What Happened To Ross?

In the ideal case, an effectively led company increases both revenues and profits as it grows. The acquisition of business opportunities grows the revenues, and the execution of the acquired business grows the profits. It is as simple as that (I think?).

ROS (Return On Sales) is a common measure of profitability. It’s the amount of profit (or loss) that remains when the cost to execute some acquired business is subtracted from the revenue generated by the business. ROS is expressed as a percentage of revenue and the change in ROS over time is one indicator of a company’s efficiency.

The figure below shows the financial performance of a hypothetical company over a 10 year time frame. In this example, revenues grew 100% each year and the ROS was skillfully maintained at 50% throughout the 10 year period of performance. Steady maintenance of the ROS is “skillful” because as a company grows, more cost-incurring bureaucrats and narrow-skilled specialists tend to get added to manage the growing revenue stream (or to build self-serving empires of importance that take more from the org than they contribute?).

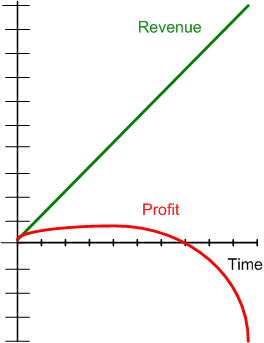

For comparison, the figure below shows the performance of a poorly led company over a 10 year operating period. In this case the company started out with a stellar 50% ROS, but it deteriorated by 10% each subsequent year. Bummer.

So, what happened to ROS? Who was asleep at the wheel? Uh, the executive leadership of course. Execution performance suffered for one or (more likely) many reasons. No, or ineffective, actions like:

- failing to continuously train the workforce to keep them current and to teach them how to be more productive,

- remaining stationary and inactive when development and production workers communicated ground-zero execution problems,

- standing on the sidelines as newly added “important ” bureaucrats and managers piled on more and more rules, procedures, and process constraints (of dubious added-value) in order to maintain an illusion of control,

- hiring more and more narrow and vertically skilled specialists that increased the bucket brigade delays between transforming raw inputs into value-added outputs,

may have been the cause for the poor performance. Then again, maybe not. What other and different reasons can you conjure up for explaining the poor execution performance of the company?