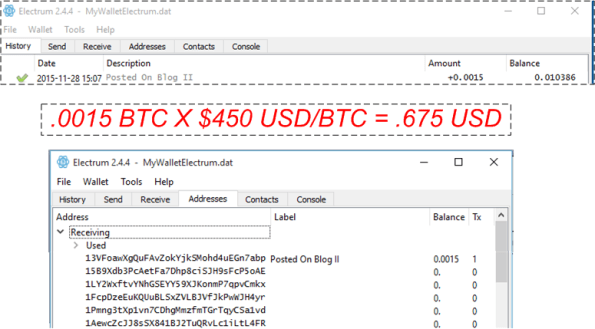

In all my years of blasphemous blogging, I’ve never made any money off of my writing “talent” – until recently.

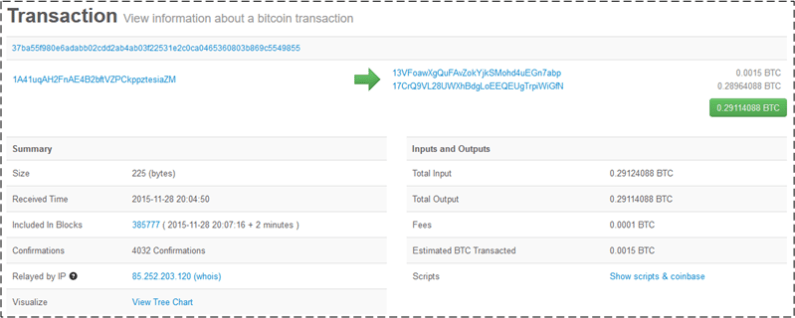

As the figure below illustrates, I received my first bitcoin tip on November 28, 2015 (a day that will live in infamy!). The top snippet shows that someone sent 1.5 millibits of BTC to the bitcoin address in my Electrum wallet that I’ve labeled “Posted On Blog II“. The bottom snippet shows the exact bitcoin address that maps onto the text label – which you can also see in the right hand column of this page below the QR code graphic.

Since the Bitcoin blockchain is publicly visible to ALL people, 24 X 7, forever, I looked up the transaction details on Blockchain.info:

On the tip date, I published a tribute to Andreas Antonopoulos titled “The Bitcoin Ambassador“. Thus, I suspect it was Andreas himself who tipped me from his bitcoin address at 1A41uqAH2FnAE4B2bftVZPCkppztesiaZM. If the address is one of yours, then thank you Andreas. If not, then thanks to whoever did so.

As you might have concluded, I won’t be quitting my day job anytime soon to vigorously pursue a latent career in writing.

Opening The Gates

Because it’s such a mind-blowing idea, and the first time they hear about it is usually through a short, negative press story, most people are initially repulsed by Bitcoin (like I was!). As you’re about to see, even really smart people fall into the “Bitcoin is evil” trap when the subject is broached.

The following excerpt, which gracefully closes Nathaniel Popper‘s must-read book, “Digital Gold“, shows how uber-philanthropist Bill Gates was initially perturbed when Xapo CEO and Bitcoin advocate Wences Casares suggested that Bitcoin could be used to further the Bill & Melinda Gates Foundation‘s mission to “unlock the possibility inside every individual“:

In the hallway walking to lunch, after the Bezos-Buffett conversation, Wences spotted Bill Gates, who had been notably reticent about Bitcoin. Wences knew that Gates’s multibillion-dollar foundation had been making a big push to get people in the developing world connected financially, and Wences approached him to explain why Bitcoin might help his cause. As soon as Wences broached the topic, Gates’s face clouded over, and there was a note of anger in his voice as he told Wences that the foundation would never use an anonymous money to further its cause. Wences was somewhat taken aback, but this was not the first time he had been challenged by a powerful person. He quickly said that Bitcoin could indeed be used anonymously— but so could cash. And Bitcoin services could easily be set up so that users were not anonymous. He then spoke directly to the work that Gates was doing, and noted that the foundation had been pushing people in poor countries into expensive digital services that came with lots of fees each time they were used. The famous M-Pesa system allowed Kenyans to hold and spend money on their cell phones, but charged a fee each time. “You are spending billions to make poor people poorer,” Wences said. Gates didn’t just roll over. He vigorously defended the work his foundation had already done, but Gates was less hostile than he had been a few moments earlier, and seemed to evince a certain respect for Wences’s chutzpah. Wences saw the crowd that was watching the conversation, and knew he had to be careful about antagonizing Bill Gates, especially in front of others. But Wences had another point he wanted to make. He knew that back in the early days of the Internet, Gates had initially bet against the open Internet and built a closed network for Microsoft that was similar to Compuserve and Prodigy— it linked computers to a central server, with news and other information, but not to the broader Internet, as the TCP/ IP protocol allowed. “To me it feels like you are trying to get the whole world connected with something like Compuserve when everyone already has access to TCP/ IP,” he said, and then paused anxiously to see what kind of response he would get. What he heard back from Gates was more than he could have reasonably hoped for. “You know what? I told the foundation not to touch Bitcoin and that may have been a mistake,” Gates said, amicably. “We are going to call you.” After Wences got back to California, he received an e-mail from the Gates Foundation, looking to set up a time to talk. Not long after that, Gates made his first public comments praising at least some of the concepts behind Bitcoin, if not the anonymity. And so Bitcoin and its believers attracted one more person who was willing to give this new technology a look, and remain open to the possibility that the whole thing wasn’t, at least, entirely crazy.

