Archive

Bypassing The Riskiest Link

On the left, we have the traditional method of investment. An investor buys stock in a company that makes a product or service. The investor trusts that both the company’s executives and the company’s product offerings will generate increasing wealth over time.

As the right hand side of the diagram shows, a Bitcoin investor can bypass the riskiest link in the investment chain – a Bitcoin company’s management. Rather than being concerned about executive incompetence (like Mt. Gox and all the other Bitcoin companies that have gone bust), a Bitcoin investor can buy and hold bitcoins directly – just like he/she can buy gold. Indeed, I have been slowly buying up some Bitcoins over the last 6 months as a speculative investment – just in case we have another 2008-like financial meltdown in the future.

Even if Bitcoin doesn’t succeed as a widespread currency of exchange or unit of account, it can succeed as a store of “perceived value” – just like gold. Like gold and unlike fiat currency, Bitcoin is guaranteed to be scarce. But unlike gold, Bitcoin is easily and quickly transportable, cheap to store, and highly divisible.

Pseudonymous, Not Anonymous

Since cash is “anonymous“, hard-core criminals like drug dealers and terrorists prefer to transact in cash:

Unlike what many uninformed people think (thanks to the mainstream press and political sound-bytes), Bitcoin is NOT anonymous. Bitcoin is “pseudonymous“.

Unlike cash, each bitcoin is tethered to an address that is visible to anyone, anywhere, anytime. Every transaction is stored in the immutable, publicly visible, Bitcoin blockchain. And there are many Blockchain forensic analysis programs that can trace the path of every bitcoin ever mined from address to address.

Bitcoin <-> Cash exchanges are required to “know their customers“. So, when you sign up for an account at an exchange (like Coinbase.com), by law, you must supply personal information to the exchange (I had to upload a picture of my driver’s license).

As soon as a criminal decides to cash out bitcoins through an exchange, the game is over – it’s just a matter of time. Simply ask the jailed criminals who’ve used Bitcoin in their dealings how they ended up where they are.

So, criminals, stop tarnishing the image of the greatest innovation since the internet. Stay away from Bitcoin, you dumbasses.

The Waste Of Mining?

Fervent anti-bitcoiners have a bottomless cache of reasons for wanting Bitcoin to fail. One of their favorite fear-mongering strategies is to warn of “the impending ecological catastrophe” that they think will engulf the world if Bitcoin succeeds on a global scale.

In order for bitcoins to be created, they, like gold, need to be “mined“. However, unlike the physical mining required to unearth gold, virtual mining is required to “unearth” bitcoins. Virtual mining for bitcoins requires a large amount of electricity because Bitcoin miners race against each other using a computationally dense hashing algorithm to validate transactions and add a verified block to the immutable blockchain.

For its contributory work in helping to keep the blockchain secure, the winning miner of a block is rewarded with a spanking brand new batch of bitcoins (currently set to 25 bitcoins per block). After each block is added to the blockchain, the race to add the next block of transactions commences.

Unlike newly mined physical gold which require a costly post-mining process to bring the booty to market, newly minted virtual bitcoins can be used immediately – to pay a miner’s electrical bills, for example.

When asked about the cost of Bitcoin mining back in 2010, Bitcoin creator Satoshi Nakamoto had this to say:

What most people new to bitcoin fail to understand (but the banksters with a vested interested in maintaining the status quo do understand) is summarized nicely in Satoshi’s last two sentences:

The utility of the exchanges made possible by Bitcoin will far exceed the cost of electricity used. Therefore, not having Bitcoin would be the net waste.

Gorillas In Our Midst

“Too Big Too Fail” pushed us to the edge of the abyss in 2008. So how could our so-called government leaders let this happen….

I think I know how it was done: legal bribery of government officials (aka “lobbyists“) and the cozy, revolving door, relationship between Wall St. and the US treasury.

Why is Bernie Sanders the only US presidential candidate who even mentions breaking up these four gorillas in our midst?

Become An Instant Trillionaire!

For only $39.95 USD plus tax, you can become a trillionaire in Zimbabwe. Woot! The downside is that your trillion dollars won’t even be enough to buy a loaf of bread.

