Archive

Stunted Growth

More and more of the world’s population is becoming aware of Bitcoin’s blockbuster potential to liberate them from those fiat currencies that are being manipulated and debased by governments and central banks. As a result, more and more people have been entering the Bitcoin ecosystem to employ the virtual currency for any or all of the following use cases:

- Use as a domestic commerce payment tool

- Use as an international remittance tool

- Use as a temporary store of value

The rise in Bitcoin popularity has caused the per-block transaction occupancy to increase and bump up against the 1 MB ceiling arbitrarily burned into the protocol by Satoshi Nakamoto since its inception in 2009…

As more and more transactions contend for entry into each block, the minimum transaction fee that miners will accept for block admittance is increasing….

Assuming an average cost of 50 cents per transaction, then buying a cup of coffee for $2.50 would result in a 20% Bitcoin network tax!

As fees keep rising due to the constrained maximum transaction block size, the case for using Bitcoin as a domestic commerce tool is becoming more and more uneconomical. In the worst case, bitcoin growth can come to a screeching halt and usage can get stuck in use cases 2) and 3) as listed above.

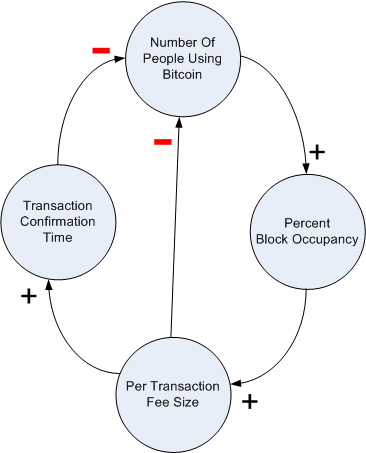

The dynamic system diagram below models the negative feedback loop that is currently in operation in the Bitcoin ecosystem. Working around the loop clockwise, here is what happens:

- As more people use bitcoin, the blocks become more saturated (+).

- As the blocks become more saturated, the transaction fees rise (+).

- As the transaction fees rise, the transaction confirmation times rise from low proposed-fee transactions being rejected by the miners or from transactions being admitted to blocks long after they’ve been initially submitted by the user. (+)

- As the fees and transaction times rise, the number of people using Bitcoin decrease. (-)(-)

The good thing about negative feedback loop systems is that they tend toward stability. A second time around the loop shows the flip in signs:

- As fewer people use bitcoin, the blocks become less saturated (-).

- As the blocks become less saturated, the transaction fees decrease (-).

- As the transaction fees decrease, the transaction confirmation times decrease from all transactions immediately being included by the miners in the very next block to be mined. (-)

- As the fees and transaction times decrease, the number of people using Bitcoin increase. (+)(+)

The key to stable Bitcoin system growth is to untether the maximum block size and allow it to grow in step with the growth in the user community so that the strength of the two negating influences in the model (fee size and confirmation time) do not drive the new number of users down to zero. The capped 1 MB maximum block size is currently stunting Bitcoin’s growth.

The $900 Breach

Just three days ago I posted “The $800 Breach“. Well, today we have the $900 breach:

The news I’m reading implies that the price rise is due to heavy trading in China as investors flee from the yuan and utilize bitcoin as a convenient “store of value” (as opposed to gold). Expect more capital controls from the Chinese government as they attempt to staunch the flow.

When Bitcoin breached the $800 barrier, I thought a modest price pullback would soon follow. I have the same sentiment in mind now that the $900 threshold has been crossed. But hey, in the wild and wacky world of bitcoin you never know what the hell is gonna happen.

Could we soon see the price of BTC eclipsing the $1136 per-ounce value of gold, or could we see an epic crash looming? With so many governments deep in debt and central banks screwing up their economies, I think the former is more likely than the latter. What do you think?

The $800 Breach

Bitcoin has breached the $800/BTC price point for the first time in a long time. With failing nation states all over the world recklessly debasing their fiat currencies, imposing negative interest rates, and outlawing the possession of cash, people are increasingly wising up to the financial liberty that the king of cryptocurrency brings to the table.

It’s never too late to buy a Bitcoin or two, or three. Consider investing 1% of your savings in the best hedge ever invented against fiat currency calamity.

A Hijacked Vision

If you dive into Satoshi Nakamoto’s writings like I have, you’ll quickly discover that his (their?) original vision for Bitcoin was that the network be available as a permission-less, peer-to-peer payment system intended for anyone, anywhere, anytime. And yes, that includes billions of disenfranchised people currently without the ability or opportunity to open a bank account.

In order for Bitcoin to scale to accommodate billions of daily users, the maximum block size currently burned into the network protocol must be increased from the paltry 1 megabyte size that’s been in effect since the birth of bitcoin way back in 2009.

Before disappearing into the ether, Satoshi foresaw the potential growth of bitcoin and had these words to say about the maximum block size:

The bitcoin core software development team, most of whom are employed by the for-profit company Blockstream, have hijacked Satoshi’s vision by steadfastly refusing to increase the bitcoin on-chain maximum block size beyond 1 megabyte.

Assuming 200 bytes per transaction, each 1 MB bitcoin block can hold a up to 5000 transactions. Since blocks are validated at 10 minute intervals, that means the network capacity is currently capped at a measly 8 transactions per second (versus Visa/PayPal capacities of hundreds of thousands of transactions/sec).

A quick glance at the home page of Blockchain.info shows that every block is full and confirmations are taking much longer than 10 minutes.

With more and more transactions competing to be added to each block, the per transaction miner’s fee, which originally amounted to pennies, is increasing at such at rate that only large transactions will make economic sense in the near future. In the worse case, people might as well quit trying to enter the Bitcoin ecosystem and revert back to using dinosaur remittance providers like Western Union at 20% per transaction.