Playing Nice

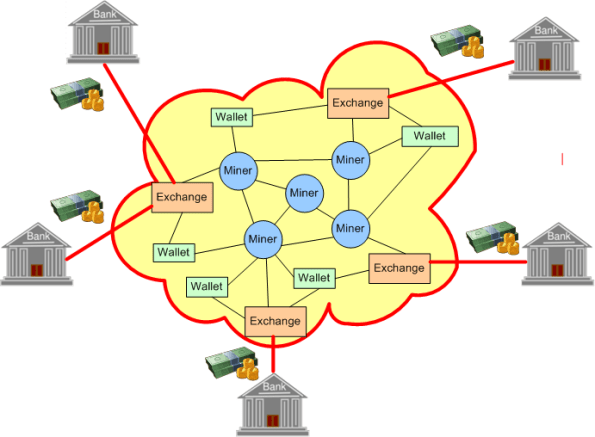

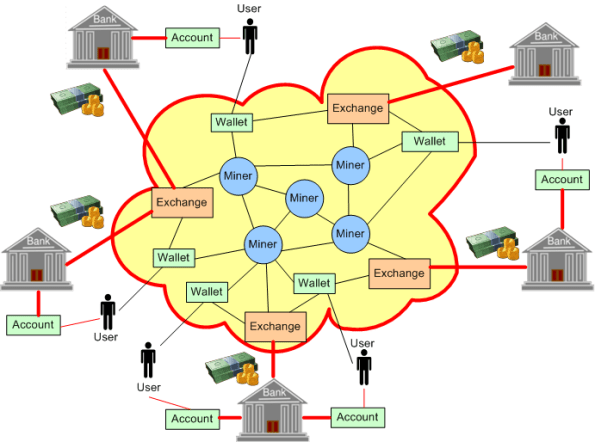

The figure below shows a simplified view of the ever growing, world-wide, Bitcoin network. Miners are awarded bitcoins for keeping the network secure and maintaining the immutable integrity of the blockchain. Mobile, PC, and web-based wallets exchange bitcoins with each other in a fluid, borderless, friction-free environment unencumbered by centralized institutions.

In the picture, the Bitcoin economy is a closed system. For it to really thrive and zoom to the moon, it must interface with, and “play nice” with, the existing international finance system. Fiat currencies, which will never cease to exist, must make their way into the system and bitcoins must make their way out of the system.

As the next figure illustrates, the purpose of BTC exchanges (Coinbase, Bitstamp, Kraken, etc) is to bridge the tenuous interface gap between traditional, highly regulated, centralized, banking systems and the decentralized Bitcoin network.

Users open an account on a bitcoin exchange, link it with their bank account, and trade dollars for bitcoin:

Since bitcoin transfers are blazingly fast and they can be used seamlessly and cheaply for both legitimate and criminal purposes, governments are right to be wary of the latter use cases. Thus, bitcoin exchanges, unlike the Bitcoin network itself, can be shutdown due to non-compliance with money laundering laws.

Since the laws of thermodynamics dictate that closed systems eventually die a slow death, opening up the Bitcoin system to the traditional world of finance and playing nice with its regulators is a win for both law abiding individuals who want more control over their money, and governments who want to stamp out criminal activity on the network.

Teeny Tiny Link

Since I use Firefox as my everyday browser, I decided to respond to the above annual Mozilla.org fundraiser e-mail by donating some bitcoin this year instead of using paypal or a credit card. As you can see from the following graphic, it wasn’t so easy to find the bitcoin link.

Upon clicking the teeny tiny bitcoin link, the following dialog box appeared:

Upon clicking the teeny tiny bitcoin link, the following dialog box appeared:

Notice that the only customer information I had to provide was my e-mail address; no physical address, telephone number, credit card number, card code, and expiration date were required.