Since central bankers and free spending governments have been stoking the flame of inflation forever, people have been hoodwinked into thinking that inflation is, like gravity, a force we must live with.

In an inflationary environment, people, knowing their hard earned money will lose value over time (minute by minute in a hyper-inflationary apocalypse), are motivated to spend and borrow as soon as possible. Inflation works just like compound interest does – but in reverse. It doesn’t make economic sense to save for the future when you know that the $1 you earned today will be worth much less in 5-10-20-30 years.

Everyone knows that rampant inflation can quickly destroy a society, but to most textbook economists a “little” inflation is required to keep an economy growing by catalyzing buying, borrowing, and investing behaviors. But, how much is a “little” inflation?

With deflation, your money doesn’t just retain its value over time, its purchasing power increases. In contrast to a little inflation, classical economists theorize that any level of deflation is bad for economies because it encourages people to save their money (they call it “hoarding” to give it a negative connotation) and discourages investment in the future.

If deflation is so bad, why has it has worked so splendidly in the computer industry? Relentless price decreases for computer hardware over time has not stopped companies from competing with each other, or investing in new products, or innovating for the future. Deflation hasn’t stopped people from buying a $1000 computer today that they know will cost $500 next year.

Unlike all fiat currencies backed by “the full faith and credit” of untrustworthy governments, bitcoins are deflationary. The Bitcoin protocol is designed to dispassionately stop the minting presses when 21 million bitcoins have been created and issued. If you own some bitcoins and the Bitcoin economy manages to survive the mighty external AND internals forces vying to tear it apart, you’ll be a happy camper some time down the road.

At This Juncture…

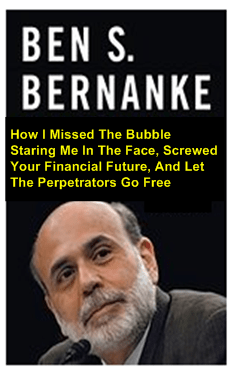

Former US federal reserve chairman Ben Bernanke recently wrote this tribute to self:

As the chairman of the Fed during the 2008 financial meltdown, Mr. Bernanke stated the following sentence just prior to the calamity that destroyed the financial well-being of thousands of people whilst leaving the super rich bankstas responsible for the fiasco unscathed:

At this juncture, however, the impact on the broader economy and financial markets of the problem in the subprime market seems likely to be contained – Ben Bernanke, Testimony before the Joint Economic Commission March 28, 2007

Maybe the book should have been truthfully titled:

Ready And Waiting

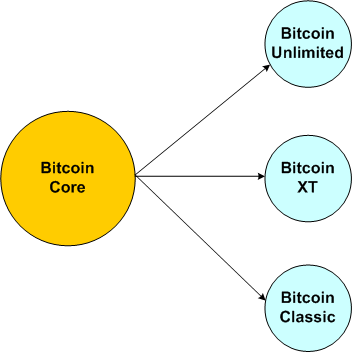

Because of the steadfast stubbornness of the Bitcoin Core software development team to refuse to raise the protocol’s maximum block size in a timely fashion, three software forks are ready and waiting in the wings to save the day if the Bitcoin network starts to become overly unreliable due to continuous growth in usage.

So, why would the Bitcoin Core team drag its feet for 2+ years on solving the seemingly simple maximum block issue? Perhaps it’s because some key members of the development team, most notably Greg Maxwell, are paid by a commercial company whose mission is to profit from championing side-chain technology: Blockstream.com. Greg Maxwell is a Blockstream co-founder.

I don’t know the deployment status of Bitcoin Unlimited or Bitcoin Classic, but I do know that a number of key Bitcoin community players experimented with running the Bitcoin XT software (authored by long-time, dedicated Bitcoiner Gavin Andresen and former Bitcoiner Mike Hearn). The Bitcoin Core team was so offended by the transgression that either they and/or their followers executed a series of DDoS attacks on XT nodes to punish the offenders and coerce the infidels to revert back to running the Bitcoin Core code.