As new individual users and businesses attempt to experiment with bitcoin, many of them are not only being turned off by larger and larger transaction fees, they’re increasingly getting annoyed by long confirmation delays – even to the point of having their transactions dropped from the network altogether because of overcapacity at peak usage times.

Of course, the bitcoin core development team (which may as well be called Adam Bach’s Blockstream Inc. team) has a billion technical excuses for keeping the max block size at 1MB, all of which have been debunked by the pro-increase-in-block-size technical community. Everyone knows the real motivation behind core’s uncompromising position: Blockstream’s plan to profit from the side chain products they are developing.

Speaking of the pro-increase-in-block-size technical community, they are on their third valiant try at attempting to put Bitcoin back on track with Satoshi’s original vision:

To hell with the Bitcoin core development team’s self-serving roadmap for Bitcoin, I support Bitcoin Unlimited. So should you.

The War On Cash

Let’s see:

- The U.S. government may be considering taking the $100 bill out of circulation.

- The E.U. is scrapping the $500 euro note.

- India is recalling the 500 and 1000 rupee notes.

- Greece is stealthily going cashless to appease the EU.

- 900 of Sweden’s 1,600 bank branches no longer keep cash on hand or take cash deposits.

The war on cash is in full swing and while the banks are, as usual, winning, the citizenry is losing money and privacy. As physical transactions with cash decrease, electronic transactions with plastic increase, which means that more transaction fees get collected and the banks get richer. In addition, since every transaction is electronically recorded, your privacy can get hacked by criminals and/or your “friendly” government.

The only way I know of for the average Joe Schmoe to fight back is for him to buy, and personally take possession of, precious metals and cryptocurrencies like bitcoin. Taking physical possession of your property is crucial because any asset that you own which resides in an entry on a centralized institutional ledger can be confiscated or frozen by your government in times of a crisis of their own making – even if you are a hard-working, law-abiding, citizen.

Regarding the precious metals and cryptocurrencies, taking possession of, and storing, a physical precious metal is much more costly/risky than doing the same for a virtual cryptocurrency. The larger the amount, the more costly/risky it is….

Ah yes, one more thing about precious metals, specifically gold. The government can unconditionally ban the possession of physical gold and demand its return to the US government. It actually has done this before. In 1933, F. D. R. issued executive order 6102, which forbade:

“….the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.”

Notice the use of the word “hoarding” – as if trying to protect your hard earned property from seizure is a bad, immoral, thing.

In the future, governments can forbid the “hoarding” of cryptocurrencies. However, since decentralized networks cannot be shutdown and private keys can be stored on tiny devices, large scale enforcement would be next to impossible.

To The Moon Alice!

Using the information below as a reference point,

let’s do some rounding and truncating and assume the following:

- The total market capitalization of gold is $10T

- The total market capitalization of negative interest bonds is $10T

With 15M BTC in circulation, the current market capitalization of Bitcoin is around $10B. If (when?) Bitcoin eventually manages to steal just 10% of the market capitalization from each of those two assets, its market cap would balloon to $2T, resulting in a gain of 200X. Yepp, that’s “X” and not “%”.

Bitcoin’s current price per USD is around $750. Multiplying this price by 200 yields a new price of $150,000 per BTC.

Of course, the BTC price could collapse to $0 at any point in time. However, since its launch in 2009, it has been declared “dead” by various experts over 106 times – and still counting.

If you’ve got $750 of play money laying around, fuggedaboud searching for the next Amazon/Apple/Google/Netflix to invest in and hoping that the esteemed management of your new investment doesn’t fuck up for a decade. Consider doing the following instead:

- Opening an account on a reputable Bitcoin exchange (I use coinbase.com (USD-to-BTC exchange fee of 1%)).

- Buying 1 Bitcoin

- Becoming your own bank and immediately moving your 1 BTC out of your online exchange wallet and into your own PC-based wallet (I use Electrum), or mobile phone-based wallet (I use Blockchain), or hardware-based wallet (I use Trezor).

If BTC collapses or (more likely) you screw up taking full personal control over your BTC, your maximum loss will be $750. However, your upside is “to the moon Alice!“.

A New Alternative

Humor me for a moment and assume that you knew your country’s fiat currency was going to collapse soon.

The traditional response to such an impending calamity would be to exchange all your fiat currency for a precious metal, especially gold.

An alternative way to preserve your wealth in an apocalyptic world would be to exchange your fiat currency for a cryptocurrency, of which Bitcoin is king. If you didn’t take any action whatsoever, your accumulated wealth would disappear in a hyperinflationaty crisis – either slowly or instantaneously. Just ask the citizens of Nigeria, Venezuela, Brazil, Argentina, Zimbabwe or any other country with incompetent, corrupt governments that rack up huge debts and continuously devalue their currency.

The problems with holding physical gold bars are: storing them, transporting them, defending them against theft, and accurately dividing them up to pay others for food/services.

With Bitcoin and other cryptocurrencies, these problems are almost non-existent. You can store the majority of your cryptocoins in a tiny, easy to hide, encrypted and password protected, hardware wallet (Trezor, Ledger, Keepkey, etc). You can periodically transfer small mounts to your cell phone wallet to pay for food and other daily expenses.

So, what would YOU do if you knew for certain that your national currency was about to go poof? Isn’t it about time you started learning about the future of money, cryptocurrencies? I suggest you start with YouTube. There are tons of introductory Bitcoin videos to watch.

And Then A Miracle Occurs

It’s a great story. A nine page white-paper hatched by a mysterious author that elegantly integrates peer-to-peer networking, cryptography, and economics to create a new form of money the world has never seen. Brilliant, simply brilliant.