Since the date on which Bitcoin XT’s increased maximum block size functionality was supposed to kick in has expired, some people have said that Bitcoin XT has outright failed. However, BD00 thinks that Bitcoin XT and/or its siblings will be adopted quicker than you can say “Blockstream” if the Bitcoin network becomes systemically unusable under a frozen Bitcoin Core code base. After all, there is at least $6 billion dollars of market value and $1 billion dollars of investment capital staked on the success of Bitcoin. So if push comes to shove, Bitcoin Core just might get shoved out into the cold by the rest of the community (users, miners, exchanges).

Dead… Yet Again

Five years ago, Mike Hearn left a great job at Google and joined the small cadre of dedicated Bitcoin Core programmers that propelled the technology to where it is today – on the cusp of becoming a hugely disruptive force in the oligarchic, klepto-world of finance. However, in a highly publicized blog post, Mike said “good riddance” to Bitcoin. In a fit of disgust, he sold all his bitcoins and boldly declared the Bitcoin experiment a failure.

Mike threw in the towel because, after two years (and still counting), the rancorous “Maximum Block Size” (MBS) debate is still raging across a fractured Bitcoin community. Currently, the maximum transaction block size is hard-coded into the Bitcoin Core source code as 1MB.

This 1MB max size handcuffs the protocol’s throughput to approximately 7 transactions per second. Compared to established payment systems like PayPal, which can handle hundreds of thousand of transactions per second, 7 tps is a drop in the bucket and a major hindrance to scaling Bitcoin up to hundreds of millions of users (the current estimate of users is (I think) around 1 million).

In one MBS camp, we have those who want to keep the maximum block size as is and concoct some fancy-schmancy, risky, pervasive code changes to scale Bitcoin up. In the other camp, we have the “Keep It Simple, Stupid” (KISS) group, of which Mike Hearn was a member. Unlike the former group, which likes to jawbone a lot without releasing any code, the KISS group, led by Mike and Gavin Andresen, actually released working code that allows for larger block sizes in the form of “Bitcoin XT“.

But alas, Bitcoin XT did not succeed. Not enough miners chose to run the code. Incredibly, those miners and businesses that did deploy Bitcoin XT were hit with DDoS attacks from advocates of the fancy-schmancy camp.

Shortly after Mike’s post went public, the doomsayers came out of the woodwork yet again. The press has had a field day:

- FastCompany: Bitcoin A “Failed” Experiment, Says Departing Developer

- Business Insider: A lead developer just quit bitcoin, saying it ‘failed’

- New York Times: A Bitcoin Believer’s Crisis Of Faith

- Reuters: Lead developer quits bitcoin saying it ‘has failed’

- The Guardian: Senior bitcoin developer says currency ‘failed experiment’

- Forbes: Bitcoin Declared An “Inescapable Failure”

- Fortune: Prominent Bitcoin Developer Declares the Digital Currency a Failure

I guess it’s time to add to the 88 obituaries already documented on the “Bitcoin Obituaries” site. Mike’s post isn’t featured there yet, but I’m guessing it will be soon. As for me, I’m stickin’ with Bitcoin for the long haul – boom or bust.

What’s Not To Like?

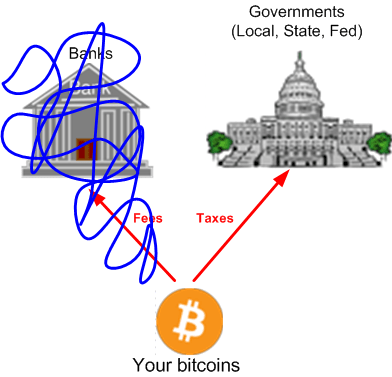

With regard to your money, here is the status quo:

The greatest threat to the well being of your pocketbook is not shown on the figure. It’s the fact that (despite “regulations“) the banks can loan out and/or invest a large fraction of the money you have deposited in their virtual “vaults” in all kinds of schemes that are highly risky to you… but not to them (thanks to the bailout and get-out-of-jail free cards they’re allowed to possess).

I’m not a right wing libertarian, so I don’t mind paying taxes to the government. However, since the banks have the power to play dice with my money, I do mind paying fees to fuel their reckless lending and investment practices.

As an alternative to the status quo, Bitcoin has the potential to entirely erase the shady banking industry as we know it from the landscape:

So, what’s not to like?